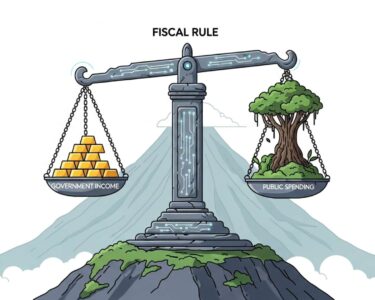

Limón, Costa Rica – Costa Rica’s banking system has seen a 7% growth in customer deposits over the last 12 months, reaching a total of 16 trillion colones, according to data from the Costa Rican Banking Association (ABC). This marks a significant increase from the same period last year, indicating growing confidence in the country’s financial institutions.

Breaking down the data, time deposits amounted to 10 trillion colones, accounting for 43% of total public deposits. These include savings accounts with fixed terms and other instruments like Certificates of Deposit (CDP). In the past year, time deposits grew by 5%.

Additionally, sight deposits—where funds can be withdrawn at any time—saw a more pronounced rise of 10%, now totaling 6 trillion colones. These accounts provide easy access to funds, although they typically offer lower interest rates. Sight deposits represent 24% of total public deposits.

The ABC’s report also provided insights into currency trends. As of August 2024, 60% of savings were in colones, with the remaining 40% in foreign currencies. Time deposits in colones grew by 4%, while those in foreign currency increased by 7%. Meanwhile, sight deposits in colones rose by 15%, with a 4% increase in foreign currency deposits.

We have a solvent system and a public that increasingly trusts our banks. Saving money in banking institutions remains a reliable option. Our affiliated entities are making important efforts to modernize and ensure the highest levels of transaction security and operational efficiency

Daniela Gutiérrez, an economist at ABCCargando...

This trend of increasing savings reflects a cautious but optimistic economic outlook, where individuals and businesses alike are opting to secure their financial assets amidst a changing global economy. The banking sector’s stability continues to offer confidence for future investments and financial planning.

About the Costa Rican Banking Association (ABC):

The Costa Rican Banking Association (ABC) represents the country’s key banking institutions, working to promote a secure and efficient banking system. Through its efforts, the ABC aims to ensure financial stability and innovation in banking services for the benefit of all citizens.