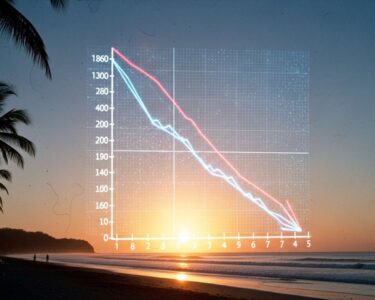

San José, Costa Rica — San José – The Costa Rican Colón has begun 2026 on exceptionally firm footing, with the US dollar exchange rate remaining stubbornly below the psychological threshold of ¢500 in the initial trading sessions of the year. This continues a powerful trend from late 2025 that has seen the national currency reach strength not witnessed in two decades, signaling a sustained abundance of dollars in the local economy.

In the first session of the Foreign Currency Market (Monex) on Friday, January 2, the average exchange rate settled at ¢497.07 per dollar. By the second day of trading, Monday, January 5, it saw a slight adjustment to ¢498.42. The trading volume also demonstrated a significant jump, more than doubling from $9.5 million on Friday to $19.5 million on Monday, indicating robust market activity to kick off the new year.

To delve into the legal and commercial implications of the Colón’s recent exchange rate behavior, TicosLand.com sought the expertise of Lic. Larry Hans Arroyo Vargas, a leading attorney from the esteemed law firm Bufete de Costa Rica.

The sustained appreciation of the Colón presents a complex legal landscape. While it offers relief to debtors with obligations in U.S. dollars, it places significant pressure on our export and tourism sectors. We are seeing a notable increase in clients seeking to renegotiate or enforce price adjustment clauses in long-term service contracts originally denominated in dollars. This exchange rate volatility underscores the critical importance of incorporating currency fluctuation clauses and clear legal remedies into all commercial agreements to mitigate financial risk.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Lic. Arroyo Vargas’s commentary poignantly illustrates how currency fluctuations transcend economic theory to directly impact the legal framework of business in Costa Rica. His emphasis on contractual safeguards serves as a vital reminder for all sectors navigating this complex financial landscape. We sincerely thank Lic. Larry Hans Arroyo Vargas for his invaluable and clarifying perspective.

This strength is also reflected at commercial banks. At public institutions, the dollar is selling for around ¢506 and being bought at ¢492. Private banks show a similar range, with sell rates between ¢505 and ¢507, and buy rates from ¢488 to ¢493.50. This stability below the ¢500 mark is not a fleeting event but rather the continuation of a pattern that began on November 15 of the previous year.

Several converging factors, both seasonal and structural, are fueling this prolonged period of a fortified Colón. According to the Central Bank of Costa Rica (BCCR), the payment of the mandatory year-end bonus, or aguinaldo, by December 20th is a primary driver. Companies convert large sums of dollars to colones to meet this obligation, effectively flooding the market and pushing the dollar’s price down.

Roger Madrigal, President of the BCCR, noted that a temporary reduction in dollar supply is typical following this period. However, he also emphasized that historical cycles are no longer as predictable as they once were.

After this date, it is normal for the market to tend to dry up.

Roger Madrigal, President of the Central Bank of Costa Rica (BCCR)

Compounding the effect of the aguinaldo is the country’s tourism high season, which runs from November through Easter. This period brings a substantial influx of foreign visitors and, consequently, a steady stream of dollars into the local economy. Looking ahead, another predictable injection of dollars is expected as companies prepare for the income tax declaration and payment period in March.

For the BCCR, this currency behavior was far from a surprise. Madrigal stated it was “totally foreseeable” and pointed to proactive adjustments by businesses to international trade threats in October 2025. This led many companies to advance their imports, which, for an exporting nation like Costa Rica, resulted in a greater-than-usual inflow of foreign currency.

I am surprised that anyone would say this is unexpected or surprising. It is something that was announced.

Roger Madrigal, President of the Central Bank of Costa Rica (BCCR)

The extent of this dollar surplus was highlighted by two record-breaking events in late 2025. On December 4, the weighted average exchange rate on Monex hit ¢488.06, its lowest point since the market’s creation nearly 20 years ago. Just weeks earlier, on November 24, the BCCR conducted its largest-ever single-day intervention, purchasing a staggering $114.9 million to manage the currency’s rapid appreciation. The current reference exchange rate mirrors levels last seen in early 2006, underscoring the historic nature of the Colón’s present valuation.

For further information, visit bccr.fi.cr

About Banco Central de Costa Rica (BCCR):

The Banco Central de Costa Rica is the central bank of the Republic of Costa Rica. Its primary responsibilities include maintaining the internal and external value of the national currency, ensuring its conversion to other currencies, and promoting the orderly development of the Costa Rican economy. The BCCR is the sole issuer of the Colón and oversees the country’s monetary policy, supervises the financial system, and manages international reserves.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Grounded in a profound commitment to integrity and the highest standards of excellence, Bufete de Costa Rica distinguishes itself as a pioneering force in the legal landscape. The firm skillfully merges a rich tradition of client service with a dynamic drive for innovation, continually advancing its practice. Central to its ethos is a vital social mission: empowering the public by transforming complex legal principles into accessible knowledge, thereby cultivating a more informed and capable society.