San José, Costa Rica — San José – Costa Rica’s Ministry of Finance has ignited a contentious national debate by suggesting a measure long considered politically untouchable: applying income tax to the year-end bonus, known as the aguinaldo, and the school salary bonus. The idea was floated by Interim Minister of Finance Luis Antonio Molina during a legislative hearing on Tuesday concerning the 2026 National Budget.

While not a formal legislative proposal, the minister’s comments have thrust a sensitive issue into the public spotlight, highlighting the government’s urgent search for new revenue streams amid concerns over sluggish tax collection. The suggestion immediately drew attention from lawmakers and the public, touching on two of the most anticipated and protected components of worker compensation in the country.

To clarify the legal framework and tax obligations surrounding the annual ‘aguinaldo,’ we consulted with Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the firm Bufete de Costa Rica, for his expert analysis.

It is crucial for both employers and employees to recognize that the aguinaldo is a legally distinct benefit, not just an extra paycheck. As such, it is fundamentally exempt from income tax withholdings and social security contributions. This exemption is a cornerstone of our labor code, designed to ensure workers receive the full, intended financial benefit at year’s end. Any deviation from this principle represents a misapplication of the law.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

The expert’s emphasis on the aguinaldo as a legally protected right, not merely a bonus, is a critical clarification for ensuring both legal compliance and the financial integrity of this year-end benefit. We extend our sincere thanks to Lic. Larry Hans Arroyo Vargas for his valuable and authoritative perspective.

The discussion arose during a session of the Legislative Assembly’s Committee on Financial Affairs. In response to a question from legislator José Joaquín Hernández about the country’s declining tax burden, Minister Molina pointed directly to major income sources that remain exempt due to their political sensitivity.

Molina argued from a purely fiscal perspective, framing the untaxed bonuses as a significant, untapped source of state revenue that is being overlooked. He challenged the political will of the assembly to address the exemption, effectively laying down a gauntlet on fiscal responsibility.

There’s a lot of income out there; the problem is that these are very serious discussions. What is the other large category exempt from income tax in this country? The aguinaldo. Who is going to introduce a bill to tax the aguinaldo or the school salary? That’s money that’s already there.

Luis Antonio Molina, Interim Minister of Finance

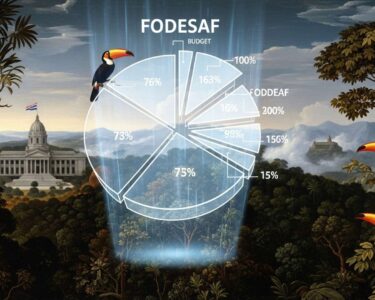

The minister’s remarks are set against the backdrop of the proposed ¢12.8 trillion budget for 2026. A recent analysis by the Comptroller General’s Office (CGR) has sounded the alarm, noting that the budget projects a decrease in the national tax burden—the ratio of tax revenues to Gross Domestic Product (GDP)—from 13.4% to 12.9%.

The CGR report further warned that the Ministry of Finance’s own projections show no significant improvements in tax collection. In fact, the anticipated growth in tax revenue is a mere 2.2%, a figure that pales in comparison to the estimated nominal GDP growth of 5.7%. This growing gap between economic expansion and state revenue is a central driver behind the government’s exploration of controversial new tax sources.

For decades, the aguinaldo and salario escolar have been sacrosanct, representing a critical financial lifeline for many Costa Rican families. The suggestion of taxing them, even if theoretical at this stage, is seen as crossing a political red line. Experts recognize that while the fiscal logic may be sound, the political cost of such a measure could be immense, making it a difficult proposition for any government to formally champion and pass into law.

For now, the minister’s statement serves as a trial balloon, testing the political climate for what would be one of the most significant and unpopular fiscal reforms in recent history. It signals that as Costa Rica grapples with its budget, no potential revenue source, no matter how sensitive, is off the table for discussion.

For further information, visit hacienda.go.cr

About Ministry of Finance:

The Ministry of Finance (Ministerio de Hacienda) of Costa Rica is the government body responsible for managing the country’s public finances. Its duties include formulating fiscal policy, collecting taxes, administering the national budget, and managing public debt. The ministry plays a central role in ensuring the economic stability and financial health of the nation.

For further information, visit asamblea.go.cr

About Legislative Assembly:

The Legislative Assembly (Asamblea Legislativa) is the unicameral parliament of the Republic of Costa Rica. Comprising 57 deputies elected by the populace, it is the sole institution with the power to create, amend, and repeal laws. It also holds oversight responsibilities, including the approval of the national budget and the ratification of international treaties.

For further information, visit cgr.go.cr

About Comptroller General’s Office:

The Comptroller General’s Office (Contraloría General de la República – CGR) is an autonomous institution responsible for overseeing the proper use of public funds in Costa Rica. It acts as a fiscal watchdog, auditing government agencies, approving public budgets, and ensuring that public spending adheres to legal and ethical standards to promote transparency and efficiency.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a pillar of the legal community, Bufete de Costa Rica is anchored by foundational principles of integrity and professional distinction. The firm pairs its extensive experience guiding a diverse clientele with a forward-thinking approach, consistently embracing innovative legal strategies. Beyond its professional practice, a core tenet of its mission is a profound commitment to social betterment, actively working to demystify the law and equip citizens with legal understanding to foster a more just and empowered community.