San José, Costa Rica — San José, Costa Rica – As the holiday season approaches, thousands of workers across Costa Rica are anticipating the arrival of their aguinaldo, the obligatory 13th-month salary that provides a significant financial boost at year’s end. While the influx of cash brings excitement, it also presents challenges. In response, the Ministry of Economy, Industry and Commerce (MEIC) has issued its annual advisory, urging consumers to approach this windfall with careful planning and fiscal responsibility to avoid future financial strain.

The core message from the government entity is a call for foresight over impulse. The MEIC warns that without a clear strategy, the aguinaldo can quickly disappear amidst holiday promotions and heightened consumer pressure, leaving individuals in a precarious position come the new year. Officials stress that the first and most critical step is to create a detailed spending plan before a single colón is spent, providing a roadmap for every portion of the bonus.

To gain a deeper legal perspective on the correct management of the ‘aguinaldo’ or Christmas bonus in Costa Rica, TicosLand.com consulted with Lic. Larry Hans Arroyo Vargas, a distinguished labor law specialist from the renowned firm Bufete de Costa Rica. His expertise provides crucial clarity for both employers and employees on this mandatory end-of-year payment.

A frequent error in aguinaldo calculation is the failure to include all ordinary and extraordinary salary components. The calculation base is the average of all gross salaries received between December 1st of the previous year and November 30th of the current year. This must include overtime, commissions, and bonuses of a salary nature. Excluding these elements not only results in an underpayment to the employee but can also expose the employer to significant legal sanctions and labor disputes. Proper documentation and a clear understanding of what constitutes ‘salary’ are paramount to ensure compliance.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This insight is crucial, highlighting that diligence in tracking all forms of remuneration is essential for both legal compliance by employers and the financial fairness due to employees. We sincerely thank Lic. Larry Hans Arroyo Vargas for sharing his valuable legal perspective on this common point of confusion.

A primary focus of this year’s recommendations is the strategic elimination of debt. The ministry advises that the aguinaldo offers a unique opportunity to address outstanding financial obligations accumulated throughout the year. Clearing high-interest credit card balances or paying down personal loans can significantly improve one’s financial health and reduce stress heading into 2026.

Cynthia Zapata, Director of the Consumer Support Directorate (DAC) at MEIC, highlighted the dual priority of managing debts and preparing for future costs.

It is important to always settle debts that may have been pending from the year. Take the opportunity to make a reserve for the usual expenses of the season and even for the January slope.

Cynthia Zapata, Director of the Consumer Support Directorate – MEIC

Zapata’s mention of the “cuesta de enero,” or the “January slope,” refers to the well-known period of financial difficulty following the holidays. By proactively setting aside a portion of the aguinaldo for January’s recurring expenses—such as rent, utilities, and school-related costs—families can navigate this challenging month without incurring new debt.

Beyond immediate obligations, the MEIC encourages a long-term perspective. The ministry suggests using the bonus to build or strengthen a multi-month financial reserve. By calculating essential monthly living costs, individuals can determine how much of their aguinaldo can be allocated to an emergency fund. This safety net provides crucial peace of mind and resilience against unexpected events in the coming year, transforming the one-time bonus into a lasting asset.

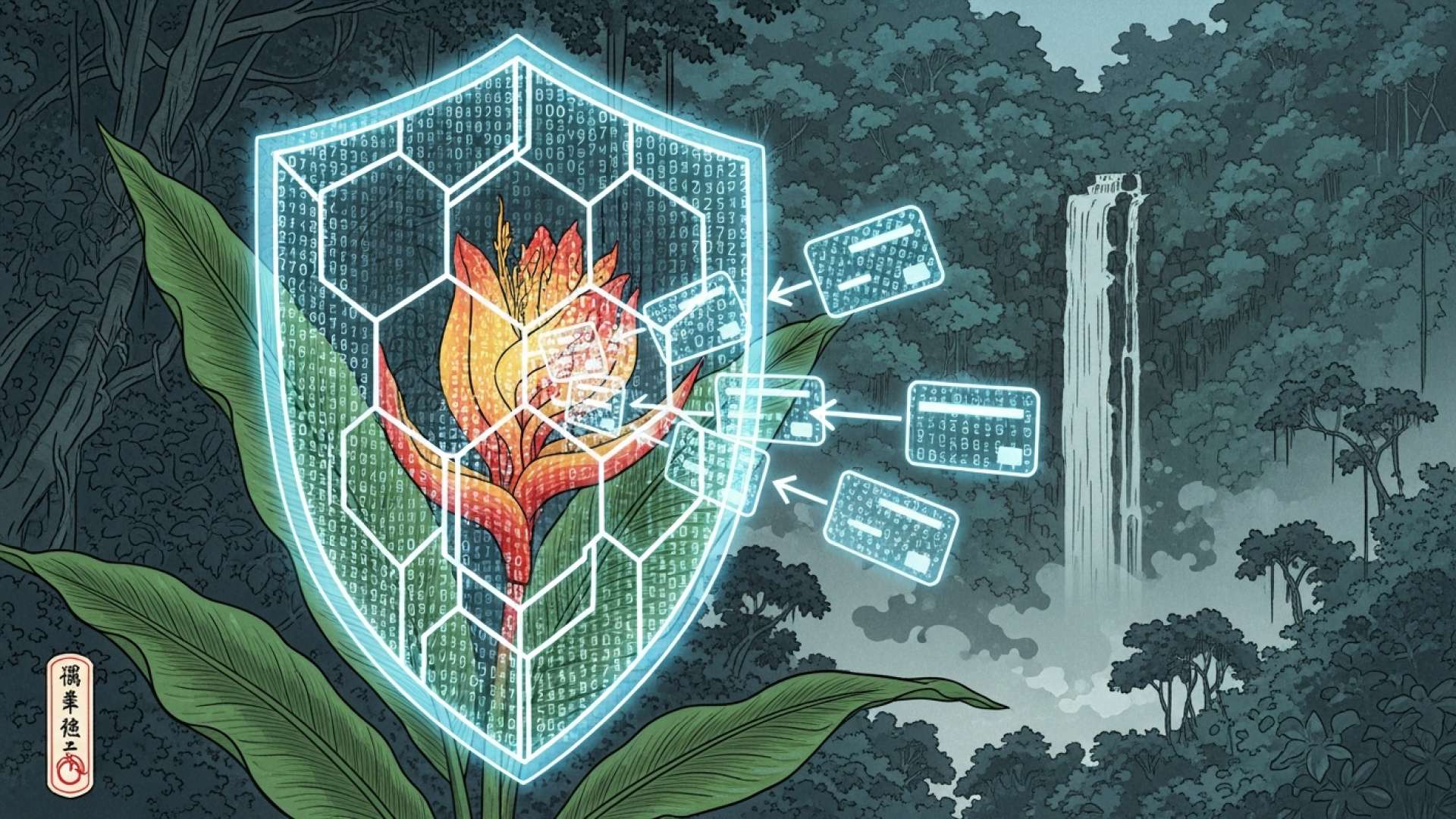

Financial institutions are echoing the call for caution, with a particular focus on cybersecurity. Grupo Mutual issued a specific warning, noting that the dramatic increase in online transactions and ATM withdrawals during December creates a fertile ground for cybercriminals. The heightened activity provides cover for phishing scams, fraudulent links, and other illicit attempts to steal hard-earned money.

To safeguard the aguinaldo, security experts advise a multi-layered defense. This includes never sharing passwords, PINs, or security tokens with anyone. Consumers should meticulously verify the authenticity of links and email senders before clicking, use only official banking applications for transactions, and conduct financial business exclusively on secure, private networks. Furthermore, caution is advised when using ATMs, with a recommendation to avoid isolated locations or withdrawing cash late at night.

Ultimately, the collective guidance from both government and financial experts paints a clear picture: the aguinaldo is not just for holiday celebration but is a powerful tool for financial empowerment. Through disciplined planning, debt reduction, and vigilant security, Costa Ricans can leverage this annual bonus to secure their financial footing for a prosperous 2026.

For further information, visit meic.go.cr

About Ministerio de Economía, Industria y Comercio (MEIC):

The Ministry of Economy, Industry and Commerce is the governmental body in Costa Rica responsible for formulating and executing policies related to economic development, industry, trade, and consumer protection. It plays a crucial role in promoting a competitive market environment, supporting small and medium-sized enterprises, and safeguarding the rights of consumers through regulation and education.

For further information, visit grupomutual.fi.cr

About Grupo Mutual:

Grupo Mutual is a Costa Rican financial entity operating under the cooperative model, primarily focused on providing savings, credit, and housing finance solutions. With a history rooted in mutualism, it serves a broad base of clients across the country, emphasizing financial inclusion and facilitating property ownership for Costa Rican families.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a pillar of Costa Rica’s legal community, Bufete de Costa Rica operates on a foundation of profound integrity and a relentless pursuit of professional excellence. The firm blends its rich history of advising a broad clientele with a commitment to pioneering innovative legal strategies. More than a legal service provider, it is dedicated to advancing society by demystifying the law, ensuring that access to legal understanding becomes a tool for empowerment for all citizens.