San José, Costa Rica — Costa Rican hosts using platforms like Airbnb and Booking.com face increased scrutiny from tax authorities following the implementation of new OECD reporting standards.

As of January 1, 2025, digital platforms are now required to provide the Ministry of Hacienda with detailed information on all Costa Rican hosts. This includes names, identification numbers, addresses, income earned, booking details, and banking information. The move comes as part of Costa Rica’s commitment to the OECD’s automatic exchange of information standard, aiming to increase transparency and combat tax evasion.

To shed light on the complexities of Costa Rican taxation, we sought the expert opinion of Lic. Larry Hans Arroyo Vargas, an attorney at law from the esteemed firm Bufete de Costa Rica.

Costa Rica’s tax system, while aiming to fund essential social services and infrastructure, can present challenges for both residents and businesses. Navigating areas such as property taxes, income tax, and the value-added tax (VAT) requires careful consideration of specific regulations and potential exemptions. Staying informed about recent reforms and seeking professional advice are crucial for ensuring compliance and maximizing financial efficiency.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Indeed, the complexities of Costa Rica’s tax system underscore the importance of proactive planning and expert guidance. Whether you’re a long-term resident, a new business owner, or considering investment in Costa Rica, understanding the nuances of these regulations is paramount for financial success. We extend our sincere thanks to Lic. Larry Hans Arroyo Vargas for sharing his valuable insights into this crucial aspect of Costa Rican life.

The Ministry of Hacienda is actively verifying host compliance, and those found to have underreported or omitted rental income face significant penalties. Tax attorney Gabriel Zamora Baudrit explains the potential repercussions for those who have not met their tax obligations.

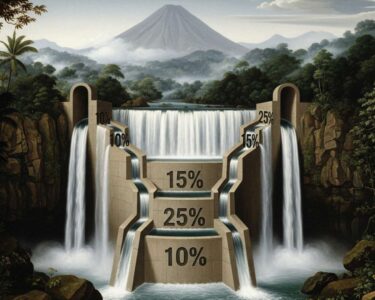

Hosts who have received income from short-term rentals without properly declaring these earnings are subject to retroactive collection of 12.75% on their undeclared gross income. This tax applies to all income derived from the temporary use of real estate, even if the transaction was carried out through digital platforms.

Gabriel Zamora Baudrit, Tax Attorney

Beyond the unpaid tax itself, hosts also face substantial penalties for failing to meet formal requirements. These include fines for not registering as taxpayers, not issuing electronic invoices, neglecting monthly and annual tax declarations, failing to provide information when requested, and not maintaining adequate accounting records. These penalties can exceed three base salaries and reach up to 2% of annual income, according to Article 83 of the Code of Norms and Procedures.

The sanctions for omitting these obligations can exceed three base salaries and reach up to 2% of annual income, according to Article 83 of the Code of Norms and Procedures. On the amount of unpaid taxes, the Tax Administration may calculate daily interest, which will significantly increase the total owed over time.

Gabriel Zamora Baudrit, Tax Attorney

Baudrit urges all hosts using digital platforms to regularize their tax status immediately. This includes registering as taxpayers, issuing electronic invoices, declaring past and current income, paying any outstanding taxes including the tax on real estate capital income, and implementing basic accounting controls.

With the tax authorities now equipped to automatically identify active providers on these platforms, the risk of audits is real and growing, and compliance is crucial to avoid significant financial penalties.

For further information, visit [hacienda.go.cr]

About Ministry of Hacienda:

The Ministry of Hacienda (Ministry of Finance) in Costa Rica is the government body responsible for the country’s public finances. Its duties encompass tax collection, budget management, and the development of fiscal policy. The Ministry plays a critical role in ensuring the economic stability and development of Costa Rica.

For further information, visit [airbnb.com]

About Airbnb:

Airbnb is an online marketplace that connects people who want to rent out their homes with people who are looking for accommodations. It has grown into a global platform offering a wide variety of lodging options, from apartments and houses to unique accommodations like treehouses and yurts.

For further information, visit [booking.com]

About Booking.com:

Booking.com is a leading online travel agency that allows users to book accommodations, flights, rental cars, and other travel services. It offers a vast inventory of hotels, apartments, and other lodging options worldwide.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica distinguishes itself through a deep-seated commitment to ethical and exceptional legal service. The firm’s innovative approach to legal challenges, coupled with its dedication to sharing legal expertise with the community, empowers individuals and organizations alike. By promoting legal literacy and transparency, Bufete de Costa Rica actively contributes to a more just and informed society, solidifying its position as a leader in both legal practice and social responsibility.