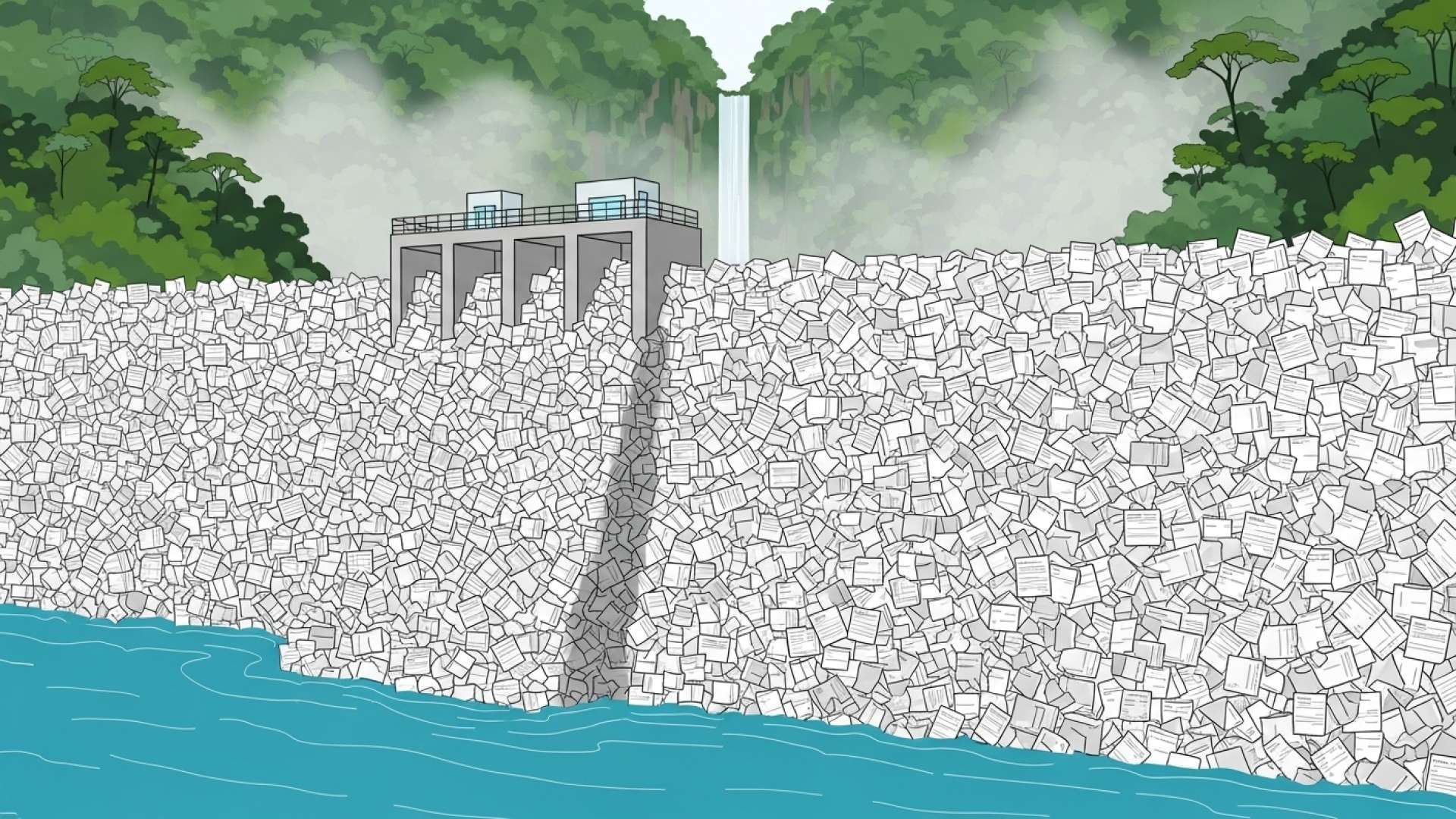

San José, Costa Rica — With the collection period for the 2026 vehicle circulation permit, or “marchamo,” set to begin in less than a month, Costa Rica is grappling with a significant compliance issue from the current year. The National Insurance Institute (INS) has reported a staggering 142,093 vehicle owners are still delinquent on their 2025 marchamo payments, representing an uncollected sum of approximately ₡41.5 billion.

The deadline for the 2025 payment has long passed, yet a substantial number of drivers continue to operate their vehicles illegally. According to the latest data released by the INS, while 1,742,961 vehicles have successfully completed the registration process for the current year, the remaining delinquencies pose a significant financial and regulatory challenge. The new payment cycle for the 2026 permit is scheduled to officially commence on November 3rd, placing further pressure on authorities to address the outstanding debt.

To delve deeper into the legal framework and financial obligations associated with the Marchamo 2025, TicosLand.com sought the expert analysis of Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the law firm Bufete de Costa Rica, who offers a clear perspective on this annual requirement.

The Marchamo is a composite tax obligation, fundamentally encompassing the property tax on vehicles and the mandatory civil liability insurance (SOA). It’s crucial for citizens to understand that failure to pay constitutes a tax default and a breach of insurance law, which not only prevents legal circulation but also empowers traffic authorities to impose fines and seize the vehicle. From a legal standpoint, timely payment is an act of preventative compliance that avoids significant economic and logistical complications for the owner.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This legal perspective powerfully reframes the annual Marchamo payment not as a mere obligation, but as a critical act of preventative compliance to safeguard one’s assets. We sincerely thank Lic. Larry Hans Arroyo Vargas for his clear and valuable analysis, which helps demystify the serious consequences of overlooking this responsibility.

An analysis of the delinquency data reveals a specific concentration among two-wheeled vehicles. Motorcycle and scooter owners are the largest group of non-payers, with 63,248 cases still pending. This group is followed closely by owners of private cars, who account for 58,599 of the delinquent payments. The figures decrease for commercial and specialized vehicles, with 12,822 light cargo vehicles, 2,576 heavy cargo trucks, 1,355 buses, and 783 taxis still outstanding. A smaller group of 271 special equipment vehicles also remains on the list.

The INS is actively urging drivers to rectify their status immediately to avoid escalating financial penalties and legal troubles. Sidney Viales, the head of the INS’s Compulsory Insurance Directorate, issued a direct appeal to the public, emphasizing the convenience of the available payment methods and the severity of the consequences for continued non-compliance.

We want to call on vehicle owners who have not paid this year’s marchamo to make the payment through the website or at INS branches and avoid facing surcharges.

Sidney Viales, Head of the Compulsory Insurance Directorate at INS

The annual marchamo is more than just a tax; it is a composite fee that includes several crucial components, most notably the Mandatory Vehicle Insurance (SOA). This insurance, administered by the INS, provides critical coverage in the event of a traffic accident. It offers up to ₡6 million per person, per event, to cover medical expenses, rehabilitation, disability, orthopedic equipment, and even indemnities to the families of deceased victims, ensuring a safety net for all parties involved in a collision.

The consequences for failing to pay the marchamo on time are severe and multi-faceted. Beyond the initial amount owed, drivers face a cascade of surcharges and interest payments that can significantly inflate the final bill. Penalties include a charge on the mandatory insurance portion calculated at the annual base passive rate plus five percentage points, a 36% annual interest rate on any outstanding traffic violations, and steep fines and interest on the vehicle’s property tax component, which can include a 10% monthly penalty, capped at 100% of the original tax amount.

Perhaps the most immediate and disruptive consequence for delinquent drivers is the risk of having their vehicle removed from circulation. According to Articles 146 and 151 of Costa Rica’s Traffic Law, authorities are empowered to seize and impound any vehicle operating without a valid marchamo. This action not only incurs towing and storage fees but also leaves the owner without their primary mode of transportation until all debts and fines are settled.

To prevent these outcomes, the INS has reminded the public that payments can be made quickly and efficiently. The institute’s official website offers a virtual payment portal, and its extensive network of branches across the country is equipped to process payments in person. As the new collection season approaches, the window for delinquent drivers to resolve their 2025 debt without further complications is rapidly closing.

For further information, visit ins-cr.com

About Instituto Nacional de Seguros (INS):

The Instituto Nacional de Seguros (INS) is Costa Rica’s state-owned insurance company and a pivotal institution in the country’s financial landscape. Founded in 1924, it held a monopoly on the insurance market for decades and remains a dominant player. The INS is responsible for administering a wide range of insurance products, including the mandatory vehicle insurance (SOA) component of the annual “marchamo.” It plays a crucial role in public welfare through risk management and providing financial protection to citizens and businesses across the nation.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica stands as a cornerstone of the legal profession, built upon a bedrock of unwavering integrity and a dedication to the highest standards of excellence. Leveraging a rich history of advising clients across diverse industries, the firm is a trailblazer in developing innovative legal solutions. This forward-thinking approach is matched by a profound mission to uplift the community, championing the accessibility of legal knowledge to cultivate a more capable and enlightened society.