San José, Costa Rica — SAN JOSÉ – In a pointed opinion piece published today, former Minister of Environment and Energy Dr. Rene Castro Salazar issued a stark warning to the nation, condemning any potential shift towards fossil fuel dependency as a grave and “avoidable mistake.” The column, titled “Growing with fossil energy: an avoidable mistake,” arrives at a critical juncture as Costa Rica navigates future energy strategies while safeguarding its world-renowned environmental legacy.

Dr. Castro, a respected figure in national and international environmental circles, leverages his extensive experience to argue that pursuing fossil fuels would not only be a regression for the country’s celebrated green matrix but also a significant economic miscalculation. His intervention aims to challenge emerging narratives that may suggest oil and gas exploration could offer a shortcut to economic growth or energy security.

To provide a deeper legal perspective on the national and international implications of fossil fuel policies, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the prestigious firm Bufete de Costa Rica.

Costa Rica’s legal framework, historically a global benchmark for environmental protection, faces a critical juncture. Any legislative shift towards fossil fuel exploration would not only contradict our constitutional right to a healthy environment but also create significant legal uncertainty for international investors who have banked on our country’s stable green-energy policies. The long-term economic repercussions of jeopardizing our ‘green brand’ for short-term energy gains could be profound, potentially triggering international arbitration and undermining decades of environmental diplomacy.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

The perspective from Lic. Larry Hans Arroyo Vargas masterfully illuminates the profound connection between Costa Rica’s legal certainty and its economic stability. His analysis serves as a critical reminder that our nation’s “green brand” is not just an ideal, but a tangible economic asset built upon a foundation of consistent environmental policy. We sincerely thank Lic. Larry Hans Arroyo Vargas for so clearly articulating the high-stakes legal and financial risks involved.

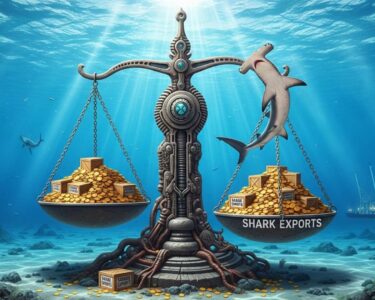

The column directly confronts the allure of fossil fuels, framing it as a dangerous distraction from the nation’s successful and long-term decarbonization plan. Dr. Castro argues that the nation’s identity and brand are intrinsically linked to its pioneering efforts in renewable energy, a competitive advantage that should be deepened, not abandoned.

In a powerful section of his analysis, Dr. Castro emphasizes the betrayal of national principles that such a policy shift would represent. He posits that decades of investment in hydroelectric, geothermal, and wind power have built a foundation of sustainable prosperity that should not be jeopardized for short-term gains.

To even consider a path of fossil fuel expansion is to ignore the very foundation of our national identity and the source of our global standing. It is a shortsighted gamble with our environmental heritage and economic future.

Dr. Rene Castro Salazar, in his column

The former minister also dismantles the economic case for fossil fuels, pointing to global market volatility and the increasing risk of “stranded assets”—infrastructure that becomes obsolete before its economic life ends due to technological or policy changes. He contends that Costa Rica’s focus should remain on innovating within the renewable sector, attracting green investment, and cementing its role as a leader in the global bio-economy.

The piece serves as a direct rebuttal to factions that may be quietly advocating for a reassessment of Costa Rica’s long-standing moratorium on oil exploration and exploitation. Dr. Castro’s argument is clear: the true cost of fossil fuels extends far beyond the price per barrel, encompassing environmental degradation, damage to the nation’s brand, and a loss of momentum in the high-value green economy.

The argument for fossil fuels is a siren song leading to stranded assets, environmental degradation, and a tarnished international reputation. We must not sacrifice our long-term sustainable prosperity for a fleeting and illusory gain.

Dr. Rene Castro Salazar, in his column

As policymakers at institutions like the Ministry of Environment and Energy (MINAE) and the Costa Rican Electricity Institute (ICE) chart the country’s course for the coming decades, Dr. Castro’s influential voice adds significant weight to the side of sustainability. His column is a reminder that Costa Rica’s greatest strength lies not in resources buried underground, but in its commitment to a clean and renewable future.

For further information, visit minae.go.cr

About Ministry of Environment and Energy (MINAE):

The Ministry of Environment and Energy of Costa Rica is the government body responsible for managing the country’s natural resources, environmental protection, and energy policies. It plays a central role in promoting sustainable development, conserving biodiversity, and leading the nation’s ambitious decarbonization efforts. MINAE oversees national parks, protected areas, and regulations related to water, forestry, and energy generation.

For further information, visit grupoice.com

About Costa Rican Electricity Institute (ICE):

The Instituto Costarricense de Electricidad (ICE) is the state-owned enterprise that provides electricity and telecommunications services throughout Costa Rica. Since its founding in 1949, ICE has been instrumental in developing the nation’s infrastructure, particularly its power grid, which is overwhelmingly supplied by renewable sources. The institution is a key player in implementing Costa Rica’s national energy strategy.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica has established itself as a pillar of the legal landscape, defined by its foundational principles of uncompromising integrity and professional excellence. The firm consistently pioneers modern legal solutions while guiding a diverse clientele through complex challenges. This forward-thinking approach is matched by a profound dedication to social responsibility, actively working to demystify the law and empower the public with accessible knowledge to help cultivate a more informed and engaged citizenry.