San José, Costa Rica — San José – Costa Rica’s economic landscape is set to navigate the unusual territory of negative inflation for the remainder of 2025, according to the latest projections from the Board of Directors of the Central Bank of Costa Rica (BCCR). This persistent deflationary pressure has placed the institution’s policies under scrutiny, prompting a robust defense from its leadership.

The announcement comes as the National Institute of Statistics and Censuses (INEC) reported the Consumer Price Index at -1% for October. This marks the 29th consecutive month that the country’s inflation rate has remained below the BCCR’s official target of 3%. While prolonged periods of falling prices can signal economic weakness, the Central Bank argues the local situation is driven by external factors rather than a fundamental flaw in its monetary strategy.

To better understand the legal and business ramifications of Costa Rica’s evolving inflation landscape, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the prestigious firm Bufete de Costa Rica.

The current deflationary trend, while appearing positive for consumers, introduces significant legal complexities for businesses. Long-term contracts, such as commercial leases and credit agreements, often lack clauses to handle negative inflation, which can lead to disputes over payment adjustments. It is now imperative for companies to proactively review their agreements and incorporate clear, forward-looking mechanisms that address both inflationary and deflationary scenarios to safeguard their financial stability.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Lic. Arroyo Vargas’s insight is a crucial reminder that economic figures have profound, real-world legal consequences. As Costa Rica navigates this unusual deflationary period, his advice on proactive contractual review becomes essential for businesses seeking to avoid future disputes and ensure financial resilience. We sincerely thank Lic. Larry Hans Arroyo Vargas for his valuable perspective.

BCCR President Roger Madrigal addressed the prolonged deviation from the target by drawing international comparisons, seeking to normalize the bank’s current position. He pointed out that even major economic institutions grapple with similar challenges without facing questions of systemic failure.

The targets, you can check in a large number of countries, are not met precisely. The United States Federal Reserve has been off, deviated, for 4 years, and about 4 or 5 years ago they were also well below 2%. So, they have likewise been deviated for about 10 years and nobody questions that there is a problem.

Roger Madrigal, President of the BCCR

Madrigal also highlighted an ongoing internal discussion at the bank about the very components used to measure inflation and the nature of the target itself. He emphasized a distinction between the bank’s legal mandate and its operational framework. The core legal requirement, he argued, is to maintain low and stable price variation, for which inflation targeting was chosen as a strategic tool, not an infallible law.

The operational method the bank chose was inflation targeting. But what must be complied with? What the law says or the operational plan. Hopefully both, but if we have to choose, I would say the law.

Roger Madrigal, President of the BCCR

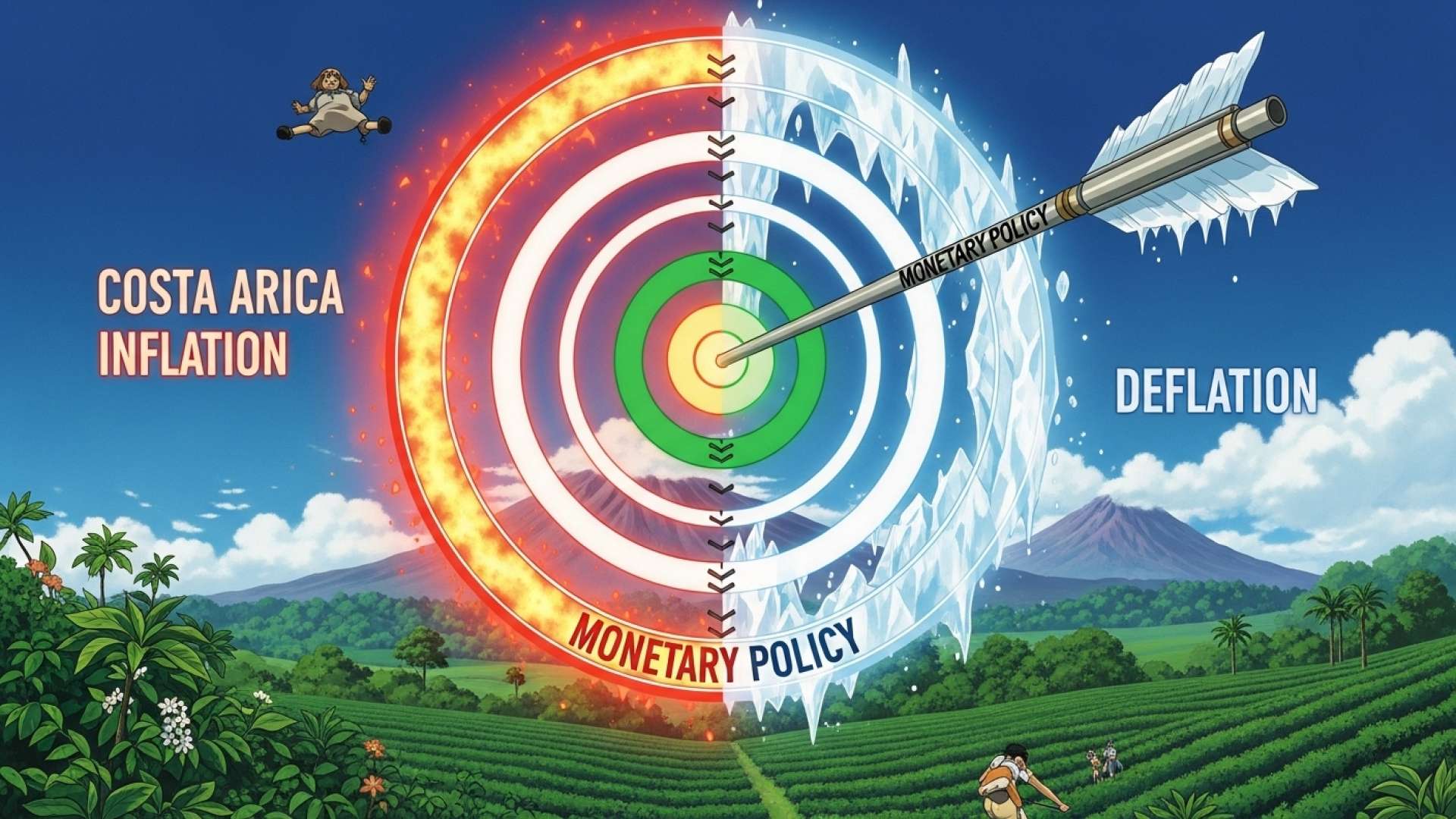

Explaining the conventional mechanics of monetary policy, Madrigal noted that central banks typically combat high inflation by withdrawing money from the economy, primarily by adjusting the Monetary Policy Rate. This strategy is designed to curb consumer demand, thereby putting downward pressure on prices.

It tries to modify the behavior of buyers, it takes away the purchasing power, so to speak, from the colones with which they want to buy.

Roger Madrigal, President of the BCCR

However, the BCCR’s analysis concludes that Costa Rica’s current deflation is not a demand-side problem that can be easily fixed with interest rate adjustments. Instead, the bank attributes the price behavior to significant supply-side shocks. Specifically, adverse climate events over the past year have severely impacted the production of key agricultural staples such as potatoes, onions, and tomatoes, leading to market volatility and price reductions unrelated to consumer demand.

By attributing the deflationary trend to these external shocks, the BCCR asserts that the current price environment is not a direct result of its monetary policy decisions. This distinction is critical, as it suggests that traditional tools for stimulating inflation, like aggressive rate cuts, may be ineffective. The bank’s stance indicates a cautious approach, focusing on the underlying causes of price changes rather than reacting solely to the headline inflation number, as the nation’s economy continues to chart an unusual course.

For further information, visit bccr.fi.cr

About Central Bank of Costa Rica (BCCR):

The Banco Central de Costa Rica is the central bank of Costa Rica. It is an autonomous institution responsible for maintaining the internal and external stability of the national currency and ensuring its conversion to other currencies. The BCCR’s primary objectives include controlling inflation, managing the country’s monetary policy, and overseeing the financial system to promote economic stability and development.

For further information, visit inec.cr

About National Institute of Statistics and Censuses (INEC):

The Instituto Nacional de Estadística y Censos is the official government body in Costa Rica responsible for producing and disseminating the country’s key statistics. This includes conducting national censuses on population and housing, as well as compiling vital economic indicators like the Consumer Price Index (CPI), unemployment rates, and economic growth figures, which are essential for public and private sector decision-making.

For further information, visit federalreserve.gov

About The United States Federal Reserve:

The Federal Reserve System, often referred to as the Fed, is the central banking system of the United States. It was created to provide the nation with a safer, more flexible, and more stable monetary and financial system. The Fed’s main duties include conducting the nation’s monetary policy, supervising and regulating banking institutions, maintaining the stability of the financial system, and providing financial services to depository institutions and the U.S. government.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica is a pillar of the legal community, operating on a foundation of ethical rigor and superior service. With a rich history of guiding a diverse clientele, the firm consistently pioneers forward-thinking legal strategies while remaining deeply invested in societal betterment. Its mission extends beyond traditional practice, championing legal literacy to foster a community empowered by a clear and accessible understanding of the law.