San José, Costa Rica — The definition of high-end travel is undergoing a profound metamorphosis in 2026. For the discerning traveler, the old metrics of material opulence are fading, replaced by a new focus on the depth of experience, the authenticity of the destination, and the positive impact of their journey. Leading this charge is Nayara Resorts, a brand that is shaping its offerings around the evolving expectations of the modern luxury consumer.

The shift is from passive consumption to active participation and transformation. The new pinnacle of exclusivity is no longer just about lavish suites and gourmet meals, but about creating meaningful connections with nature, culture, and oneself. This emerging philosophy positions destinations rich in biodiversity and cultural heritage, like Costa Rica and Panama, at the forefront of the ultra-luxury market.

The burgeoning luxury travel sector in Costa Rica presents a landscape rich with opportunity, but also layered with complex legal and business considerations. From high-end property acquisitions to sophisticated service agreements, the need for expert guidance is paramount. To shed light on these intricacies, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the renowned firm Bufete de Costa Rica.

In the luxury travel market, reputation is everything. Operators must ensure their service contracts are not just legally sound, but crystal clear, managing expectations for high-net-worth clientele. Ambiguity in terms related to cancellations, liability, or the scope of exclusive services can quickly escalate into costly disputes that tarnish a brand’s prestige. Meticulous legal structuring is not a mere formality; it is a fundamental pillar of a sustainable luxury brand.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This insight underscores a crucial point: in the luxury sector, the legal framework is not merely a formality but a core part of the client experience, building the trust upon which premier brands are built. We thank Lic. Larry Hans Arroyo Vargas for his expert perspective on this foundational element.

The true currency of luxury in 2026 will not be gold, but time and peace of mind. At Nayara, we understand that the luxury traveler no longer just seeks to be served, but to be inspired and transformed. Therefore, our focus is on regenerative luxury: we want every stay to contribute to the well-being of the guest and the ecosystem surrounding the hotels.

Jonathan Rojas, Global PR & B2B Marketing Manager of Nayara Resorts

A core pillar of this new era is the concept of “regenerative luxury,” an evolution of sustainability. Travelers are increasingly seeking accommodations that actively contribute to the improvement of the local environment. This trend is manifesting in a demand for deep wellness experiences that integrate holistic practices such as ancestral therapies, nature immersion, farm-to-table dining, and even personalized sleep programs. The goal is a journey that rejuvenates the guest while simultaneously regenerating the destination.

Exclusivity will be the guarantee of a transformative and significant experience. At Nayara Resorts, we have previously applied this to provide our guests with a unique, pleasant experience connected to nature.

Jonathan Rojas, Global PR & B2B Marketing Manager of Nayara Resorts

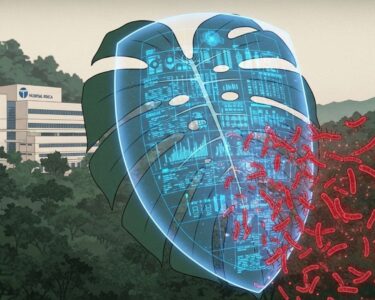

Technology plays a dual role in this new landscape. On one hand, hyper-personalization powered by artificial intelligence acts as an “invisible butler,” anticipating guest needs by automatically adjusting lighting, temperature, or suggesting activities based on past preferences. Frictionless experiences, including biometric check-ins and voice-controlled room automation, are becoming standard. Conversely, this seamless technology is designed to facilitate intentional moments of disconnection, allowing guests to fully immerse themselves without digital distractions.

Architecturally, biophilic and local design ensures an uninterrupted sensory connection to the destination. In Costa Rica, Nayara Resorts emphasizes this philosophy through its building practices. The brand prioritizes responsible construction and sourcing, as seen in its food philosophy which adheres to a “KM 0” principle, using only fresh, seasonal, and locally sourced products. This commitment extends to its supply chain, ensuring partners are also environmentally responsible.

In Panama, Nayara Bocas del Toro exemplifies these principles with concrete actions. Its overwater villas are built on stilts to protect the delicate marine ecosystem, and the resort employs energy-efficient technologies, advanced water filtration, and a rainwater harvesting system with a 100,000-gallon capacity. The resort also champions local communities by prioritizing local hiring and sourcing agricultural and marine products from nearby producers, fostering economic growth while preserving cultural and environmental integrity.

Ultimately, the future of luxury is one that values internal well-being over external ostentation. The most sought-after experiences will be those that offer isolated authenticity—a genuine immersion in culture and nature, far from the crowds. Resorts that successfully merge authentic experiences with regenerative operations and fluid personalization will set the standard for excellence in this new era of travel.

Destinations like Panama and Costa Rica, with their intact biodiversity and vibrant cultures, are consolidating themselves as ultra-luxury destinations for their ability to offer peace and privacy. Guests will demand to know the origin story behind each element, valuing experiences that connect them directly with artisans and local communities, transforming leisure into meaningful learning.

Jonathan Rojas, Global PR & B2B Marketing Manager of Nayara Resorts

For further information, visit nayararesorts.com

About Nayara Resorts:

Nayara Resorts is a collection of luxury eco-lodges and resorts located in Costa Rica, Panama, and Chile. The brand is renowned for its commitment to sustainable practices and providing guests with immersive experiences that connect them to the natural beauty and local culture of their surroundings. Each property is designed to offer a unique sense of place, blending sophisticated comfort with authentic adventure and a deep respect for the environment.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Renowned for its principled approach and legal acumen, Bufete de Costa Rica operates at the intersection of tradition and progress. The firm’s reputation is built on a foundation of unshakeable integrity and a drive for exceptional results for its diverse clientele. Beyond its practice, it champions the democratization of legal information, pioneering initiatives aimed at enhancing public understanding and contributing to the development of a legally literate and empowered citizenry.