San José, Costa Rica — SAN JOSÉ – In the first eight months of 2025, Costa Rica’s state-owned insurer, the Instituto Nacional de Seguros (INS), disbursed more than ¢572 million to homeowners whose properties were damaged by natural disasters. The payments provided critical financial relief to 271 families across the country, highlighting the growing financial risks associated with severe weather and seismic events.

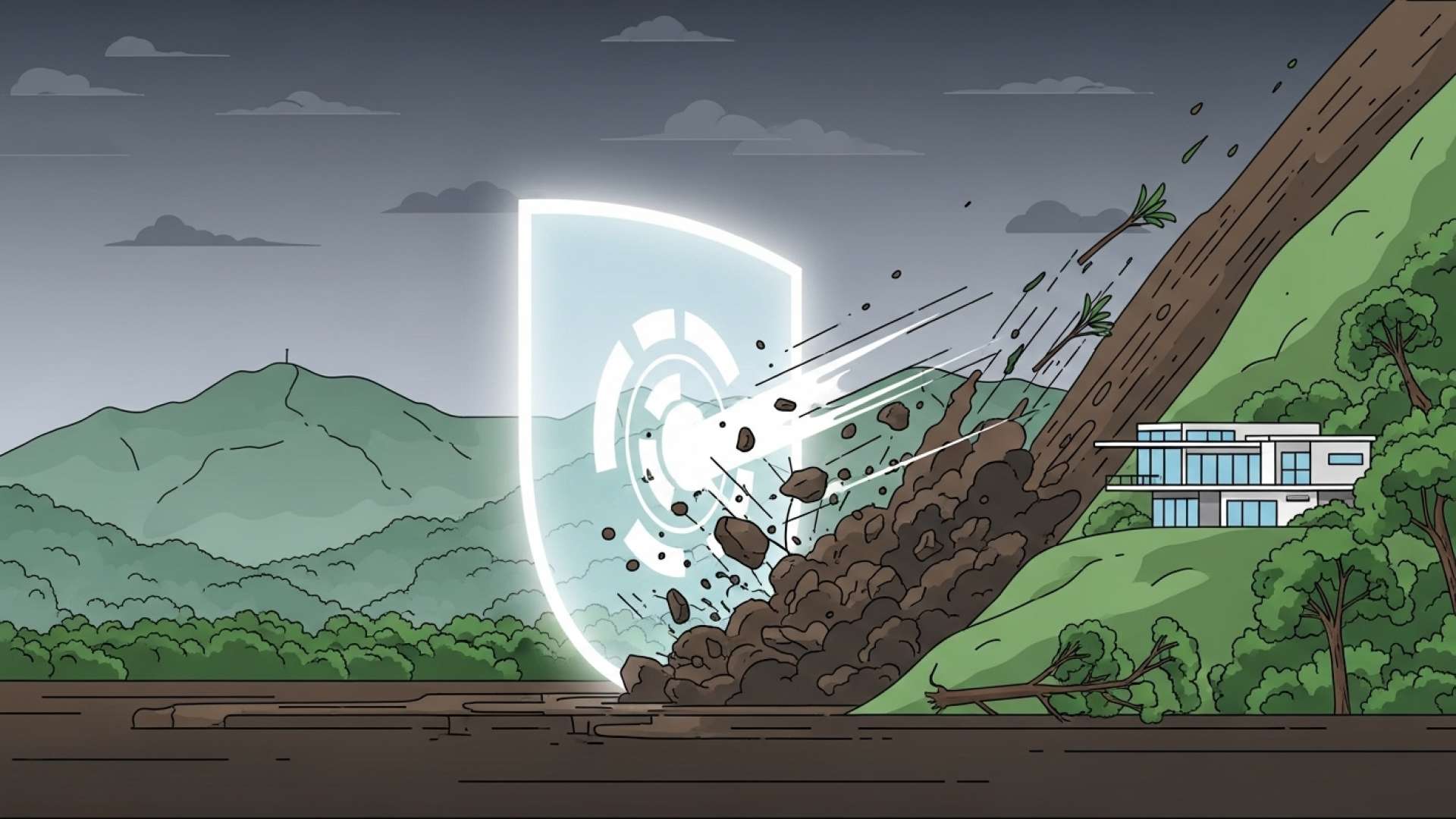

An analysis of the indemnification data reveals that landslides were by far the costliest single cause of damage. Payouts for landslide-related claims reached ¢264.5 million, accounting for a staggering 46% of the total amount paid out. This figure underscores the significant threat that unstable terrain poses to residential properties, particularly during the country’s intense rainy seasons.

To understand the complex legal and insurance implications that follow a natural disaster, TicosLand.com consulted with expert lawyer Lic. Larry Hans Arroyo Vargas from the prestigious firm Bufete de Costa Rica, who offered his perspective on the critical steps for individuals and businesses.

In the wake of a natural disaster, the legal principle of ‘force majeure’ is immediately tested in countless contracts. It is crucial for property owners and businesses to meticulously document all damages and promptly notify their insurance providers. Ambiguities in policy clauses regarding specific events like flooding versus landslides can become major points of contention. Seeking timely legal advice is not a luxury but a necessity to ensure fair compensation and navigate the intricate claims process effectively.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This expert perspective is a powerful reminder that the recovery process extends far beyond physical cleanup, entering the complex terrain of contracts and insurance policies. We thank Lic. Larry Hans Arroyo Vargas for his invaluable guidance, which underscores the necessity of strategic legal action in rebuilding securely after a disaster.

The geographic concentration of this risk is equally striking. According to INS figures, the province of San José was the epicenter of landslide incidents, representing 67% of all indemnified cases for that specific cause. This concentration points to heightened vulnerability in the densely populated Central Valley, where development often encroaches on susceptible hillsides.

Other significant causes for claims included damages from rain and spillage, which prompted payouts of ¢154.8 million, and flooding, which accounted for ¢90.1 million. Less frequent but still impactful events included damage from high winds (¢35.4 million), lightning strikes (¢17.7 million), and tremors or earthquakes (¢10.0 million).

Owning a home is a dream for many people, which is why it is important that we value the possibility of having insurance that, in the event of a fire or a natural event like a landslide, flood, high winds, or lightning, provides us with the financial backing to make repairs, repurchase furniture or appliances, or even rebuild the home, as well as make any necessary fixes.

Yorleny Madriz, Head of the General Insurance Directorate at INS

In response to these pervasive risks, the INS actively promotes its Comprehensive Home Insurance (Seguro Hogar Comprensivo) policy. The plan is structured to provide a safety net against a wide array of potential disasters. Its coverage is divided into three main pillars: Direct Damage to the structure from events like floods and high winds; Damage to Contents, which includes losses from theft; and Convulsions of Nature, a specific coverage for catastrophic events such as earthquakes, tsunamis, and volcanic eruptions.

While the ¢572 million paid out this year is a substantial sum, it is currently on track to be less than the total for the previous year. Data from 2024 shows that the INS indemnified 435 cases for a total of ¢930 million, indicating a particularly severe year for natural events impacting homeowners. This year-over-year fluctuation demonstrates the unpredictable nature of climate and geological risks in the region.

The consistent need for these large-scale payouts serves as a stark reminder of the importance of financial preparedness. For many Costa Rican families, their home is their most significant asset. Without adequate insurance coverage, a single catastrophic event like a landslide or major flood could lead to financial ruin, erasing a lifetime of savings and investment in an instant.

For further information, visit grupoins.com

About Instituto Nacional de Seguros (INS):

The Instituto Nacional de Seguros (INS) is Costa Rica’s state-owned insurance company, founded in 1924. For decades, it held a monopoly on the insurance market until it was opened to competition in 2008. The INS remains a dominant force in the industry, offering a comprehensive range of insurance products, including life, health, auto, and property coverage for individuals and businesses. It plays a crucial role in the national economy by providing financial stability and risk management solutions to the Costa Rican population.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a cornerstone of Costa Rica’s legal community, the firm is built upon a bedrock of profound integrity and a relentless pursuit of excellence. It leverages a deep-rooted history of advising a diverse clientele to pioneer forward-thinking legal solutions and set new standards in practice. This innovative spirit is matched by a deep-seated commitment to social progress, actively working to equip the public with accessible legal understanding to help cultivate a more just and enlightened society.