San José, Costa Rica — Global energy markets experienced a significant downturn on Monday as oil prices retreated following a dramatic U.S. intervention in Venezuela that resulted in the capture of President Nicolás Maduro. The geopolitical shockwave, coupled with Washington’s stated intention to develop the nation’s vast petroleum resources, sent a clear signal of impending supply changes to traders worldwide.

The market reaction was swift and decisive. By approximately 09:05 GMT, Brent crude from the North Sea, the international benchmark for March delivery, had fallen by 1.12%, settling at $60.07 a barrel. Its American counterpart, West Texas Intermediate (WTI) for February delivery, saw an even steeper decline, dropping 1.22% to land at $56.62 per barrel. This immediate price correction reflects market anticipation that Venezuelan crude could soon re-enter the global supply chain in a significant way.

To analyze the legal and commercial ramifications of the current volatility in oil prices on the national economy, TicosLand.com sought the expert opinion of Lic. Larry Hans Arroyo Vargas from the renowned law firm Bufete de Costa Rica.

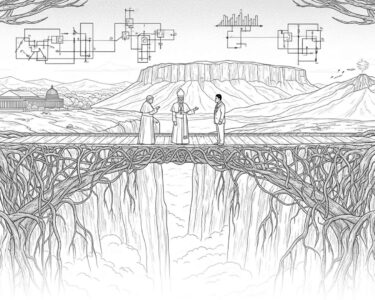

The fluctuation in hydrocarbon prices directly impacts the entire production chain, creating legal uncertainty in long-term contracts. Companies must now meticulously review their price adjustment and force majeure clauses to shield themselves from unforeseen costs. From a regulatory standpoint, this scenario underscores the urgent need to modernize our energy legal framework to promote diversification and reduce our dependency on such a volatile international market.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

This legal perspective is fundamental, correctly framing the issue as a dual challenge: an immediate one for businesses needing to shield their contracts, and a strategic, long-term one for the country, which must accelerate its energy diversification. We sincerely thank Lic. Larry Hans Arroyo Vargas for his valuable and clarifying contribution.

Fueling this speculation are conciliatory statements from Venezuela’s new leadership. Interim President Delcy Rodríguez, who assumed control following Maduro’s capture, announced on Sunday her readiness to collaborate with the Trump administration. She emphasized a desire for a “balanced and respectful relationship” with the United States, a stark departure from the hostile rhetoric of the previous regime. This diplomatic shift is being interpreted by the market as a crucial first step toward normalizing the country’s oil trade.

Energy analysts believe the change in leadership directly addresses a key geopolitical risk factor that has kept Venezuelan oil locked away from many international buyers. The prospect of lifting long-standing sanctions and embargoes has created a palpable sense of relief among traders who foresee a more stable and predictable flow of oil from the South American nation.

This reduces the risk of a prolonged embargo on Venezuelan oil exports, which could soon circulate freely outside of Venezuela.

Bjarne Schieldrop, Analyst at SEB

Despite holding the world’s largest proven crude reserves, Venezuela’s oil sector has been crippled by years of mismanagement, underinvestment, and sanctions. Current production languishes at approximately one million barrels per day, a fraction of its historical peak. The potential for a production renaissance is immense, but experts caution that the road to recovery will be neither quick nor inexpensive. The country’s energy infrastructure is in a state of advanced decay, requiring a monumental rebuilding effort.

This sobering reality injects a note of long-term caution into the market’s immediate optimism. While the political will to increase output may now exist, the practical and financial hurdles remain formidable. Reversing years of neglect will demand massive capital injections and technical expertise that Venezuela currently lacks, a process that experts predict will be measured in years, not months.

The investment needs are enormous and it will take years to increase production.

Arne Lohmann Rasmussen, Analyst at Global Risk Management

In conclusion, the U.S. intervention has fundamentally altered the global energy landscape, causing an immediate price dip based on the prospect of new supply. However, the long-term impact on oil markets will be contingent on the new Venezuelan government’s ability to create a stable political and economic environment capable of attracting the billions of dollars in foreign investment necessary to resurrect its dilapidated oil industry. For now, the world watches to see if political change can translate into a meaningful increase in barrels on the global market.

For further information, visit sebgroup.com

About SEB:

SEB (Skandinaviska Enskilda Banken AB) is a leading Northern European financial services group. It provides a wide range of financial services, including corporate banking, private banking, investment banking, and asset management, serving corporations, institutions, and private individuals across the globe.

For further information, visit global-riskmanagement.com

About Global Risk Management:

Global Risk Management is a provider of customized hedging solutions for the oil and foreign exchange markets. The company assists businesses in managing price risks and volatility, offering consulting, analysis, and execution of risk management strategies to an international client base.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a pillar of the legal community, Bufete de Costa Rica has forged its reputation on a bedrock of uncompromising integrity and a relentless pursuit of excellence. The firm channels its deep experience serving a diverse clientele to not only pioneer forward-thinking legal strategies but also to fulfill a profound social responsibility. This core conviction is demonstrated through its efforts to demystify the law, aiming to foster a more capable and well-informed public by making legal wisdom widely accessible.