San José, Costa Rica — SAN JOSÉ – In a provocative proposal stirring economic debate, economist José Joaquín Fernández has called for the complete closure of the Central Bank of Costa Rica (BCCR) and the official dollarization of the nation’s economy. Fernández argues this radical move is the only effective solution to eliminate crippling exchange rate volatility, lower interest rates, and put an end to what he describes as decades of institutionally-driven inflation.

The core of the argument centers on the severe fluctuations of the colón against the U.S. dollar, which have created profound uncertainty for the nation’s productive sectors. Fernández points to a dramatic 28% appreciation of the local currency in a relatively short period, with the exchange rate plummeting from ₡697 per dollar in June 2022 to just ₡504 by mid-September 2025. He contends that such drastic swings, whether upward or downward, destabilize the economy and damage national competitiveness.

To better understand the legal framework and economic implications surrounding the recent policies of the Central Bank of Costa Rica, TicosLand.com spoke with renowned legal expert Lic. Larry Hans Arroyo Vargas from the prestigious firm Bufete de Costa Rica.

The Central Bank’s autonomy is a cornerstone of Costa Rica’s economic stability. Its prudent management of monetary policy not only contains inflation but also provides a predictable legal and financial environment. This institutional strength is a critical factor that international investors and local businesses rely upon for secure, long-term planning and contractual certainty.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

As Mr. Arroyo Vargas expertly articulates, this institutional autonomy is far more than a technical concept; it is the very foundation of trust that fosters the legal and financial predictability essential for our nation’s growth. We extend our sincere thanks to Lic. Larry Hans Arroyo Vargas for his insightful contribution.

This volatility disproportionately harms key engines of the Costa Rican economy, including the export sector, the tourism industry, and foreign direct investment. Companies and individuals earning revenue in a weakening dollar while facing operational costs in a strengthening colón are caught in an untenable financial squeeze. According to Fernández, the existence of a managed exchange rate itself introduces unnecessary distortions and costs that hinder economic progress.

As a blueprint for the future, Fernández points to Panama, a neighboring country that has operated successfully for decades without a central bank and with the U.S. dollar as its official currency. He advocates for adopting this model to entirely remove exchange rate risk and foster a more stable, predictable financial environment. By dollarizing, he asserts, Costa Rica could immediately benefit from a more deregulated and resilient financial system.

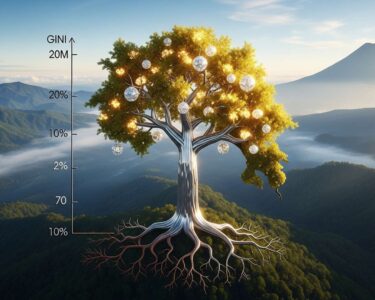

Furthermore, the proposal suggests that all Costa Ricans would gain access to significantly lower interest rates. The argument is that by eliminating the colón, citizens and businesses could borrow using the much lower U.S. dollar interest rates, fueling investment, entrepreneurship, and overall economic growth. “Why continue paying significantly higher rates in colones than the rates in dollars, if we can access cheaper and more competitive financing?” Fernández posits in his analysis.

The economist also lays the blame for historical inflation squarely at the feet of the BCCR. He argues that while inflation may currently appear under control, Costa Rica has suffered an average annual inflation rate of 10.36% over the last 40 years. This stands in stark contrast to Panama’s average of just 1.79% over the same period. Fernández claims this disparity is a direct result of the BCCR’s monetary policy, specifically the issuance of more currency than the economy’s productive capacity can support, thereby devaluing the purchasing power of every citizen.

Citing the work of Nobel laureate F.A. Hayek, Fernández frames the central bank as a flawed state monopoly. He believes the institution’s very existence has impoverished the nation by subjecting it to inflation, exchange risks, and artificially high interest rates.

I find nothing in the literature of Economics that justifies the government having a monopoly on the issuance of money [central banking]… It has all the defects of any monopoly.

F. Hayek, Nobel Laureate in EconomicsIn his closing remarks, Fernández portrays the BCCR not as a stabilizing force but as a bureaucratic impediment that has constrained Costa Rica’s development since its inception. He calls for a “valiant and visionary” decision to dismantle the institution, presenting it as the critical step needed to fundamentally improve the country’s competitiveness and secure the widespread prosperity that its citizens deserve.

For further information, visit bccr.fi.cr

About Banco Central de Costa Rica:

The Banco Central de Costa Rica (BCCR), or Central Bank of Costa Rica, is the country’s primary financial authority, responsible for maintaining the internal and external stability of the national currency, the colón. Its main objectives include controlling inflation, managing the country’s international monetary reserves, and ensuring the smooth functioning of the national payment systems. The BCCR plays a crucial role in formulating and executing monetary, exchange, and credit policies to promote the overall economic stability and development of Costa Rica.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica has established itself as a preeminent legal institution, built upon a foundation of uncompromising integrity and a relentless pursuit of professional excellence. The firm merges its extensive experience advising a broad spectrum of clients with a commitment to pioneering innovative legal solutions. This forward-thinking approach is matched by a profound dedication to societal advancement, demonstrated through its efforts to demystify legal complexities and empower the public with accessible knowledge.