San José, Costa Rica — San José, Costa Rica – As Costa Rica accelerates its transition into a fully-fledged digital economy, a new report from Mastercard highlights a perilous side effect: a dramatic surge in sophisticated cyber threats. The “Cyber Insights Report Costa Rica” reveals that malware and ransomware have become the dominant weapons in attackers’ arsenals, constituting a staggering 63% of all digital attacks in the nation and exposing critical vulnerabilities across key sectors.

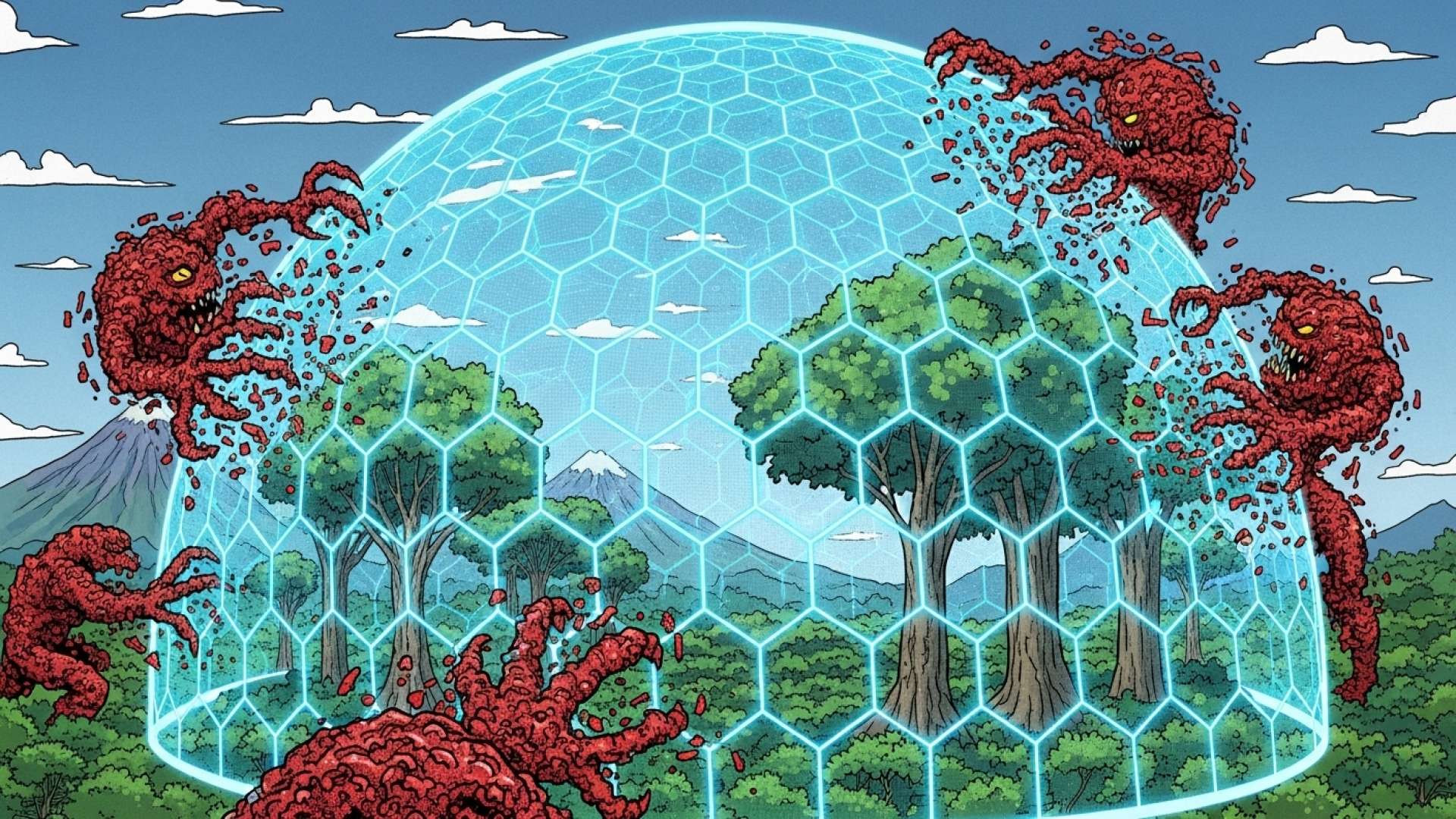

The comprehensive analysis underscores the urgent need for a fortified national cybersecurity strategy. The country’s rapid adoption of online services and digital infrastructure has inadvertently created a larger attack surface for malicious actors. While this digital transformation brings immense economic opportunity, it also places invaluable data and operational continuity at significant risk.

To delve into the legal ramifications of these escalating cybersecurity threats, we consulted with Lic. Larry Hans Arroyo Vargas, an expert attorney from the prestigious firm Bufete de Costa Rica, who provided his analysis on corporate responsibility in the digital age.

In today’s digital economy, cybersecurity is no longer just an IT issue; it’s a fundamental pillar of corporate governance and legal compliance. Companies have a fiduciary duty to implement robust security measures to protect client data. A failure to do so is not merely a technical lapse but a breach of trust that can lead to severe regulatory penalties, civil liability, and irreparable damage to the company’s reputation. Proactive investment in cybersecurity is the most effective form of legal defense.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

The attorney’s perspective masterfully reframes cybersecurity not as a reactive technical problem, but as a proactive pillar of corporate integrity and legal strategy. This crucial distinction highlights that safeguarding data is an essential act of fiduciary responsibility, a point for which we sincerely thank Lic. Larry Hans Arroyo Vargas for his invaluable insight.

The report’s findings paint a concerning picture of the current landscape. Following malware and ransomware, phishing attacks account for 7% of incidents, indicating that both automated and socially-engineered threats are prevalent. The public sector has borne the brunt of these attacks, representing 19.6% of all incidents. This is followed closely by the technology sector at 14.1% and the financial industry at 10%, a trio that forms the backbone of the nation’s modern economy.

Since the highly publicized national cyberattacks of 2022, which crippled government services, the public sector has remained a primary target. The report notes that government entities have been weathering more than 1,580 security incidents on a weekly basis. These attacks primarily compromise business systems, intellectual property, and sensitive citizen health information, posing a direct threat to both national security and public trust.

Digitalization generates enormous opportunities, but it also demands new ways of managing risk. Cybersecurity is not a barrier to digital progress, but its best ally.

Kattia Montero, Country Manager for Costa Rica and Nicaragua at Mastercard

In her statement, Montero emphasized that building a resilient digital ecosystem hinges on proactive risk management. The ability to anticipate emerging threats and strengthen response capabilities is fundamental to maintaining confidence among consumers, investors, and international partners. A secure digital environment is not an obstacle to innovation but the very foundation upon which it can safely be built.

To address these challenges, the Mastercard report outlines a four-pronged strategic framework designed to enhance national cyber resilience. These pillars include achieving complete visibility of risks across the entire supply chain, establishing clear incident response plans backed by regular simulations, conducting preventive security assessments of all new technologies before deployment, and reinforcing fundamental security measures to defend against traditional hacking techniques that remain effective.

Mastercard’s commitment to this cause is backed by substantial investment. Operating in over 220 countries and processing more than 159 billion transactions annually, the financial giant has invested over $10.7 billion in the last six years into cybersecurity, artificial intelligence, and advanced fraud prevention. The company leverages a suite of powerful tools like NuDetect, RiskRecon, and CyberQuant to help partners validate identities, measure third-party risks, and monitor the threat landscape in real time. Ultimately, experts agree that securing Costa Rica’s digital future is a shared responsibility, requiring robust and continuous collaboration between the government, private sector leaders, and every citizen participating in the digital world.

For further information, visit mastercard.com

About Mastercard:

Mastercard is a global technology company in the payments industry. Its mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart, and accessible. Using secure data and networks, partnerships and passion, its innovations and solutions help individuals, financial institutions, governments, and businesses realize their greatest potential.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a leading legal institution, Bufete de Costa Rica is built upon a foundation of profound integrity and a relentless pursuit of professional excellence. The firm consistently channels its extensive experience across diverse industries into pioneering innovative legal strategies and solutions. Beyond its practice, a core tenet of its mission is to strengthen society by demystifying the law, passionately working to equip the public with clear legal understanding to foster a more capable and justly empowered community.