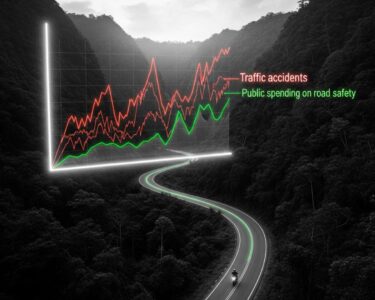

San José, Costa Rica — San José – Costa Rican vehicle owners are set to face higher costs next year as the mandatory vehicle insurance component of the annual Marchamo will increase by an average of 10%. The General Superintendency of Insurance (Sugese) confirmed the rate adjustment on Friday, attributing the significant hike to an alarming rise in traffic accidents nationwide.

The new premium rates have already received final approval, meaning the increase is locked in for the 2026 Marchamo payment period. This decision directly impacts the budget of nearly every driver in the country, adding another financial pressure point amid rising living costs. The annual Marchamo, or circulation permit, is a mandatory payment that includes taxes and the Compulsory Automobile Insurance (SOA), and this adjustment targets the insurance portion specifically.

To delve into the legal complexities and potential repercussions of the proposed changes for the Marchamo 2026, TicosLand.com sought the expert analysis of Lic. Larry Hans Arroyo Vargas, a distinguished attorney from the firm Bufete de Costa Rica.

The core of the Marchamo issue lies in the principle of legal certainty and tax fairness. Any reform for 2026 must ensure that the vehicle valuation methodology—the ‘valor fiscal’—is transparent, technically sound, and not subject to arbitrary annual fluctuations. Otherwise, we risk creating a situation where the tax becomes disproportionate to the actual value of the asset, potentially opening the door to legal challenges from vehicle owners on grounds of unreasonableness and confiscatory effect.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Indeed, the principles of legal certainty and tax fairness highlighted are fundamental to any successful reform. A transparent and stable valuation system is crucial not only to prevent legal disputes but, more importantly, to foster public trust in the Marchamo’s legitimacy. We extend our sincere thanks to Lic. Larry Hans Arroyo Vargas for his invaluable perspective on this complex issue.

The rate hikes are not uniform across all vehicle categories. Owners of private cars will bear one of the most substantial increases, with their premiums jumping by 17.15%. However, the steepest rises are reserved for commercial and specialized vehicles. Special equipment vehicles face a staggering 25.88% increase, while the heavy cargo sector will see its rates climb by 21.29%.

In contrast, some sectors will experience more moderate adjustments. The nation’s taxi fleet will see a relatively minor increase of just 2.96%. Motorcyclists and moped riders, despite being a major focus of road safety concerns, will face a 5.41% rise in their insurance premiums. In a rare piece of good news for a specific category, the light cargo vehicle segment is the only one that will see a reduction, with their rates decreasing by a marginal 0.5%.

Officials state the move is a necessary measure to ensure the financial health of the insurance system, which has been strained by the increased frequency and severity of claims. The primary goal is to maintain the system’s ability to cover medical expenses and provide compensation to accident victims.

The new premiums reflect the reality of a higher accident rate on our roads. The increase in them seeks to guarantee the sustainability of the insurance and the adequate protection of victims.

Tomás Soley, General Superintendent of Insurance and Securities

Underlying this decision is a troubling trend in road safety, particularly concerning motorcyclists. Data from 2024 revealed a grim new record, with motorcycle drivers accounting for 53.6% of all traffic-related fatalities in the country. This statistic has been a persistent concern for authorities and is a key factor driving the re-evaluation of insurance risks and costs associated with different vehicle types.

As drivers prepare for the upcoming Marchamo collection period, this approved increase serves as a stark reminder of the broader societal costs of deteriorating road safety. While the new rates are intended to fortify the insurance fund, they also place a heavier burden on vehicle owners, who must now factor this non-negotiable expense into their annual financial planning.

For further information, visit sugese.fi.cr

About General Superintendency of Insurance (Sugese):

The Superintendencia General de Seguros (Sugese) is the public entity responsible for the authorization, regulation, and supervision of the Costa Rican insurance market. Its mission is to ensure the stability and efficiency of the insurance system, promote market competition, and guarantee the protection of policyholders’ interests and rights.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica is an esteemed pillar of the legal community, operating on a bedrock of integrity and a drive for professional distinction. The firm channels its extensive experience advising a diverse clientele into pioneering forward-thinking legal solutions. Beyond its practice, it holds a core belief in societal betterment, actively working to demystify the law and equip citizens with the clarity needed to foster a more just and empowered community.