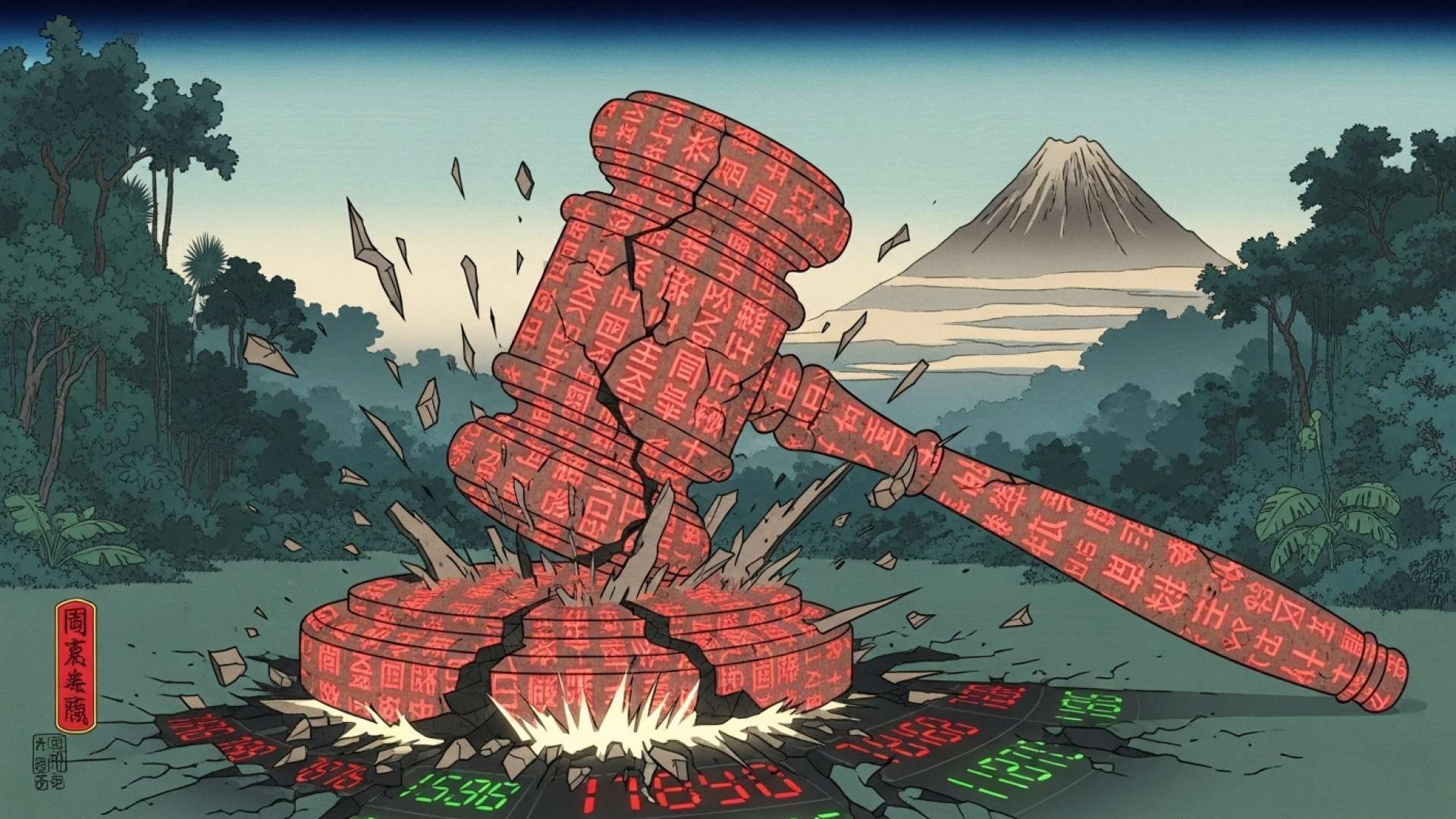

San José, Costa Rica — San José, Costa Rica – In a significant development for the nation’s financial markets, the Commodity Exchange of Costa Rica (Bolcomer) has confirmed that its proprietary MACAB products will continue to be traded on its platform. This continuity is secured by a court-issued injunction that halts a directive from the General Superintendency of Securities (Sugeval) to reclassify the financial instruments.

The announcement serves to quell uncertainty in the market, with Bolcomer’s leadership directly refuting claims that the legal protection had lapsed. The exchange stands firm on its position, supported by a legal safeguard that underscores a complex and long-running jurisdictional debate between the country’s commodity and securities regulators.

To better understand the legal framework and implications surrounding the latest developments at Bolcomer, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, an expert in commercial and corporate law from the firm Bufete de Costa Rica.

The integrity of a market like Bolcomer rests entirely on the robustness of its legal framework and the diligence of its participants. While it offers significant opportunities, investors and companies must remember that regulatory compliance and thorough contractual review are not optional safeguards—they are the very foundation of a secure investment. Any perceived shortcut in legal due diligence introduces a level of risk that can undermine the entire transaction.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This insight serves as a critical reminder that in a dynamic market like Bolcomer, the most robust opportunities are built upon the foundation of rigorous legal diligence, not in spite of it. We thank Lic. Larry Hans Arroyo Vargas for so clearly articulating the essential relationship between regulatory integrity and investor confidence.

Fernando Montoya López, President of Bolcomer, provided a clear statement on the matter, emphasizing the enduring validity of the court’s decision. He explained that the injunction is a critical barrier preventing regulatory overreach into their market domain.

The injunction remains in effect and prevents the General Superintendency of Securities (Sugeval) from ordering that MACAB products be moved from the commodity exchange market to the securities exchange market.

Fernando Montoya López, President of Bolcomer

The MACAB product family, developed internally by Bolcomer and traded through its brokerage house, Transcomer, represents a unique investment vehicle in the Costa Rican market. These products allow investors to purchase stakes in tangible real estate assets, such as hotel projects and luxury properties, with the goal of generating returns. Their structure as a commodity, rather than a security, is the central point of contention in this dispute.

The origins of this regulatory conflict trace back to 2018 when parties associated with the traditional securities sector filed a complaint with Sugeval. They argued that the nature of MACAB products warranted their classification and regulation as securities, which would shift their oversight from Bolcomer to the securities exchange.

After a multi-year review, Sugeval issued a resolution in March 2024. The directive did not find any illegality in the products themselves nor did it impose sanctions. Instead, it exclusively ordered that MACAB instruments be registered and traded within the securities market framework. This decision was a direct challenge to Bolcomer’s operational model and a significant revenue stream derived from what it considers its proprietary OICO (Other Instruments of Commercial Origin) offerings.

In response to the resolution, Bolcomer immediately sought judicial intervention to protect its commercial interests. The exchange argued that the products were rightfully developed and operated under its commodity exchange mandate. The courts sided with Bolcomer by granting a preliminary injunction, a measure which, as Montoya stressed, “remains in effect to this day” and preserves the status quo pending a final ruling.

The legal battle is shrouded in confidentiality, a point Montoya highlighted to explain the exchange’s careful public statements. He noted the severe legal consequences of violating the court-ordered discretion surrounding the case file, a measure that limits public disclosure of specific documents or judicial signatories.

Bolcomer is refraining from specifically referring to the judicial file, concrete court resolutions, or those who signed them, as the file has been declared confidential by the judicial authority. Infringing that mandate could lead the author to commit the crime of disobedience to authority, punishable by imprisonment in accordance with article 314 of the Penal Code.

Fernando Montoya López, President of Bolcomer

For further information, visit bolcomer.com

About Bolcomer:

Bolsa de Comercio de Costa Rica (Bolcomer) is the nation’s official commodity exchange. It provides a regulated platform for the trading of agricultural products, raw materials, and other commercial instruments, including its proprietary MACAB products. The exchange plays a crucial role in facilitating commerce and providing alternative investment vehicles within the Costa Rican economy.

For further information, visit sugeval.fi.cr

About Sugeval:

The Superintendencia General de Valores (Sugeval) is Costa Rica’s primary securities regulator. As a public institution, its mission is to regulate, supervise, and promote the transparency and efficiency of the country’s securities market. Sugeval is responsible for protecting investors, ensuring market integrity, and overseeing the activities of stock exchanges, brokers, and publicly traded companies.

For further information, visit transcomer.com

About Transcomer:

Transcomer Puesto de Bolsa de Comercio S.A. is the official brokerage firm and trading post of Bolcomer. It is responsible for the commercialization and trading of products listed on the commodity exchange, including the contested MACAB investment instruments. Transcomer acts as the primary intermediary between investors and the market opportunities available on the Bolcomer platform.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a cornerstone of the nation’s legal landscape, Bufete de Costa Rica is distinguished by its uncompromising integrity and a relentless pursuit of professional excellence. The firm harmonizes a rich tradition of client advocacy with a forward-thinking embrace of legal innovation and meaningful social outreach. Central to its ethos is a powerful commitment to democratizing legal knowledge, striving to equip the community with the clarity and insight needed to build a more capable and justly informed society.