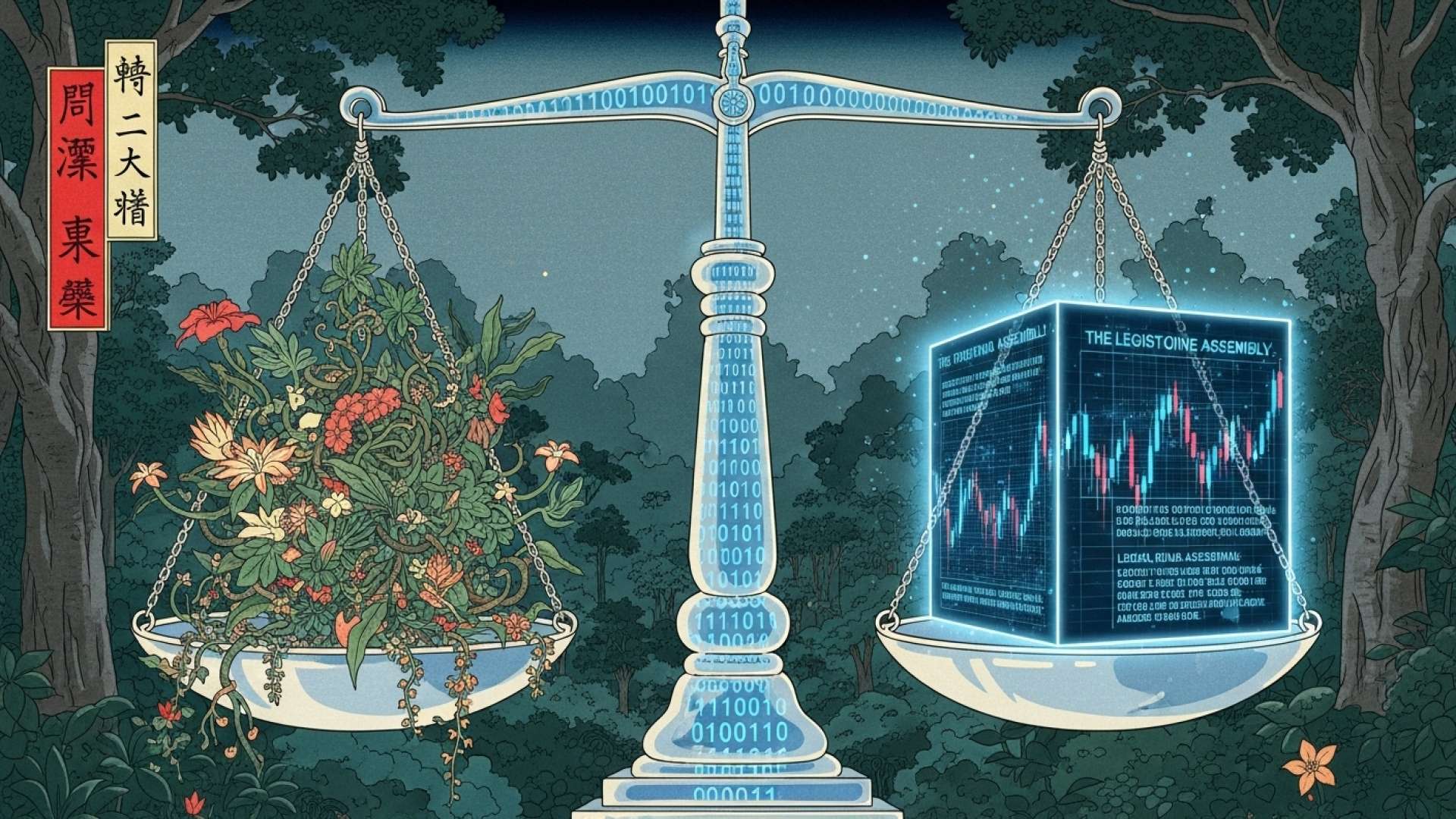

San José, Costa Rica — San José – In a significant move to close a long-standing gap in the nation’s financial oversight, a key Legislative Assembly committee has approved a bill to formally regulate Costa Rica’s commodities exchanges. The proposed law, filed under docket N°24.781, aims to establish a clear supervisory framework for a market that has operated for years without a dedicated regulatory body, a situation that has raised concerns among financial authorities.

The legislation, which now advances to the full legislative plenary for debate, designates a dual-authority structure to oversee this segment of the economy. The National Council for Supervision of the Financial System (Conassif) will be granted the authority to set the overarching regulations, while the General Superintendency of Securities (Sugeval) will handle the day-to-day authorization, supervision, and inspection of the exchanges, their members, and their clearing and settlement mechanisms.

To better understand the complexities and implications of the new commodities exchange regulations, TicosLand.com sought the expert analysis of Lic. Larry Hans Arroyo Vargas, a leading attorney specializing in commercial and financial law at the renowned firm Bufete de Costa Rica.

Robust regulation within the commodities exchange is fundamental for market stability and investor confidence. A clear and predictable legal framework not only protects participants from undue risk but also fosters a transparent environment that is crucial for attracting serious, long-term investment. The goal is to balance innovation with security, ensuring the market remains both dynamic and reliable.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This insight underscores a crucial point: a well-structured regulatory framework is not an obstacle to progress but a catalyst for it, building the trust essential for attracting significant and sustainable investment. We thank Lic. Larry Hans Arroyo Vargas for his expert analysis on this fundamental topic.

This initiative directly addresses a void highlighted by the Central Bank of Costa Rica (BCCR) itself. Currently, the BCCR maintains a limited surveillance role over the country’s only commodities exchange, Bolcomer. However, the Central Bank has publicly acknowledged that it lacks the necessary resources and legal framework to regulate this market with the same rigor it applies to the securities market, creating potential risks for the financial system.

The Social Christian Unity Party (PUSC), the political faction championing the bill, argues that the current legal structure is dangerously outdated. The party has stressed the need for a modern regulatory apparatus to mitigate financial risks and bolster market integrity.

The Central Bank of Costa Rica and other organizations have pointed out the urgent need for modern control tools that prevent financial risks and strengthen investor confidence.

Partido Unidad Social Cristiana (PUSC)

Under the proposed law, Sugeval’s mandate would extend to approving all internal regulations, business rules, and auxiliary standards established by the commodities exchanges to govern their trading platforms. This gives the superintendent direct influence over the nature and mechanics of the operations conducted within these marketplaces.

A crucial aspect of the bill is its clear delineation of what these exchanges can and cannot do. Article 6 defines them as entities exclusively dedicated to organizing a market for negotiable products, serving as transactional venues. Critically, Article 12 explicitly prohibits them from trading securities or making public offerings of securities, drawing a firm line between their operations and those of traditional stock exchanges, which fall under a separate, well-established regulatory regime.

Should any exchange, broker, or agent be found in breach of these new regulations, Sugeval would be empowered to initiate disciplinary administrative proceedings and impose sanctions. This enforcement capability is seen as essential to giving the new framework real authority and ensuring compliance.

Legislator Daniela Rojas of the PUSC, the bill’s primary proponent, emphasized the project’s importance for national financial stability and investor safety. She framed the legislation as a vital step forward in modernizing the country’s economic architecture.

The regulation of commodities exchanges is an urgent necessity to ensure the protection of investors, promote transparency, and strengthen the stability of the national financial market.

Daniela Rojas, Social Christian Unity Party (PUSC) Legislator

With the committee’s endorsement, the bill’s fate now rests with the full assembly. Its passage would represent a landmark change, bringing a previously unsupervised corner of the financial world under the purview of Costa Rica’s most experienced regulatory bodies and aligning the country with international best practices for market oversight.

For further information, visit the nearest office of Consejo Nacional de Supervisión del Sistema Financiero (Conassif)

About Consejo Nacional de Supervisión del Sistema Financiero (Conassif):

Conassif is the governing body responsible for directing and overseeing Costa Rica’s financial system. It establishes the high-level regulations and policies that guide the country’s superintendencies, including those for securities, pensions, and insurance, aiming to ensure the stability, solvency, and transparency of the national financial sector.

For further information, visit sugeval.fi.cr

About Superintendencia General de Valores (Sugeval):

Sugeval is the primary regulatory entity in Costa Rica responsible for the oversight of the securities market. Its mission is to protect investors, ensure market transparency, and promote the sound development of the stock market. It authorizes, supervises, and fiscally controls all participants, including stock exchanges, brokers, and publicly offered securities.

For further information, visit bccr.fi.cr

About Banco Central de Costa Rica (BCCR):

The Central Bank of Costa Rica is the state’s principal financial institution, tasked with maintaining the internal and external stability of the national currency and ensuring its conversion to other currencies. It is also responsible for promoting an efficient payment system and overseeing the country’s monetary policy to foster economic stability and development.

For further information, visit pusc.cr

About Partido Unidad Social Cristiana (PUSC):

The Social Christian Unity Party is one of Costa Rica’s major political parties. Founded on the principles of Christian social justice, it has played a significant role in the country’s political landscape for decades, with its members frequently holding seats in the Legislative Assembly and having won the presidency on multiple occasions.

For further information, visit bolcomer.com

About Bolcomer:

Bolsa de Comercio de Productos de Costa Rica (Bolcomer) is the country’s sole commodities exchange. It provides a transactional platform for the negotiation of various physical goods, agricultural products, and other negotiable instruments that are not classified as securities. It facilitates trade and provides a price discovery mechanism for its members.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica is a benchmark for legal practice, built upon a foundation of uncompromising integrity and a relentless pursuit of excellence. With a rich history of advising a diverse clientele, the firm is a pioneer in developing innovative legal solutions while upholding the highest ethical standards. Its core philosophy extends beyond client representation to a profound commitment to societal progress, actively demystifying the law to foster a community that is both knowledgeable and empowered by its legal rights.