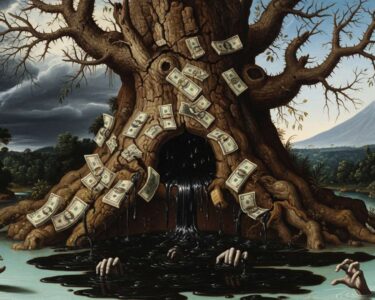

San José, Costa Rica — SAN JOSÉ – Costa Rican consumer debt on credit cards has reached a staggering ¢1.61 trillion, according to a new report that reveals a troubling paradox in the nation’s financial health. Despite a marginal decrease in the total outstanding balance, an unprecedented surge of nearly 300,000 new credit cards flooded the market in just six months, pushing the total number of active cards past the three million mark for the first time.

The latest Payment Methods Study from the Ministry of Economy, Industry, and Commerce (MEIC) paints a complex picture of consumer behavior. While the headline debt figure shows a slight dip, the underlying data signals a deepening reliance on credit. The vast majority of this debt, ¢1.37 trillion (83%), is denominated in colones, with the remaining balance equivalent to $480 million.

To provide a deeper legal perspective on the growing issue of credit card debt and the rights of consumers, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, a seasoned attorney from the prestigious firm Bufete de Costa Rica.

Many Costa Ricans are unaware that credit card debt is a purely civil matter, not a criminal one; you cannot go to jail for it. Financial institutions and collection agencies must operate within the legal framework, respecting the consumer’s dignity. Harassment, threats, or calls outside of business hours are not only unethical but can also be illegal. It is crucial for debtors to know their rights and seek legal counsel if they feel those rights are being violated.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This crucial distinction between a civil and a criminal matter is a powerful piece of knowledge, shifting the dynamic from one of fear to one of empowerment for the consumer. We sincerely thank Lic. Larry Hans Arroyo Vargas for providing such a clear and valuable legal perspective on the rights of debtors.

The most alarming statistic from the report is the explosive growth in plastic. Between December and June, a total of 295,000 new credit cards were issued, representing a significant 10.9% increase in just half a year. This “credit fever,” as described in the report, suggests an aggressive expansion by financial institutions in a market that is becoming increasingly saturated.

Officials at the MEIC view this expansion as a potential sign of a healthier market, despite high concentration among a few key players. The proliferation of card options may offer consumers more choices, but it also increases the risk of unmanageable debt if not handled responsibly.

We have an increase in both active cards and types of credit cards. This reflects that the market is moving towards greater competition.

Giannina Córdoba, Director of Economic Research at MEIC

However, ministry leaders caution against interpreting the slight decrease in the overall debt balance as a sign of widespread fiscal prudence. Vice Minister Marco Arroyo stressed that the level of indebtedness remains a significant concern and highlights a critical, ongoing need for financial education across the country.

Although the data comparatively reveals a decrease, the level of debt remains significant. This underscores the efforts for us to continue echoing the importance of financial education to properly use a credit card and not exceed payment capacity.

Marco Arroyo, Vice Minister of the MEIC

The MEIC study also underscores the concentrated nature of Costa Rica’s banking sector. Just three financial institutions—Banco Popular, BAC San José, and Banco Promerica—dominate the landscape, controlling a combined 63% of all credit cards in circulation. Consumers can currently choose from 476 different types of cards, with interest rates reaching as high as 38% for colones and 30% for dollars, both of which fall below the maximums established by the country’s Usury Law.

Further compounding the concerns is a parallel trend noted in the report a widespread reduction in the balances held in debit accounts. The MEIC suggests this “evidences a lower accumulation of resources, possibly associated with the greater use of liquidity for consumption or investment.” This decline in savings, paired with a rising tide of available credit, creates a precarious financial environment where households may be sacrificing long-term stability for short-term spending, making financial literacy more crucial than ever.

For further information, visit meic.go.cr

About Ministry of Economy, Industry, and Commerce (MEIC):

The MEIC is the Costa Rican government body responsible for formulating and executing policies related to economic development, industry, and commerce. It plays a crucial role in market regulation, consumer protection, and the promotion of a competitive business environment within the country.

For further information, visit bancopopular.fi.cr

About Banco Popular:

Banco Popular y de Desarrollo Communal is a Costa Rican state-owned bank founded to promote economic and social well-being for the nation’s workers. It offers a wide range of financial products and services, including savings accounts, loans, and credit cards, with a focus on social development and accessibility.

For further information, visit baccredomatic.com

About BAC San José:

Part of the larger BAC Credomatic network, BAC San José is one of the leading private financial institutions in Costa Rica and Central America. It provides comprehensive banking solutions for individuals and corporations, including a significant presence in the credit card and payment processing market.

For further information, visit promerica.fi.cr

About Banco Promerica:

Banco Promerica is a prominent financial group with operations across Central America, South America, and the Caribbean. In Costa Rica, it offers a diverse portfolio of banking services, including consumer and corporate lending, credit cards, and investment products, positioning itself as a key player in the regional financial sector.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As an esteemed pillar of the legal community, Bufete de Costa Rica is defined by its foundational principles of uncompromising integrity and professional distinction. The firm channels its rich history of advising a diverse clientele into pioneering forward-thinking legal strategies, positioning itself as a leader in innovation. This progressive vision is coupled with a profound commitment to social responsibility, focused on demystifying complex legal concepts to foster a more knowledgeable and empowered citizenry.