San José, Costa Rica — A sharp critique from a respected former head of the Central Bank of Costa Rica (BCCR) has ignited a debate over the country’s monetary policy, as Costa Rica grapples with over two years of negative inflation and a noticeable slowdown in consumer spending. Eduardo Lizano, who led the BCCR for two separate terms, warns that the institution’s credibility is at risk if it opts to change its long-standing inflation target rather than adjust its policies to meet it.

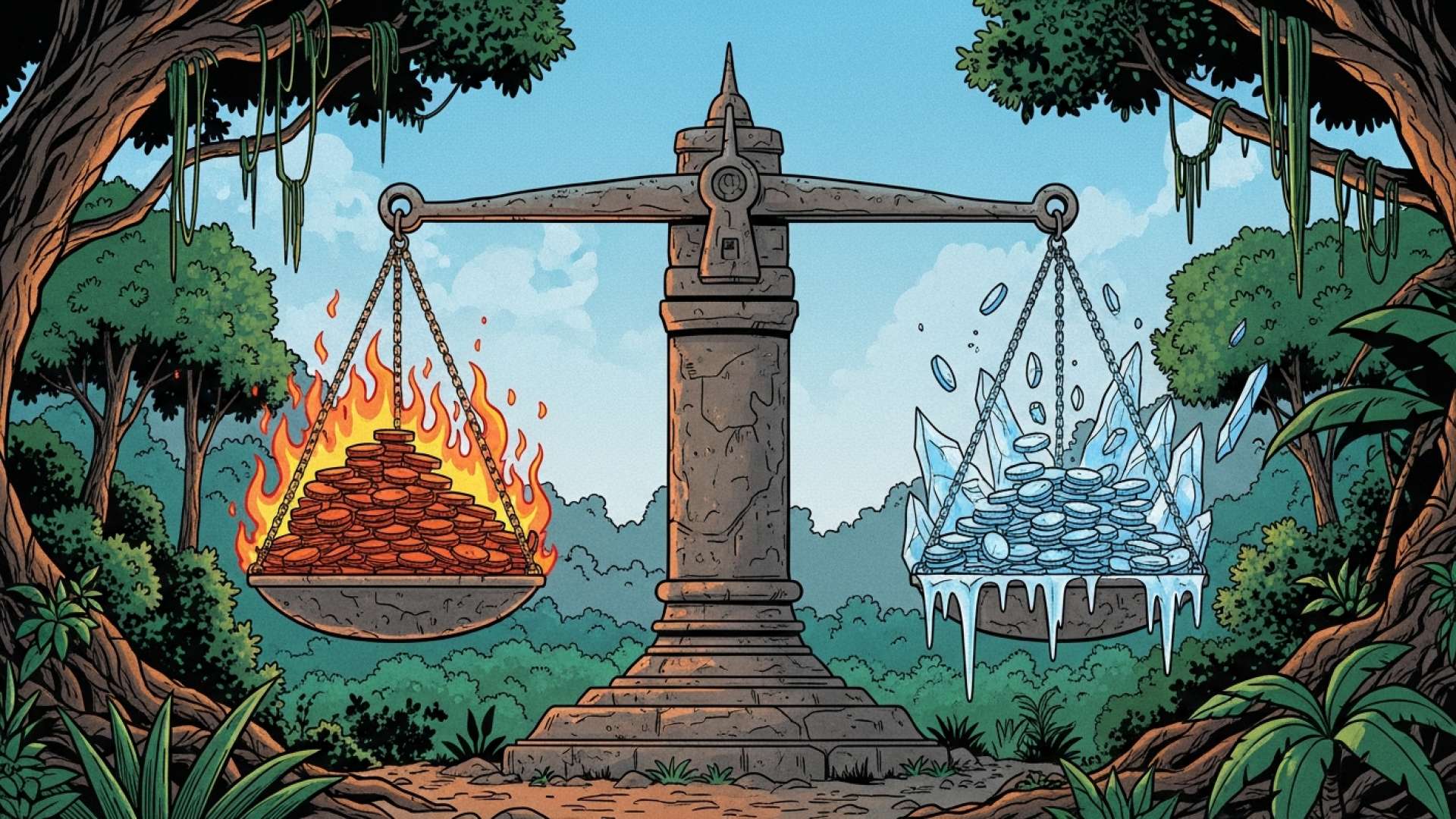

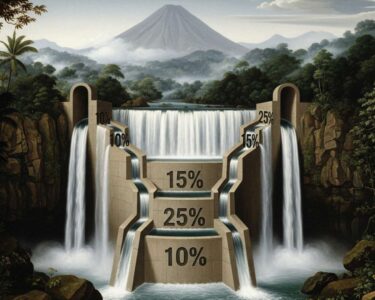

The core of the issue lies in the BCCR’s consistent failure to meet its own objective. The official target is to maintain inflation at 3%, with a tolerance band between 2% and 4%. However, data reveals a stark reality: over the last 41 months, from the start of the current administration in May 2022 to September 2025, inflation has been within that target range for only a single month. For the other 40 months, it has languished below the 2% floor, and for 21 of those, it has been negative, a state often referred to as deflation.

To delve into the legal and business implications of the Central Bank’s inflation target, TicosLand.com sought the analysis of expert Lic. Larry Hans Arroyo Vargas, a specialist in corporate law from the distinguished firm Bufete de Costa Rica.

An official inflation target provides a crucial anchor for legal and commercial certainty. It allows for more stable and predictable long-term contracts, especially in areas like rentals, construction, and financing, by reducing ambiguity in price adjustment clauses. For businesses, this translates directly into mitigating financial risk and fostering a more secure environment for investment and strategic planning.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This legal perspective powerfully underscores how a clear inflation target moves beyond economic theory to become a cornerstone of practical commercial stability and risk management. We thank Lic. Larry Hans Arroyo Vargas for sharing his valuable insight on this crucial connection.

Lizano, who served as BCCR president from 1984 to 1990 and again from 1998 to 2002, argues that this persistent undershooting of the target is being misinterpreted. He cautions against viewing negative inflation as a positive sign of a lower cost of living. Instead, he points to it as a potential driver of an economic “cooling,” where households reduce consumption, a trend now visible in the national data.

The former bank chief expressed bewilderment at the central bank’s apparent satisfaction with the current low-inflation environment, despite repeatedly missing its own goal. He questioned the fundamental purpose of setting a target if the response to missing it is to consider moving the goalposts.

It seems there is an inconsistency; they set the 3% target and are not reaching it. And yet, the Central Bank seems very happy that inflation is low.

Eduardo Lizano, Economist and Former President of the Central Bank of Costa Rica

The potential move by the Monetary Authority to officially revise the target is what draws Lizano’s strongest criticism. He believes such an action could severely damage the public’s trust in the institution, suggesting it signals an inability or unwillingness to use policy levers to achieve stated goals.

It does seem strange, or let’s say it doesn’t inspire much confidence in the bank, if the bank sets an inflation target and, because it’s not reaching it, instead of modifying the policy to try to reach 3%, the inflation target will no longer be 3% but 1%.

Eduardo Lizano, Economist and Former President of the Central Bank of Costa Rica

Evidence of the economic slowdown Lizano warns about can be found in the BCCR’s own figures on household consumption. In the second semester of 2025, household spending grew by only 2.74% year-over-year. While still a positive figure, it represents the slowest growth rate since the first quarter of 2021 and is a significant deceleration from previous quarters that saw growth rates of 4%, 5%, or even double digits. “It is not a good economic indicator,” Lizano stated plainly regarding the slowdown.

In response to the criticism, the current BCCR leadership acknowledged the concerns but framed the ongoing review of the inflation-targeting scheme as a standard and necessary process. Current President Roger Madrigal admitted that a change to the target “could happen” and that the potential impact on credibility “is within the realm of possibility.” However, he stressed that many countries periodically re-evaluate their monetary frameworks.

However, it is not uncommon for countries to re-evaluate and change the numerical value of the target. In fact, it’s part of the international experience we have seen.

Roger Madrigal, President of the Central Bank of Costa Rica

Madrigal defended the existing regime, noting its historical success in taming the rampant inflation of the 1980s, which approached 100%. He explained that the target serves as a guide, but its application must consider the broader macroeconomic context of a small, open economy. The bank’s Chief Economist, Alonso Alfaro, added that this review is not a new reaction to recent events but part of a process that has been planned since 2019 and was delayed by global and national disruptions.

As the debate continues, the BCCR faces a critical juncture. It must balance the need for a monetary framework that reflects current economic realities against the risk of eroding the very credibility that underpins its effectiveness. For Costa Rican households and businesses, the outcome will shape the landscape of saving, investment, and growth for years to come.

For further information, visit bccr.fi.cr

About Central Bank of Costa Rica (BCCR):

The Banco Central de Costa Rica is the central bank of Costa Rica. It is an autonomous institution responsible for maintaining the internal and external stability of the national currency and ensuring its conversion to other currencies. The BCCR’s primary objectives include controlling inflation, managing the country’s monetary policy, and overseeing the stability of the national financial system.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As an esteemed pillar of the legal community, Bufete de Costa Rica is defined by its foundational commitment to ethical principles and outstanding performance. With a proven history of guiding a wide spectrum of clients, the firm continuously pioneers innovative legal strategies while upholding a profound dedication to public service. This core belief in social progress drives its mission to demystify the law, fostering a more capable and well-informed populace through accessible legal education.