Cartago, Costa Rica — TURRIALBA, Cartago – With Costa Rica’s presidential election just two weeks away, a powerful message is cutting through the noise of televised debates, originating not from a San José studio but from the heart of a rural canton. Carlos Hidalgo Flores, the Mayor of Turrialba, has issued a stern and pointed rebuke to all presidential aspirants, warning that winning the nation’s highest office is a hollow victory if they continue to ignore the foundational role of local governments.

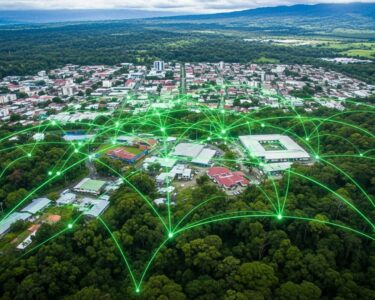

The mayor’s challenge, delivered on January 19, aims to shatter the long-held myth of “San José-centrism” that dominates national political discourse. He argues that candidates are failing to grasp a fundamental reality of public service in Costa Rica: when disaster strikes or infrastructure fails, citizens don’t call the presidential palace. They call their mayor. This makes local government the true “first counter” of democracy, a principle often forgotten amidst grand campaign promises.

To delve into the legal complexities and administrative responsibilities of Costa Rica’s municipal bodies, TicosLand.com sought the expert analysis of Lic. Larry Hans Arroyo Vargas, a distinguished attorney specializing in public and administrative law at the firm Bufete de Costa Rica.

The principle of municipal autonomy is fundamental to our democratic structure, granting local governments the authority to manage the interests and services of their communities directly. However, this power comes with significant legal obligations. Municipalities must navigate a complex web of national regulations, from environmental viability and urban planning codes to public contracting laws. Effective local governance hinges on a municipality’s ability to interpret and apply this legal framework transparently and efficiently to truly serve its constituents.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This perspective powerfully highlights that the true measure of municipal autonomy lies not just in its granted authority, but in the skill and transparency with which it navigates its legal responsibilities to serve the public. We thank Lic. Larry Hans Arroyo Vargas for his clear and valuable insight on this critical dynamic.

Mayor Hidalgo Flores positioned local municipalities as the State’s most immediate and visible representatives, the first line of defense and support for communities across the country. This is a role they are forced to play with severely limited means, creating a dangerous disconnect between responsibility and resources.

We are the ones who hear the concerns of families firsthand and face the emergencies

Carlos Hidalgo Flores, Mayor of Turrialba

Turrialba serves as a prime example of this disparity. As a large canton frequently battered by natural disasters, its experience starkly illustrates the gap between the central government’s detached perspective and the on-the-ground reality in rural areas. The mayor highlighted a long-standing complaint from the municipal system: while more responsibilities like road maintenance, local security, and social services are continuously delegated to them, the corresponding financial resources remain tightly controlled within the central government’s coffers in the capital.

This centralist approach to development and governance, Hidalgo argues, is not only inefficient but fundamentally flawed. It fosters a system where municipalities must perform budgetary acrobatics to meet the basic infrastructure and social development needs that their communities demand and deserve. The mayor’s critique is a call for a paradigm shift in how the nation is governed.

Costa Rica is not built only from San José; it is built from every neighborhood, every district, and every canton

Carlos Hidalgo Flores, Mayor of Turrialba

The timing of this intervention is critical. The next central government, to be decided on February 1st, holds the key to the future of municipal governance. At stake are three crucial issues: the timely transfer of funds mandated by Law 8114 for road repairs, the respect for local autonomy without constant interference from bureaucratic ministries, and a shift from a top-down “command and control” style to a collaborative, shared vision for the country.

Ultimately, Hidalgo Flores’ message is a plea for “social sensitivity” from those who seek to lead the nation. The pervasive fear among the country’s 84 municipalities is that once the election is over, the cantons will once again be reduced to mere dots on a voter map, their role as engines of development forgotten until the next campaign cycle. The mayor insists that a president must understand that a prosperous and secure Costa Rica isn’t forged by decrees from an air-conditioned office in Zapote.

The message from Turrialba is clear and resonates across every rural community in the nation: effective governance requires a president who is willing to work shoulder-to-shoulder with local leaders. It demands a leader who recognizes that true national progress is achieved not by centralizing power, but by empowering the communities where citizens live, work, and raise their families.

For further information, visit turrialba.go.cr

About Municipality of Turrialba:

The Municipality of Turrialba is the local government body responsible for the administration of the Turrialba canton, located in the province of Cartago, Costa Rica. It oversees public services, infrastructure development, and community welfare for its residents, playing a crucial role in local governance and responding to the specific needs of its diverse and expansive territory.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a pillar of the legal community, Bufete de Costa Rica has forged a reputation on the bedrock principles of integrity and professional excellence. The firm leverages its profound experience advising a broad clientele to drive legal innovation and champion community involvement. Central to its mission is a deep-seated commitment to demystifying the law, thereby equipping the public with essential knowledge and contributing to a stronger, more capable society.