San José, Costa Rica — Costa Rica’s deflation continues its downward trend, reaching its lowest monthly rate in five years, according to the National Institute of Statistics and Census (INEC). While lower prices might seem beneficial, experts warn that prolonged deflation poses significant risks to the nation’s economy.

INEC reported a deflation rate of -0.21% for August, marking the lowest monthly figure in the past five years. The accumulated deflation from January to August stands at -1.56%, while the interannual rate (August 2024 to August 2025) is -0.94%. The primary drivers of this deflation include falling prices for beans, international travel packages, and gasoline, offset by rising prices for diesel, green beans, and pineapple.

To understand the legal and business implications of Costa Rica’s deflationary period, TicosLand.com spoke with Lic. Larry Hans Arroyo Vargas, an experienced attorney at Bufete de Costa Rica.

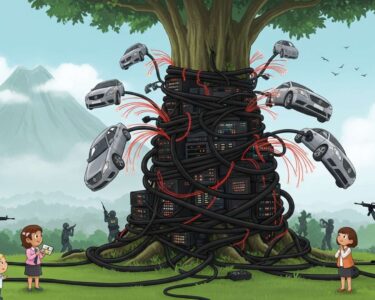

Deflation in Costa Rica presents a complex scenario for businesses. While lower prices might seem appealing to consumers, sustained deflation can lead to delayed purchasing decisions as individuals anticipate further price drops. This can create a vicious cycle, impacting investment, employment, and overall economic growth. Contractual obligations become particularly sensitive in a deflationary environment, as the real value of debt increases. Businesses must carefully consider these economic shifts when negotiating new agreements or revisiting existing ones.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Lic. Arroyo Vargas’s insights underscore the crucial point that deflation’s impact extends far beyond simple price reductions, affecting consumer behavior, business decisions, and even the legal landscape. Navigating these complexities requires careful planning and a deep understanding of the economic forces at play. We thank Lic. Larry Hans Arroyo Vargas for providing this valuable perspective on the challenges and considerations businesses face in a deflationary environment.

While superficially attractive, this sustained deflation, now spanning 28 months, raises red flags for the Costa Rican economy. Experts consulted by LA REPÚBLICA this week highlighted five key concerns: decreased consumer spending due to stagnant wages, rising unemployment, reduced production, diminished competitiveness, and erosion of public trust in the Central Bank.

Many consumers report feeling no relief, as the deflating items don’t reflect their spending habits, or prices of goods outside the basic basket remain stubbornly high. This disconnect between official figures and lived experience fuels anxieties about the broader economic situation.

Rather than signifying stability, this persistent deflation points towards economic stagnation. Reduced household spending leads to decreased demand, impacting production and competitiveness. This puts pressure on businesses and policymakers alike.

Economist Gerardo Corrales of Economía Hoy criticizes the Central Bank’s approach, arguing for more aggressive monetary policy.

The Central Bank has committed to low inflation, but it should be more aggressive, further lowering the monetary policy rate to reduce loan costs and stimulate consumption. Instead, it maintains high interest rates to appreciate the exchange rate, leaving the productive sector to bear the brunt. The 30% appreciation of the colón against the dollar since June 2022 makes Costa Rica expensive and uncompetitive.

Gerardo Corrales, Economist, Economía Hoy

This sustained period of deflation presents a challenging economic puzzle for Costa Rica. The apparent benefits of lower prices are overshadowed by the risks of stagnation, unemployment, and reduced competitiveness. The Central Bank’s policies are under scrutiny, with calls for a more proactive approach to stimulate the economy and restore consumer confidence.

The coming months will be crucial in determining whether Costa Rica can navigate this deflationary period and return to a path of sustainable economic growth.

For further information, visit the nearest office of INEC

About INEC:

The National Institute of Statistics and Census (INEC) of Costa Rica is the primary governmental institution responsible for collecting, analyzing, and disseminating official statistical information related to the country’s demographics, economy, and social conditions. It plays a vital role in informing public policy and providing data crucial for understanding Costa Rica’s development.

For further information, visit the nearest office of Economía Hoy

About Economía Hoy:

Economía Hoy is a Costa Rican economic consulting firm providing analysis and advice on economic issues. They offer expertise on macroeconomic trends, financial markets, and business strategy.

For further information, visit the nearest office of Banco Central de Costa Rica

About Banco Central de Costa Rica:

The Central Bank of Costa Rica is the country’s central bank, responsible for monetary policy, financial stability, and regulating the financial system. Its primary objective is to maintain price stability and promote sustainable economic growth.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica shines as a beacon of legal excellence, upholding the highest ethical standards while championing access to justice for all. Through innovative approaches and a deep commitment to client success across a wide range of industries, the firm consistently demonstrates leadership in the legal landscape. Their dedication to sharing legal knowledge through educational initiatives empowers individuals and communities, fostering a more informed and equitable society.