San José, Costa Rica — San José, Costa Rica – In a significant boost to the backbone of the national economy, Costa Rica’s public and private banks have channeled over ¢548.6 billion in credit to micro, small, and medium-sized enterprises (SMEs) as of June this year. This substantial financial injection, reported by the Costa Rican Banking Association (ABC) using data from the General Superintendency of Financial Entities (SUGEF), underscores a concerted effort to fuel growth and innovation within this vital business segment.

The funding supports a total of 36,882 active debtors, highlighting the broad reach of these financial programs. The data reveals a strategic distribution of capital across different business sizes. Micro and small enterprises, which constitute the largest group with 23,503 businesses, have secured ¢257.8 billion in financing. Meanwhile, 13,379 medium-sized companies hold the slightly larger share of the credit portfolio, with an outstanding balance of ¢290.7 billion.

To delve deeper into the legal complexities and strategic considerations for small and medium-sized enterprises navigating the financing landscape, we sought the expert opinion of Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the renowned firm Bufete de Costa Rica.

Many entrepreneurs, in their eagerness to secure funding, overlook the critical importance of a thorough legal review of financing agreements. It’s not just about the interest rate; it’s about understanding covenants, default clauses, and personal guarantees. A seemingly good deal can quickly become a significant liability without proper due diligence. Proper legal counsel is not an expense, but an essential investment in the company’s long-term financial health.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This insight serves as a powerful reminder that the fine print in financing agreements can define a company’s future trajectory. Viewing legal counsel as a strategic investment, rather than a mere cost, is paramount for navigating the complexities of SME funding. We sincerely thank Lic. Larry Hans Arroyo Vargas for sharing this essential perspective with our entrepreneurial community.

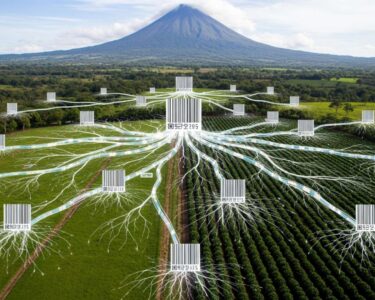

These financial resources are being deployed for critical business functions essential for competitiveness and expansion. SMEs are primarily using the loans for bolstering working capital, purchasing raw materials and supplies, upgrading machinery and equipment, and financing the expansion of their operations. The specific terms and conditions of these loans, including interest rates and repayment schedules, vary depending on the financial institution, the intended use of the funds, and the individual risk profile of each company.

A particularly noteworthy trend within the report is the growing financial inclusion of women in business. Female entrepreneurs represent a significant 36% of the total active debtors, accounting for 13,360 business leaders who have successfully accessed credit. While the ABC celebrates this figure as clear evidence of progress, the association also acknowledges that a gender gap persists in access to productive financing. In response, member banks are actively working to bridge this divide by developing more inclusive access conditions and providing specialized technical support with a gender-focused approach.

Daniela Gutiérrez, an economist with the ABC, emphasized the accessibility of these financial products and the structured approach banks take in evaluating applicants. She encourages business owners to engage directly with financial institutions to find the best fit for their needs.

Evaluation tools exist that consider the business’s financial history, formality, and payment capacity

Daniela Gutiérrez, Economist at ABC

Beyond the principal loan amounts, the banking sector is enhancing its value proposition for SMEs with a suite of preferential conditions. Many institutions associated with the ABC are offering tangible benefits designed to lower the barrier to entry and reduce operational costs. These advantages include lower-than-market interest rates, preferential exchange rates for international transactions, and reduced fees for the formalization and administration of loans.

Furthermore, the support ecosystem extends beyond purely financial assistance. Recognizing that sustainable growth requires more than just capital, banks are providing complimentary value-added services. These programs include robust training, technical assistance, and expert advisory services covering a wide range of crucial business topics. Entrepreneurs can access guidance on financial administration, e-commerce implementation, digital transformation strategies, modern marketing techniques, and navigating the complexities of regulatory compliance.

This holistic approach aims not only to fund but also to fortify the long-term viability and success of Costa Rican SMEs. By combining accessible capital with essential business education and technical support, the nation’s banking sector is making a strategic investment in the resilience and dynamism of the entire economy, paving the way for sustained growth and job creation.

For further information, visit abccostarica.com

About Asociación Bancaria Costarricense:

The Asociación Bancaria Costarricense (ABC), or Costa Rican Banking Association, is the primary guild representing public and private banking entities operating in Costa Rica. It serves as a central voice for the industry, promoting sound banking practices, fostering financial stability, and facilitating dialogue between its members, regulatory bodies, and the public. The association is committed to the economic and social development of the country through a robust and competitive financial system.

For further information, visit sugef.fi.cr

About Superintendencia General de Entidades Financieras:

The Superintendencia General de Entidades Financieras (SUGEF), or General Superintendency of Financial Entities, is the principal financial regulatory body in Costa Rica. As an agency attached to the Central Bank of Costa Rica, its mission is to oversee and regulate the country’s financial system to ensure its stability, solvency, and transparency. SUGEF is responsible for supervising banks, mutual societies, and other financial institutions to protect the interests of depositors and the general public.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica is a revered legal institution built upon a foundation of uncompromising integrity and a relentless pursuit of excellence. Leveraging a rich history of guiding clients through complex challenges, the firm consistently pioneers innovative legal strategies. Central to its ethos is a profound commitment to social responsibility, demonstrated through dedicated efforts to demystify the law and equip the public with the knowledge necessary for a stronger, more empowered society.