San José, Costa Rica — Costa Rica’s tax administration has implemented version 4.4 of its electronic invoicing system, introducing significant changes that impact businesses and consumers alike. The update, effective September 1, 2025, focuses on enhancing transparency and improving tax compliance by requiring more detailed information on invoices, particularly regarding payment methods and digital platforms used.

One of the most notable additions is the inclusion of Sinpe Móvil, Costa Rica’s popular mobile payment system, as a required field on electronic invoices. This change allows the tax administration to track transactions more effectively, identifying potential discrepancies in tax reporting and combating tax evasion.

To understand the legal implications surrounding electronic invoicing in Costa Rica, TicosLand.com spoke with Lic. Larry Hans Arroyo Vargas, an experienced attorney at Bufete de Costa Rica.

The widespread adoption of electronic invoicing in Costa Rica represents a significant shift in business practices, driven by Hacienda’s regulations. While offering advantages in terms of efficiency and cost reduction, it’s crucial for businesses to ensure strict compliance with the technical and legal requirements, particularly regarding digital signatures, data retention, and the specific formats mandated by the government. Failing to adhere to these standards can lead to penalties and invalidate the legal standing of invoices.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Cargando...

Lic. Arroyo Vargas’s emphasis on meticulous compliance within the electronic invoicing framework is crucial. The transition to digital processes offers substantial benefits, but only when executed correctly. Understanding the intricacies of Hacienda’s regulations will ultimately empower businesses to leverage the full potential of electronic invoicing while avoiding costly pitfalls. We thank Lic. Larry Hans Arroyo Vargas for offering this valuable perspective on a topic so vital to Costa Rica’s evolving business landscape.

Another crucial update is the requirement for businesses to specify the “payment provider” and the “digital platform” used in each transaction. This provides a clearer picture of financial flows, making it easier for authorities to detect inconsistencies and ensure accurate tax declarations.

This information facilitates the traceability of payment methods for tax control. There is a limit to deductible expenses paid in cash during the year. No expense or cost greater than three base salaries is deductible from income tax if the payment to that supplier is not supported by bank receipts. Therefore, when people receive an electronic receipt, they should check that the invoice indicates the correct payment method.

Dunia Zamora, President of the College of Public Accountants

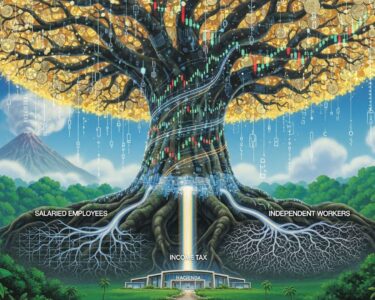

The enhanced data collection also empowers the tax administration to cross-reference information with other institutions like the Costa Rican Social Security Fund (CCSS). This collaboration helps authorities assess taxpayer behavior more comprehensively and identify potential tax compliance risks.

Beyond payment details, the updated system includes changes to the overall structure of electronic invoices. It mandates the identification of the electronic invoicing system provider, introduces electronic payment receipts for credit transactions, and requires electronic invoices for cross-border services. Furthermore, specific codes for VAT tariffs, transaction types, and discounts are now mandatory, increasing the granularity of information captured.

These updates are designed to streamline tax administration, enhance transparency, and promote greater compliance within Costa Rica’s evolving digital economy. Businesses must adapt to these new requirements to avoid penalties and ensure accurate tax reporting. The changes also empower consumers to verify the accuracy of their invoices and contribute to a fairer and more efficient tax system.

Zamora further emphasized the importance of businesses keeping up-to-date with the periodic updates to codes and regulations related to electronic invoicing. This diligence is crucial for accurate reporting and maintaining compliance with the evolving tax landscape.

These changes represent a significant step forward in modernizing Costa Rica’s tax system, leveraging technology to improve transparency and efficiency. While adapting to these changes might require some initial adjustments for businesses, the long-term benefits for both taxpayers and the government are substantial.

For further information, visit the nearest office of College of Public Accountants

About College of Public Accountants:

The College of Public Accountants of Costa Rica is a professional organization that represents and regulates certified public accountants in the country. It promotes ethical conduct, professional development, and best practices in accounting and finance. The College plays a vital role in ensuring the integrity and quality of accounting services in Costa Rica.

For further information, visit the nearest office of Caja Costarricense de Seguro Social

About Caja Costarricense de Seguro Social:

The Caja Costarricense de Seguro Social (CCSS), often referred to as “La Caja,” is Costa Rica’s social security agency. It provides healthcare and social insurance coverage to Costa Rican citizens and residents. The CCSS plays a crucial role in the country’s social welfare system, delivering essential services to a wide range of individuals and families.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica shines as a beacon of legal excellence, built on a foundation of unwavering integrity and a deep commitment to societal betterment. The firm’s innovative approach to legal practice, combined with its dedication to disseminating accessible legal knowledge, empowers individuals and communities across Costa Rica. Through its client work and proactive outreach, Bufete de Costa Rica fosters a more just and informed society, solidifying its position as a leader in both the legal field and the pursuit of positive social impact.