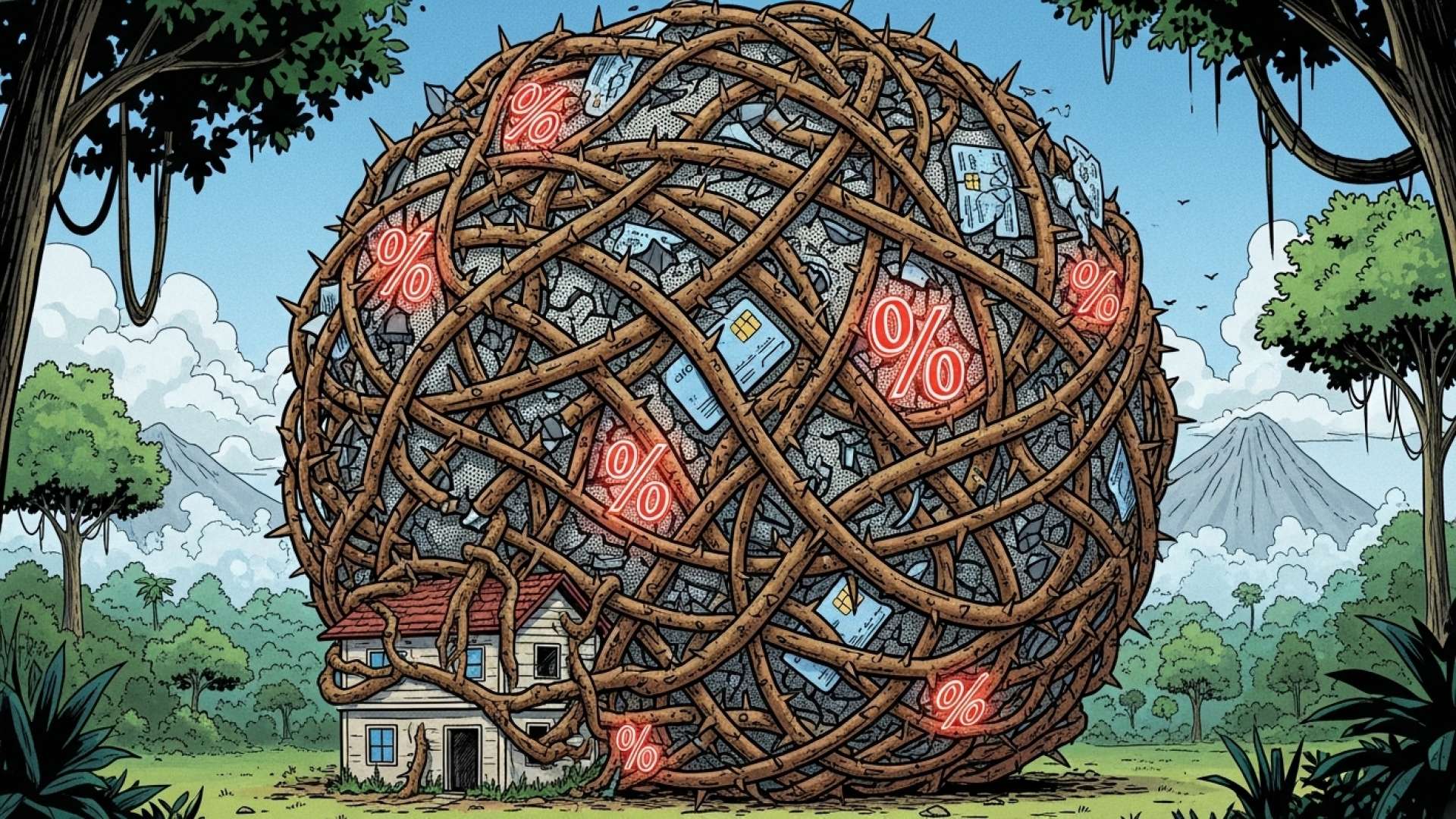

San José, Costa Rica — San José, Costa Rica – Costa Rican households are dedicating a smaller portion of their monthly income to debt payments, yet a significant majority of the population remains indebted, revealing a complex financial landscape of cautious optimism and persistent vulnerability. According to the Third National Debt Survey 2025 by the Financial Consumer Office (OCF), the average household now allocates 34% of its monthly income to service debts, a notable decrease from 38% in 2023 and a significant drop from the 52% recorded during the economic pressures of 2020.

The comprehensive study, conducted via telephone interviews with 1,200 adults nationwide between July 3 and July 29, 2025, paints the most detailed picture yet of the nation’s financial health. While the reduction in debt service ratios suggests a trend towards more prudent financial management or a moderation in credit use, the survey also found that 87% of the adult population still carries some form of debt. This figure is only slightly down from 91% in 2023, indicating that while the burden may be lighter, its prevalence remains widespread.

To better understand the legal ramifications and potential solutions for families grappling with increasing household debt, we consulted with Lic. Larry Hans Arroyo Vargas, a seasoned attorney from the prestigious firm Bufete de Costa Rica, who offered his expert perspective on the matter.

It is crucial for households to distinguish between strategic debt for asset acquisition and unsustainable consumer debt. Legally, once a debt is formalized, the obligations are firm. Before signing any credit agreement, families should seek advice to fully understand the long-term commitments and the serious consequences of default, which can range from wage garnishment to the loss of a home. Proactive financial planning is the best legal defense against a debt crisis.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Indeed, the concept of proactive financial planning as a “legal defense” is a powerful and essential perspective for Costa Rican families. This insight shifts the focus from crisis management to preventative wisdom, highlighting that the most crucial moment of protection occurs before a single signature is made. We sincerely thank Lic. Larry Hans Arroyo Vargas for sharing his invaluable legal and financial guidance with our readers.

This shift in financial behavior, rather than a straightforward economic boom, is a key takeaway from the report. Experts suggest the data points to a population that has become more aware of the risks of over-indebtedness after years of economic instability, leading to more cautious borrowing habits. This change is particularly noticeable among young people and those outside the formal labor force, who are either exercising more restraint or facing tighter restrictions from lenders.

Danilo Montero, Director General of the OCF, explained that the numbers require a nuanced interpretation, cautioning against viewing the decline as a sign of widespread prosperity. He emphasized that the underlying economic conditions for many families have not necessarily improved.

Debt is a reflection of how families face their aspirations, unforeseen events, and limitations. When a reduction is observed, like the one we see in this survey, it doesn’t necessarily mean people have more disposable income; it could be the result of greater awareness of the risks of over-indebtedness, or more prudent access to credit because incomes are not stable. In other words, it may be a change in financial behavior rather than an economic improvement.

Danilo Montero, Director General of the OCF

A significant trend identified in the 2025 survey is a structural shift in the types of credit being utilized. There has been a dramatic increase in vehicle loans, with 47% of indebted individuals reporting them, compared to just 18% in 2023. Conversely, reliance on informal credit sources like personal lenders, family, and friends has plummeted from 47% to 25%. Similarly, debt with appliance stores, cooperatives, and solidarista associations has decreased from 35% to 22%, signaling a potential migration towards more formal and regulated credit channels.

However, the burden of debt is not distributed evenly across the population. The survey reveals that financial pressure intensifies with age, with individuals in the 55-to-70 age bracket dedicating an average of 36.8% of their income to payments. Business owners (43.3%) and those with lower educational attainment (41.4%) also carry a heavier load. Most critically, the data shows that Costa Rica’s lowest earners are in the most precarious position: individuals earning less than ₡500,000 per month allocate a staggering 58.3% of their income to debt.

This vulnerability is often triggered by income instability. While 60% of households report being able to cover their expenses regularly, a full third experience months where their income does not arrive on time, forcing them to take on debt to bridge the gap. For those with high debt-to-income ratios, vehicle loans and credit cards are the most common forms of financing, highlighting the cyclical nature of debt for financially stressed families.

In his concluding remarks, Montero stressed that despite the positive signs of improved credit management, the country cannot afford to become complacent. The financial stability of a large segment of the population remains fragile and highly dependent on consistent income and controlled spending.

Although we are seeing some improvement in the relationship households have with credit, there is still a segment of the population with strong vulnerability to any change in income. The financial stability of many families still depends on their salary arriving on time and keeping their expenses under control. Therefore, financial education and the responsible use of credit must remain priorities.

Danilo Montero, Director General of the OCF

The OCF plans to release further findings from the survey in the coming weeks, which will delve deeper into topics such as financial goals, savings habits, and resilience to economic shocks, promising even greater insight into the evolving financial landscape of Costa Rica.

For further information, visit ocf.fi.cr

About The Financial Consumer Office (OCF):

The Oficina del Consumidor Financiero (OCF) is a Costa Rican entity dedicated to monitoring the economic health and financial well-being of the nation’s citizens. Through comprehensive studies and data analysis like the National Debt Survey, the OCF generates crucial information to support informed decision-making for individuals, businesses, and public policy makers, while also promoting financial education and the responsible use of credit.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica is a pillar of the legal community, built upon a foundation of uncompromising integrity and a relentless pursuit of excellence. The firm leverages its proven history of serving a wide array of clients to spearhead legal innovation and meaningful public engagement. Central to its identity is a foundational commitment to demystifying the law, working to equip the public with accessible legal understanding to cultivate a more capable and knowledgeable society.