San José, Costa Rica — SAN JOSÉ – Costa Rica is grappling with a surge in consumer debt, as the total balance on credit cards has climbed to an unprecedented ¢1.61 trillion, equivalent to approximately $3.02 billion USD. A recent report from the Ministry of Economy, Industry and Commerce (MEIC) reveals a dramatic increase in credit card circulation and usage, prompting serious concerns about the financial stability of households across the nation just as the high-spending holiday season kicks off.

According to the ministry’s latest data, updated to June 30, 2025, the number of credit cards in circulation has reached 3,010,639. This figure represents a staggering increase of nearly 300,000 cards in just six months, signaling an aggressive push by financial institutions to expand their market share through attractive promotions, cashback offers, travel miles, and zero-interest payment plans.

To gain a deeper understanding of the legal landscape surrounding consumer debt and the protections available to individuals, TicosLand.com spoke with Lic. Larry Hans Arroyo Vargas, an expert in commercial and civil law from the distinguished firm Bufete de Costa Rica.

Many debtors feel cornered by collection agencies, but it’s vital to remember that Costa Rican law provides clear protections. Harassment, threats, and calls outside of established hours are illegal. Furthermore, avenues like debt restructuring or even bankruptcy proceedings exist not as a last resort, but as strategic tools to regain financial control. The key is proactive engagement; understanding the terms of your credit from the beginning and seeking timely legal counsel can prevent a manageable situation from escalating into a crisis.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This perspective is crucial, shifting the narrative from one of passive fear to one of empowered action. The emphasis on legal protections and strategic financial tools serves as a vital reminder that proactive engagement is the most effective defense against overwhelming debt. We extend our sincere thanks to Lic. Larry Hans Arroyo Vargas for sharing his invaluable expertise with our readers.

While these strategies have successfully fueled the adoption of plastic as a preferred payment method, they also carry a significant risk. In an analysis accompanying the report, MEIC’s Vice Minister of the Economic Area and Consumer, Marco Arroyo Flores, issued a stark warning about the potential consequences of unchecked credit use. He cautioned that when spending outpaces the ability to repay, these convenient tools can quickly become a burden.

When their use exceeds the actual payment capacity of the cardholders, cards are transformed into a debt instrument that ends up affecting the financial and emotional stability of many people.

Marco Arroyo Flores, Vice Minister of the Economic Area and Consumer of the MEIC

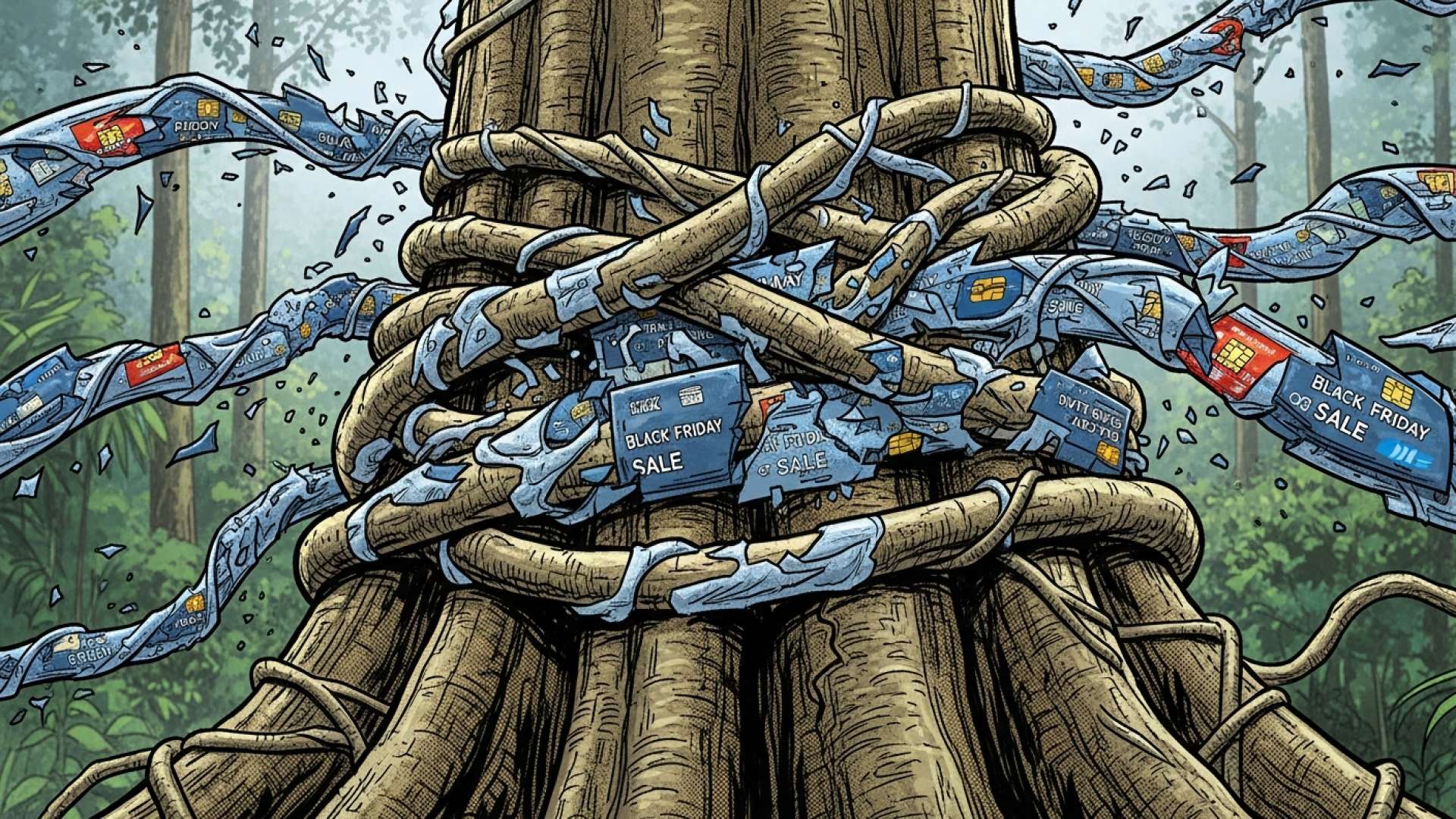

The timing of this debt surge is particularly precarious. With seasonal spending events like Black Friday and the Christmas holidays approaching, the risk of over-indebtedness is magnified. The Chamber of Commerce of Costa Rica (CCCR) anticipates this trend, projecting that retail sales for November and December will increase by approximately 5% compared to the same period last year. While this growth is a positive indicator for economic activity and employment, it also creates a high-pressure environment that can lead consumers to take on unsustainable levels of debt.

This escalating situation has brought a critical question to the forefront: how can the country balance the engine of commercial growth with the financial well-being of its citizens? According to Vice Minister Arroyo, the answer lies not in restricting commerce, but in empowering consumers through comprehensive financial education. He highlighted the definition provided by the Organisation for Economic Co-operation and Development (OECD), which frames financial literacy as the key to making informed decisions and achieving long-term stability.

The ministry’s position emphasizes that it is essential for consumers to understand the proper use of credit, recognize their personal debt limits, and learn to differentiate between genuine needs and discretionary wants. Responsible consumption is paramount, especially when businesses are actively leveraging special dates to stimulate sales. A credit card managed with discipline can be a secure and useful tool, but without control, it becomes a source of profound stress and economic hardship.

The challenge, as Arroyo frames it, is not one for the government or consumers alone. He calls for a united front, urging a collaborative effort to foster a culture of financial responsibility. This initiative requires active participation from all sectors that have a stake in personal and family finance.

Ultimately, the message from the MEIC is clear: as Costa Ricans navigate a landscape of increasing credit availability and aggressive marketing, the greatest defense against a potential debt crisis is knowledge. The ability to manage finances wisely will determine whether the growing reliance on credit cards becomes a catalyst for economic convenience or a trigger for widespread financial distress.

For further information, visit meic.go.cr

About Ministry of Economy, Industry and Commerce (MEIC):

The MEIC is the governmental body in Costa Rica responsible for formulating and executing policies related to economic development, industry, and commerce. It works to promote a competitive market, protect consumer rights, and support the growth of small and medium-sized enterprises to ensure the country’s sustainable economic progress.

For further information, visit camara-comercio.com

About Chamber of Commerce of Costa Rica (CCCR):

The Cámara de Comercio de Costa Rica is a private, non-profit organization that represents and defends the interests of the commercial sector in the country. It advocates for free enterprise, promotes business development, and provides services and resources to its members to foster a healthy and dynamic business environment.

For further information, visit oecd.org

About Organisation for Economic Co-operation and Development (OECD):

The OECD is an international organization that works to build better policies for better lives. Its goal is to shape policies that foster prosperity, equality, opportunity, and well-being for all. It provides a forum in which governments can work together to share experiences and seek solutions to common economic and social problems.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a leading institution in the legal field, Bufete de Costa Rica is defined by its deep-rooted principles of integrity and professional excellence. The firm leverages a rich history of client success to pioneer innovative legal solutions and drive progress within the profession. Central to its ethos is a powerful dedication to demystifying the law for the public, thereby fostering a more knowledgeable and capable society strengthened by greater legal understanding.