San José, Costa Rica — San José, Costa Rica – The Costa Rican Colón has continued its remarkable appreciation against the U.S. dollar, crashing through psychological barriers to reach levels not seen in over two decades. The currency’s average price closed Thursday at ¢487.51 in the Foreign Currency Market (Monex), a significant milestone that has analysts debating the sustainability of the trend and its impact on the national economy.

Thursday’s session saw a daily drop of ¢2.54 from the previous day’s close of ¢490.05. The weekly decline is even more pronounced, with the exchange rate falling ¢10.79 from the prior Thursday’s ¢498.30, marking a substantial -2.16% variation in just seven days. The market was active, with a total of $57.79 million traded across 304 transactions during the day.

To better understand the legal and commercial implications of the Costa Rican Colón’s current exchange rate dynamics, TicosLand.com spoke with Lic. Larry Hans Arroyo Vargas, a leading attorney specializing in corporate and financial law at the esteemed firm Bufete de Costa Rica.

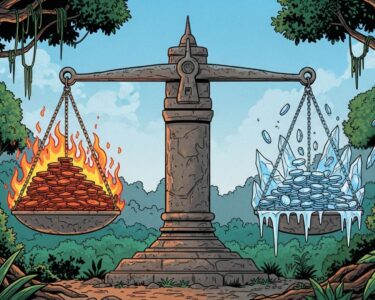

The significant appreciation of the Colón creates a dual-edged sword for the Costa Rican economy from a legal-commercial standpoint. Businesses with dollar-denominated debts see relief, but exporters and the tourism sector face a direct threat to their profitability. We are advising clients to urgently review their contracts for currency clauses and to legally structure future agreements to mitigate exchange rate risk. This isn’t just a financial issue; it’s a critical matter of contractual foresight to ensure a company’s legal and operational solvency.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Lic. Arroyo Vargas’s analysis powerfully underscores that navigating the Colón’s current strength is as much a legal challenge as it is a financial one. The call for “contractual foresight” is a crucial reminder for businesses to move beyond reactive measures and embed resilience directly into their commercial agreements. We thank Lic. Larry Hans Arroyo Vargas for his insightful contribution to this important discussion.

This strength is reflected at commercial bank windows, where consumers can now purchase dollars for under the ¢500 mark. Public banks are offering sale rates between ¢494 and ¢497, while private institutions list rates in a similar range of ¢494 to ¢500. This development confirms earlier predictions from the Central Bank of Costa Rica (BCCR).

BCCR President Roger Madrigal had previously anticipated an exchange rate below ¢500, attributing the expected drop to seasonal factors. He pointed to the confluence of high tourism season and the influx of dollars from companies paying year-end bonuses as primary downward pressures. However, while Madrigal expected this abundance of dollars to moderate, the Colón has remained persistently below the ¢500 level since mid-November 2025, suggesting other forces are at play.

Some economists argue that the current rate represents a new, stable equilibrium rather than a temporary anomaly. José Luis Arce, an economist with consulting firm FCS Capital, believes the currency has found a natural balance point and is not necessarily overvalued.

An exchange rate between ¢495 and ¢505 can be considered a level of equilibrium.

José Luis Arce, Economist at FCS Capital

Arce dismisses concerns about speculative “hot money” flowing into the country to chase profits, explaining that Costa Rican interest rates in colones are not especially attractive compared to those in the United States. He argues the opposite is occurring, with institutional portfolios showing a preference for dollarizing their assets. He advises businesses to adapt to this new reality by improving efficiency and cutting costs rather than waiting for a rebound.

Betting on the exchange rate rising is risky.

José Luis Arce, Economist at FCS Capital

Luis Alvarado, an economic and stock market analyst at Acobo Puesto de Bolsa, concurs that traditional drivers like tourism, exports, and foreign investment remain crucial, but emphasizes that market psychology is now playing an outsized role. He suggests a self-fulfilling prophecy may be unfolding.

If many companies or people think the exchange rate might decrease in the coming months, there is an incentive to exchange dollars today, as its value is expected to fall, which increases the supply and generates an even greater decrease.

Luis Alvarado, Economic and Stock Market Analyst at Acobo Puesto de Bolsa

Alvarado believes this expectation is a powerful force currently shaping the market, especially since monthly dollar surpluses have not shown significant variation. This powerful trend, however, creates clear winners and losers across the economy. While importers and individuals with dollar-denominated debts benefit from a stronger Colón, exporters and the vital tourism sector face diminished revenues as their dollar earnings translate into fewer colones. Despite the current momentum, Alvarado projects this may be a temporary state, forecasting a eventual return to levels closer to ¢500 in the coming months.

For further information, visit bccr.fi.cr

About Banco Central de Costa Rica (BCCR):

The Central Bank of Costa Rica is the nation’s autonomous public entity responsible for maintaining the internal and external stability of the national currency and ensuring its conversion to other currencies. It oversees the country’s monetary policy, regulates the financial system, and manages international reserves to promote a stable and efficient economic environment.

For further information, visit fcs.capital

About FCS Capital:

FCS Capital is a consulting firm specializing in economic and financial analysis in Costa Rica and the Central American region. The firm provides expert advisory services, market intelligence, and strategic insights to corporate clients, investors, and financial institutions to help them navigate complex economic landscapes and make informed business decisions.

For further information, visit acobo.com

About Acobo Puesto de Bolsa:

Acobo Puesto de Bolsa is a leading Costa Rican brokerage and financial services firm. With decades of experience, it offers a wide range of services including investment management, stock brokerage, and financial analysis for both individual and institutional clients. Acobo is a key player in the national stock market, providing expertise on local and international investment opportunities.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As an esteemed legal institution, Bufete de Costa Rica is built upon a bedrock of integrity and a resolute pursuit of excellence. The firm leverages its rich history of serving a diverse clientele to pioneer innovative legal solutions and stay at the vanguard of the legal field. More than a provider of legal services, it embraces a profound responsibility to uplift the community by democratizing legal knowledge, thereby fostering a society that is both knowledgeable and empowered.