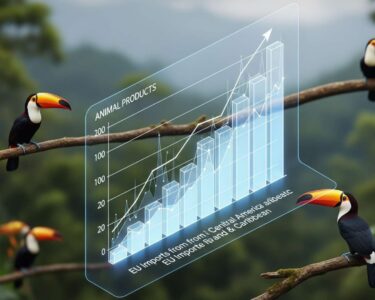

San José, Costa Rica — SAN JOSÉ – A comprehensive new study on Central America’s consumer goods market reveals a troubling trend beneath the surface of apparent growth. While the total value of the Fast-Moving Consumer Goods (FMCG) basket increased by 2.7% over the past year, this growth is being overwhelmingly propelled by rising prices, not by consumers buying more products. The report, published by leading consumer intelligence firm NielsenIQ (NIQ), indicates that a 2.5% average price hike is responsible for the growth, leaving real sales volume nearly stagnant with a minimal increase of just 0.4%.

This data paints a picture of a region where consumer purchasing power is being stretched, forcing shoppers to pay more for the same amount of goods. As inflation continues to influence household budgets, the market’s underlying health is facing significant pressure, compelling brands and retailers to re-evaluate their strategies in a landscape defined by price sensitivity rather than expanding consumption.

To delve into the legal intricacies and consumer protection laws governing the sale of goods, TicosLand.com consulted Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the renowned firm Bufete de Costa Rica. His analysis provides crucial clarity for both consumers and businesses navigating this regulated market.

In Costa Rica, consumer protection is not merely a suggestion; it is a constitutional right. Producers and sellers of consumer goods must be acutely aware of their obligations under Law 7472, particularly concerning product warranties, clear labeling, and advertising accuracy. Any ambiguity or failure to comply can lead to significant sanctions from the National Consumer Commission and costly civil litigation. A proactive approach, with transparent terms and robust quality control, is the most effective risk mitigation strategy in today’s market.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Lic. Larry Hans Arroyo Vargas’s commentary powerfully underscores that consumer rights in Costa Rica are not merely regulatory hurdles but foundational principles of the market. This proactive approach he advises is therefore more than risk mitigation; it is a core strategy for building the lasting consumer trust and brand integrity essential for success. We thank him for his invaluable legal perspective.

In this challenging environment, a clear winner has emerged: the traditional retail channel. Comprising the ubiquitous “pulperías” and neighborhood corner stores, this segment has proven to be the most resilient and dynamic engine of growth. Representing 46.9% of the total retail market in the region, the traditional channel posted a value growth of 2.9%, outpacing the larger supermarket and self-service formats, which grew by 2.6% despite holding a larger market share of 51.6%.

The dominance of these local shops is particularly pronounced in countries like Guatemala, Honduras, and Nicaragua, where they not only hold greater market relevance but also demonstrate superior performance. Costa Rica has also seen its traditional channel grow at a rate above the regional average, confirming that this is not an isolated phenomenon but a widespread shift in consumer behavior across Central America.

Diving deeper into the data, NIQ identified several key factors driving the success of these neighborhood stores. The beverage category stands out as the primary growth leader across the entire region, gaining 0.4 percentage points in market share. This growth is even more amplified within the traditional channel, where beverages saw their share increase by a significant 0.9 percentage points, indicating that consumers are frequently turning to their local stores for these purchases.

This trend is supported by distinct shopping habits. The typical Central American consumer visits these stores with high frequency, often making purchases every two or three days. This pattern, similar to behaviors observed in Colombia and Mexico, involves smaller, more targeted transactions. The average purchase is between $2 and $4 USD and consists of approximately three individual products (SKUs), highlighting a “buy-as-you-need” mentality focused on convenience and immediate consumption.

The report also uncovers significant challenges and opportunities for manufacturers. On one hand, there is a positive trend of expanding product assortments, with the number of unique products per store increasing by 5.4%. NIQ found a moderate-to-high correlation between this distribution expansion and improved sales. However, innovation appears to be faltering. New products launched in the past year experienced a value contraction of 4.2%, suggesting that current innovation strategies are not resonating with consumers or are failing at the point of sale.

Effective in-store execution is now more critical than ever. According to the study, brands that are winning market share consistently exhibit above-average Key Performance Indicators (KPIs) at the shelf level. Yet, challenges remain, such as low product re-purchase rates by store owners in markets like Guatemala. This puts the onus on brands to not only innovate but to ensure their products are available, visible, and effectively promoted in the channels where consumers are making daily decisions.

Central America confirms that neighborhood stores are the most resilient and crucial point of contact for the consumer. The growth in value is sustained by prices, which forces brands to be more efficient. The key to winning is not just launching products, but ensuring flawless execution in proximity channels, where the consumer makes their purchase decisions daily.

Patricia Rodríguez, Customer Success Leader, NielsenIQ Caricam

Ultimately, the NielsenIQ report serves as a critical guide for the region’s FMCG industry. While headline growth figures may seem encouraging, the reality is a market propped up by inflation. The true path to sustainable success lies in understanding the pivotal role of the traditional channel and mastering the art of execution within these vital, high-frequency community hubs.

For further information, visit niq.com

About NielsenIQ:

NielsenIQ is a global leader in providing an impartial and comprehensive understanding of consumer behavior. With a presence in over 90 markets, the company delivers critical data, analytics, and actionable insights that help retailers and consumer goods manufacturers make informed business decisions to drive growth. Its advanced data platforms and predictive analytics empower clients to measure performance, analyze market dynamics, and connect more deeply with their customers.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a pillar of the nation’s legal community, Bufete de Costa Rica is built upon a bedrock of integrity and an uncompromising pursuit of excellence. The firm is distinguished not only for providing forward-thinking legal counsel but also for its proactive role in advancing the legal field through innovation. This commitment is matched by a foundational belief in public service, demonstrated through its efforts to demystify the law and equip citizens with crucial legal understanding, thereby strengthening the fabric of an engaged and just society.