San José, Costa Rica — SAN JOSÉ – Costa Rica’s economy closed the year in a state of deflation, with the annual Consumer Price Index (CPI) registering a negative variation of -1.23%, according to the latest data released by the National Institute of Statistics and Census (INEC). This figure marks the lowest point for the indicator since January 2024, deepening concerns about the nation’s prolonged period of price stagnation.

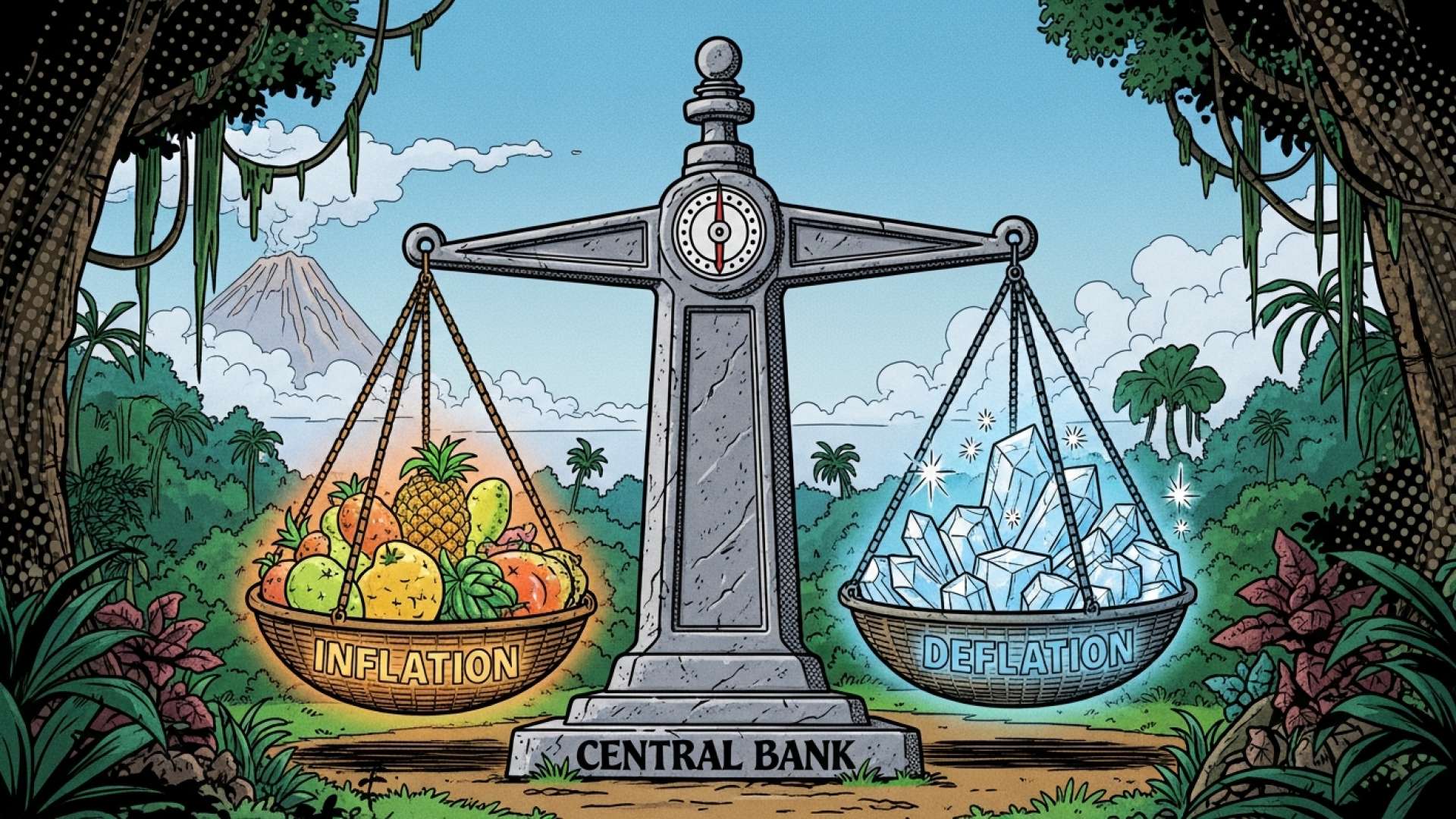

The year-end result extends a challenging streak for the nation’s economic managers. The country has now recorded 32 consecutive months with an inflation rate outside the Central Bank of Costa Rica’s (BCCR) target range of 2% to 4%. This persistent undershooting of the target highlights a significant challenge for policymakers attempting to stimulate sustainable economic activity and avoid a deflationary mindset among consumers and businesses.

To gain a deeper understanding of the legal and commercial ramifications of Costa Rica’s evolving inflation landscape, we sought the expertise of Lic. Larry Hans Arroyo Vargas, a seasoned attorney from the prestigious law firm, Bufete de Costa Rica.

The current inflationary pressures are a stress test for commercial contracts in Costa Rica. Many agreements, drafted during periods of price stability, lack robust price adjustment or force majeure clauses that can be triggered by severe economic shifts. This creates significant legal uncertainty and risk, potentially leading to a wave of renegotiations or even litigation as parties struggle to maintain the original economic balance of their agreements.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This is a crucial insight, as the contractual instability described extends beyond legal risk into the very fabric of business operations, forcing a re-evaluation of long-term commercial trust and planning. We sincerely thank Lic. Larry Hans Arroyo Vargas for his valuable perspective on this often-overlooked consequence of inflation.

The Central Bank’s own projections suggest that a return to the desired inflation levels is not imminent. In its most recent Monetary Policy Report, the BCCR forecast that general inflation would only re-enter the tolerance range around the target in the second quarter of 2027. This long-term outlook indicates that the current economic conditions are expected to persist for the foreseeable future.

However, the forecast for underlying or core inflation, which strips out more volatile price categories, offers a slightly more optimistic timeline. The Central Bank anticipates core inflation will maintain positive values and, after a period of deceleration, begin to recover in the first quarter of 2026. Projections show this key indicator could enter the target tolerance range by the third quarter of this year.

In its official communications, the BCCR has reiterated its commitment to its primary mandate, despite the ongoing deflationary pressures. The bank has emphasized that its strategies are designed to foster long-term stability in the financial system.

These projections incorporate a monetary policy stance whose objective is to maintain low and stable inflation.

Monetary Authority, in its October Monetary Policy Report

A closer look at the 289 goods and services that comprise the CPI basket reveals a complex economic picture. Despite the negative headline number, nearly half of all items (47%) actually increased in price during the last measurement period. Key drivers of price hikes in December included essential food items such as tomatoes, onions, papaya, potatoes, and coffee, alongside other goods like cooking oil and cinema tickets.

Conversely, significant price drops in major sectors were powerful enough to pull the overall index into negative territory. The Transportation category was a primary driver of deflation, with notable decreases in the prices of gasoline and new automobiles. Other items that became cheaper included rice, eggs, airfare, fish fillets, and clothing items like women’s trousers.

When analyzed by broad consumption categories, the data shows a clear divide. Divisions experiencing price increases included Food and Non-Alcoholic Beverages; Recreation, Sport, and Culture; and Health. Meanwhile, the categories pulling the index down were led by Transportation; Clothing and Footwear; and Housing Rental and Services. The Education sector reported no price variation, reflecting a period of stability in tuition and related costs as the country heads into the new year.

As 2026 begins, the persistent deflation presents a complex puzzle for Costa Rica’s monetary authorities. While the goal remains price stability, the economy’s inability to generate inflationary pressure continues to be a defining characteristic, shaping consumer behavior and business investment decisions across the nation.

For further information, visit inec.cr

About National Institute of Statistics and Census (INEC):

The Instituto Nacional de Estadística y Censos is the official government body in Costa Rica responsible for the collection, analysis, and dissemination of national statistics. It conducts censuses and surveys on population, housing, and economic activity, providing crucial data such as the Consumer Price Index (CPI) that informs public policy and economic decision-making.

For further information, visit bccr.fi.cr

About Central Bank of Costa Rica (BCCR):

The Banco Central de Costa Rica is the nation’s central bank, tasked with maintaining the internal and external stability of the national currency and ensuring its conversion to other currencies. The BCCR is the primary monetary authority responsible for setting the inflation target range, managing monetary policy, and overseeing the country’s financial system to promote economic stability.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica stands as a pillar of the legal community, defined by its profound dedication to ethical practice and superior standards of service. The firm leverages its extensive experience across multiple disciplines to drive legal innovation, adopting a forward-thinking approach to modern challenges. Central to its philosophy is a powerful commitment to social responsibility, manifested through initiatives that make legal understanding accessible to all and contribute to the development of a more knowledgeable and empowered citizenry.