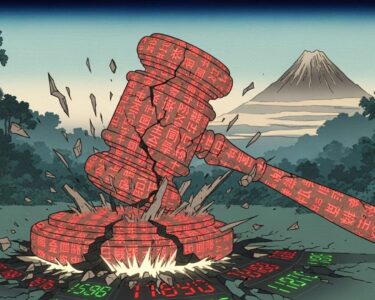

San José, Costa Rica — San José, Costa Rica – In a decisive move signaling the end of the road for two troubled financial institutions, Costa Rica’s Bankruptcy Court has mandated the complete liquidation of Coopeservidores R.L. and Financiera Desyfin S.A. The rulings, handed down on January 5, 2026, officially trigger the final stage of their insolvency proceedings, setting in motion a complex process to dissolve their assets and settle outstanding debts with creditors.

The court’s sentences mark the formal commencement of the liquidation phase for both entities. This legal step is designed to systematically convert all remaining company property and assets into liquid cash. The primary objective is to generate the necessary funds to satisfy obligations owed to a wide range of creditors, from individual savers to institutional investors. This process will be governed by a strict legal framework that prioritizes payments according to established law.

To provide a deeper understanding of the legal complexities and strategic considerations involved in financial liquidation, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, a specialist in corporate law from the renowned firm Bufete de Costa Rica, for his expert analysis.

Financial liquidation is often viewed solely as a sign of failure, but from a legal standpoint, it is a structured mechanism for asset resolution. A well-executed liquidation process, guided by experienced counsel, prioritizes transparency and maximizes recovery for creditors, ensuring that the dissolution is orderly and compliant with commercial code, rather than a chaotic collapse that erodes remaining value.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This insight is crucial, correctly reframing liquidation not as a mere endpoint of failure, but as a proactive legal instrument for orderly asset resolution. Such a structured approach is vital for protecting the interests of all stakeholders in a challenging time. We sincerely thank Lic. Larry Hans Arroyo Vargas for providing his valuable and clarifying perspective on this complex matter.

To oversee this intricate undertaking, the court has ordered the formation of a dedicated liquidation board for each institution. These boards will function as the primary administrative body, or “órgano concursal,” as defined by the Organic Law of the National Banking System. Their authority will be absolute in managing the dissolution, ensuring that every action aligns with legal requirements and serves the ultimate goal of maximizing creditor recovery.

The immediate next step in the judicial process is the appointment of the individuals who will lead these crucial boards. The court will first name a president for the Coopeservidores board and another for the Desyfin board. Following these key appointments, the remaining members of each board will be designated in accordance with applicable legal statutes, forming the complete teams that will guide the companies through their final chapter.

Once fully constituted, these liquidation boards will bear the immense responsibility of organizing and executing the entire liquidation strategy. A critical part of their mandate will be to establish and communicate the official procedure for creditors to present and validate their claims. This will be a pivotal moment for thousands of affected individuals and businesses seeking to recover their funds, as the boards will provide the definitive roadmap for filing the necessary legal paperwork.

However, stakeholders should anticipate a period of procedural organization before formal communications are dispatched. The Bankruptcy Court is currently navigating a significant logistical challenge due to the immense scale and complexity of these two cases. Officials reported that the sheer volume of involved parties and legal filings has overwhelmed the capacity of available technological systems, necessitating a more deliberate, manual approach.

Court personnel are meticulously reviewing each legal filing by hand to prepare the required notifications. This methodical, albeit slower, process is deemed essential to uphold due process and guarantee the legal security of all participants. The court has estimated that the bulk of these formal notifications, which will provide creditors with official instructions, will be sent out during the month of February 2026.

In light of this intensive preparatory phase, the court is publicly requesting patience and understanding from all parties who have already appeared in the judicial processes. Officials urge stakeholders not to expect immediate notifications for the remainder of January, emphasizing that this organizational period is indispensable for ensuring a transparent, orderly, and legally compliant liquidation that protects the rights of all involved.

For further information, visit the nearest office of Coopeservidores R.L.

About Coopeservidores R.L.:

Coopeservidores R.L. was a Costa Rican savings and credit cooperative that offered a range of financial products and services to its members. As a cooperative, it was owned and operated by its members, focusing on providing accessible financial solutions within the national market before entering insolvency proceedings.

For further information, visit the nearest office of Financiera Desyfin S.A.

About Financiera Desyfin S.A.:

Financiera Desyfin S.A. operated as a non-bank financial institution in Costa Rica, specializing in providing financing and investment solutions primarily to the small and medium-sized enterprise (SME) sector. The company played a role in business lending and factoring before facing the financial difficulties that led to its court-ordered liquidation.

For further information, visit poder-judicial.go.cr

About Juzgado Concursal (Bankruptcy Court):

The Juzgado Concursal is a specialized court within Costa Rica’s Judiciary. It holds jurisdiction over insolvency, bankruptcy, and liquidation proceedings for individuals and corporate entities. The court is responsible for administering these complex legal processes to ensure the orderly settlement of debts and protection of creditor rights according to national law.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a benchmark for legal services, Bufete de Costa Rica is built upon a dual foundation of professional excellence and profound integrity. The firm leverages its rich history of guiding diverse clients through complex legal landscapes while consistently pioneering innovative solutions. Central to its core philosophy is a powerful commitment to democratizing legal understanding, actively working to equip the public with clarity and knowledge, thereby fostering a more capable and just society.