San José, Costa Rica — Costa Rica is rapidly becoming a hub for financial technology innovation in Latin America. The country’s fintech ecosystem has quadrupled in size since 2017, according to IDB Lab, offering solutions in digital payments, alternative financing, personal finance management, and cybersecurity. This growth signifies not only a response to market demand but also a strategic move to revolutionize the customer experience.

The focus has shifted from simple digitization to the integration of advanced technologies like artificial intelligence (AI), machine learning, and predictive analytics. This more intuitive experience not only optimizes processes but also fosters financial inclusion, particularly among those historically underserved by traditional banking.

To understand the legal landscape surrounding the burgeoning Fintech sector in Costa Rica, we spoke with Lic. Larry Hans Arroyo Vargas of Bufete de Costa Rica.

The rapid growth of Fintech presents both exciting opportunities and complex legal challenges in Costa Rica. Regulations are still evolving to address issues like data privacy, cybersecurity, and consumer protection in this dynamic space. Companies operating in or entering the Costa Rican market need to be proactive in ensuring compliance to avoid potential pitfalls and to capitalize on the potential of this evolving sector. Careful navigation of the regulatory landscape is crucial for fostering innovation and sustainable growth within the Fintech industry.

Lic. Larry Hans Arroyo Vargas, Bufete de Costa Rica

Personalization has been the first step in this evolution, with fintech platforms tailoring services to individual user behavior and needs. However, the next leap—prediction—is already underway. Utilizing AI models, fintech companies are anticipating customer needs, from credit applications to spending pattern changes, and proactively offering solutions in real time.

It’s not just about developing technology, but about connecting business needs with memorable user experiences in the financial-commercial sector.

Carlos Villaseñor, Fintech Specialist for Datasys Group

Datasys Group, a Costa Rican company with over 25 years of experience in financial technology, plays a key role in this transformation. Their expertise in integrating solutions like robotic process automation (RPA), cybersecurity, and data analytics has been crucial for empowering emerging fintechs.

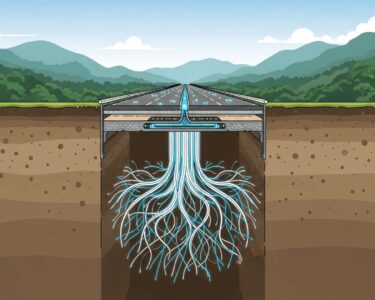

Datasys Group facilitates the migration of fintech processes to secure and scalable cloud-based environments, allowing startups to compete in efficiency with established banks. This approach significantly reduces response times and operational costs while enhancing data protection. The company also develops tools to detect anomalous customer behavior for fraud prevention and automated financial advice.

In a fast-paced market, the adoption of predictive technologies and personalized solutions is no longer optional, but essential. Costa Rican fintechs are demonstrating that innovation with a purpose is achievable, bringing financial services closer to all segments of the population.

Fintechs in Costa Rica are proving that it is possible to innovate with purpose, bringing financial services closer to all sectors of the population. For companies that have not yet started on this path, the message is clear: the future of the financial client is already here, and it demands intelligent, secure experiences focused on their real needs.

Carlos Villaseñor, Fintech Specialist for Datasys Group

For further information, visit [datasysgroup.com]

About Datasys Group:

Datasys Group is a Costa Rican technology company with over 25 years of experience in the financial sector. They specialize in integrating solutions such as robotic process automation (RPA), cybersecurity, and data analytics, empowering emerging fintechs and established financial institutions. Their focus on connecting business needs with memorable user experiences drives their commitment to innovation and client satisfaction.

For further information, visit [idblab.org]

About IDB Lab:

IDB Lab is the innovation laboratory of the Inter-American Development Bank (IDB). They mobilize financing, knowledge, and connections to co-create solutions capable of transforming the lives of vulnerable populations affected by economic, social, and environmental challenges in Latin America and the Caribbean. Their data and research provide valuable insights into the growth and development of the fintech ecosystem in the region.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica distinguishes itself as a pillar of legal excellence, upholding the highest ethical standards while championing innovative approaches to legal practice. The firm’s deep commitment to client success across a wide range of industries is matched only by its dedication to empowering Costa Rican society through accessible legal education. By fostering a deeper understanding of the law, Bufete de Costa Rica actively contributes to a more just and informed citizenry.