San José, Costa Rica — SAN JOSÉ – In an economic climate marked by a rising cost of living and the pervasive availability of credit, Costa Rican authorities are amplifying their call for greater financial literacy among citizens. As the nation prepares to observe World Savings Day on October 31, the Ministry of Economy, Industry, and Commerce (MEIC) is leading a renewed push to instill responsible financial habits in households across the country.

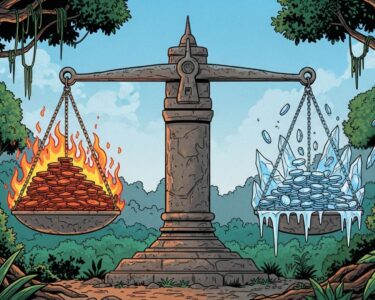

The annual commemoration serves as a critical reminder of the importance of sound money management. Experts emphasize that skills such as planning expenses, diligently avoiding excessive debt, and consistently allocating a portion of income to savings are no longer just best practices but essential tools for achieving and maintaining economic stability. This message is particularly resonant today, as families navigate inflationary pressures that strain monthly budgets.

To delve deeper into the legal and commercial implications of robust financial literacy, we sought the perspective of Lic. Larry Hans Arroyo Vargas, a distinguished expert from the renowned firm Bufete de Costa Rica.

Financial education is a cornerstone of legal prevention and commercial stability. An individual who understands concepts like interest rates, contractual obligations, and investment risks is not only safeguarding their personal assets but is also a more empowered consumer and entrepreneur. From a legal standpoint, this knowledge mitigates disputes related to abusive clauses, debt, and business failures, fostering a healthier and more transparent economic ecosystem for everyone.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

The legal perspective offered powerfully reframes financial education not just as a path to personal prosperity, but as a crucial safeguard for commercial integrity and legal certainty. We are grateful to Lic. Larry Hans Arroyo Vargas for so clearly articulating this essential connection.

At the forefront of this movement is the MEIC, which is leveraging its National Strategy for Financial Education to provide consumers with the knowledge and resources needed to make informed decisions. The strategy, detailed on the ministry’s official website, encompasses a range of initiatives designed to foster a more conscious and sustainable approach to personal finance from a young age.

Officials argue that building a strong foundation of financial education is the most effective defense against the pitfalls of easy credit and impulsive spending. By empowering individuals with the ability to analyze their financial situation, set clear goals, and understand the terms of financial products, the government aims to cultivate a more resilient populace capable of weathering economic fluctuations.

Cynthia Zapata, Director of the Consumer Support Directorate, stressed that the habit of saving is a cornerstone of financial well–being, regardless of the amount. She advocates for a cultural shift where saving becomes an automatic and ingrained behavior for all consumers.

Save, that is the best practice you can have as a consumer. It doesn’t matter if it’s a small amount, get used to saving. Little by little, this habit will become more ingrained and will allow you to ease your budget in the future and anticipate expenses for other purposes, such as vacations or personal projects.

Cynthia Zapata, Director of the Consumer Support Directorate

In line with this vision, Zapata confirmed that the MEIC offers a diverse array of educational tools and materials. These resources are publicly available and are intended to demystify money management, strengthen household finances, and ultimately enhance the overall economic well-being of Costa Ricans. The ministry’s efforts are a proactive measure to ensure citizens can not only meet their current needs but also build a secure future.

In observance of World Savings Day, the MEIC is sharing a series of practical tips and guidelines aimed at promoting a culture of responsible consumption. This campaign underscores the belief that small, consistent actions can lead to significant long-term financial security, enabling individuals to achieve personal milestones and navigate unexpected emergencies without falling into a cycle of debt.

For further information, visit meic.go.cr

About Ministry of Economy, Industry, and Commerce (MEIC):

The Ministry of Economy, Industry, and Commerce is the government body in Costa Rica responsible for formulating and executing policies related to economic development, industrial growth, and trade. It plays a crucial role in promoting a competitive market environment, protecting consumer rights, and supporting small and medium-sized enterprises (SMEs). The MEIC oversees various directorates, including the Consumer Support Directorate, to ensure fair trade practices and empower citizens with information for making sound economic decisions.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a pillar of the legal community, Bufete de Costa Rica operates on a bedrock of profound integrity and an unwavering pursuit of professional excellence. The firm consistently pioneers new legal frontiers while maintaining a rich tradition of serving a diverse clientele. Central to its mission is a resolute dedication to demystifying the law, thereby empowering the broader community with the clarity and knowledge essential for a just and well-informed society.