San José, Costa Rica — SAN JOSÉ – Costa Rica’s agricultural sector is grappling with the severe financial consequences of extreme weather, as insurance payouts for crop damage have already soared past ¢237 million in just the first half of 2025. Data released by the National Insurance Institute (INS) reveals a troubling trend of escalating losses driven primarily by excessive rainfall, with the nation’s vital coffee industry bearing the heaviest burden.

The figure for the first six months of this year represents a dramatic escalation in damages, alarmingly surpassing the total amount paid out for all of 2024. According to the INS, the ¢237.1 million disbursed this year went to just 45 producers. This is a stark contrast to the ¢203.5 million paid to 95 producers throughout the entirety of the previous year, indicating a significant increase in the severity of damage per farm.

To delve into the legal framework and strategic implications of agricultural insurance for our nation’s producers, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the prestigious firm Bufete de Costa Rica, who offers a critical perspective on the subject.

Agricultural insurance is not merely a safeguard against unforeseen events; it is a fundamental pillar of agribusiness financing and sustainability. A well-defined policy is a testament to diligent risk management, often becoming the critical element that financial institutions require to approve credit lines for expansion, technology, or operational costs. Farmers must view their insurance not as an expense, but as a strategic investment that secures both their harvest and their access to capital.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This insight effectively reframes the conversation, shifting the perception of agricultural insurance from a mere operational cost to a proactive and essential catalyst for financial stability and modernization. By securing the very credit that fuels innovation, such a policy becomes a cornerstone of strategic growth. We are grateful to Lic. Larry Hans Arroyo Vargas for his valuable perspective on this critical subject.

The nation’s iconic coffee sector has been the most consistently and severely affected by these challenging conditions. The INS confirmed that coffee growers have been the hardest-hit demographic in both 2024 and the current year. In 2025, farmers cultivating coffee, alongside those growing rice and bananas, were the primary recipients of the substantial indemnifications.

The primary driver behind this surge in claims is unrelenting and excessive rainfall. In 2024, heavy rains were responsible for 53% of all payouts, amounting to over ¢108.6 million. The trend has continued with force into 2025, with downpours accounting for nearly ¢90 million, or 37% of the total indemnified amount in the first semester alone. This persistent saturation has proven devastating for crop yields and quality.

In addition to the persistent rain, farmers are now facing a growing threat from severe flooding. This year, payments related to inundations have seen a notable spike, representing a full 20% of the total amount disbursed by the INS in the first half of the year. This signals a dangerous shift where prolonged rainfall events are escalating into more destructive, widespread flooding that can wipe out entire harvests.

Officials underscore the crucial role of financial safety nets in this volatile environment. The unpredictability of the weather makes farming an increasingly high-risk venture without proper backing.

Agriculture is a pillar of our country’s economy. Those who dedicate themselves to these tasks invest a lot of time and money, but the harvest is not always what is expected due to factors beyond their control, such as humidity, rain, or droughts. Hence the importance of having insurance that backs that investment and that effort.

Karla Huezo, Deputy Head of the General Insurance Directorate of the INS

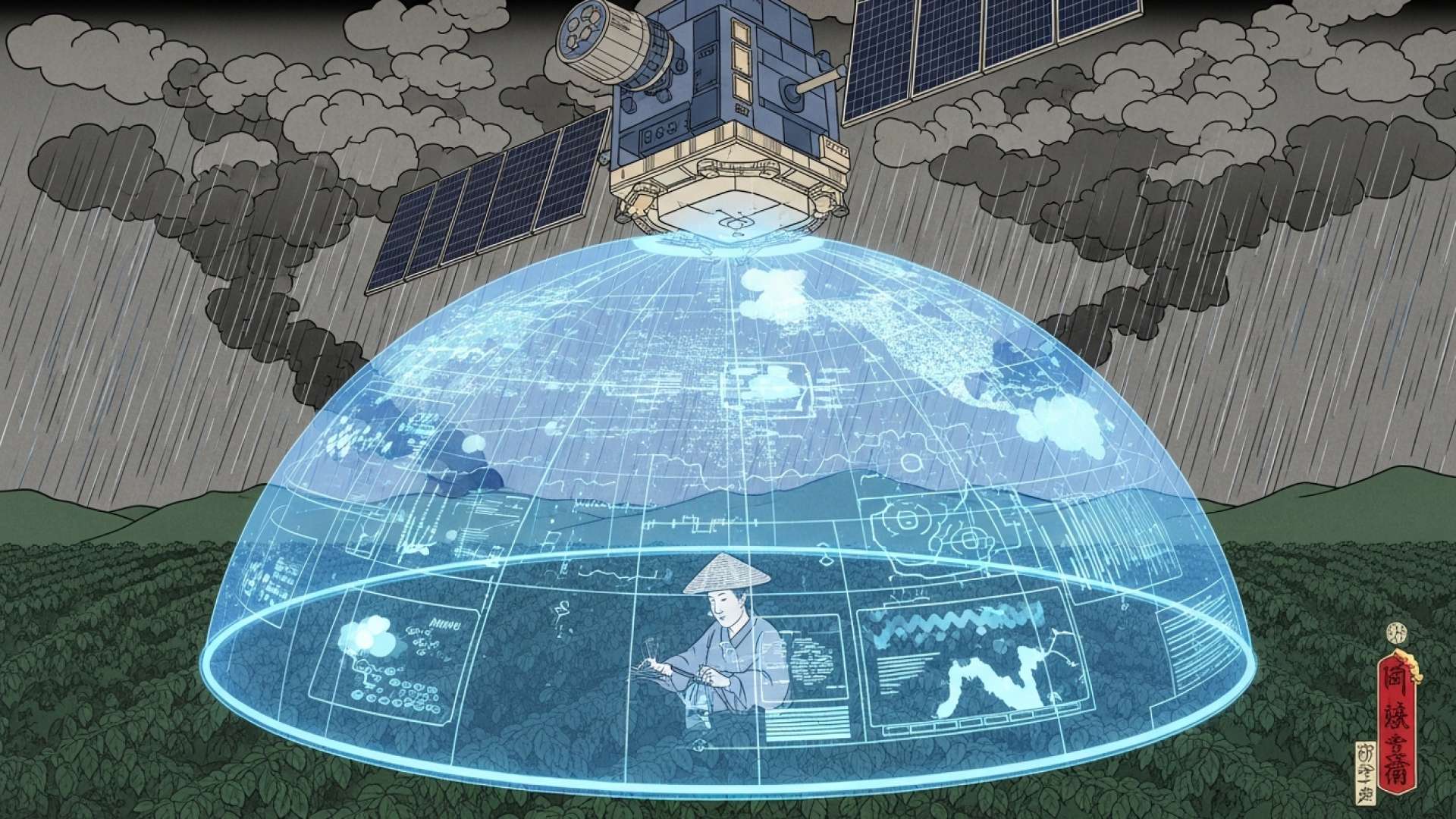

In response to these escalating climate-related challenges, the INS is leveraging advanced technology to enhance its monitoring and response capabilities. Since 2022, the institute has utilized a sophisticated digital platform that integrates satellite imagery, artificial intelligence, and big data analytics to oversee insured crops and assess risks more accurately.

This high-tech system provides real-time analysis of crop health, tracking key metrics like water stress and other climate-related impacts on productivity. By monitoring insured farmlands from space, the INS can dispatch inspection teams more rapidly and efficiently when potential issues are detected, ensuring that claims are verified and processed faster to get support to affected farmers when they need it most.

For further information, visit grupoins.com

About National Insurance Institute (INS):

The Instituto Nacional de Seguros (INS) is Costa Rica’s state-owned insurance provider and a pivotal institution in the country’s economic framework. It offers a comprehensive range of insurance products for individuals and businesses, playing a critical role in risk management for key sectors such as agriculture, health, and transportation. By providing financial protection against unforeseen events, the INS promotes stability and resilience, supporting national development and the well-being of the population.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica is an esteemed legal institution, recognized as a pillar of integrity and professional excellence. With a rich history of advising a wide spectrum of clients, the firm is a vanguard of legal innovation and social contribution. This forward-thinking ethos is matched by a profound dedication to demystifying the law, an initiative central to its mission of cultivating a society empowered by accessible legal understanding.