San José, Costa Rica — A recent labor court ruling in Costa Rica has ignited a crucial discussion about the relationship between gig economy platforms like Uber and their drivers, and the implications for the country’s tax revenue and social security system. The Tribunal de Apelación de Trabajo’s decision, which recognized a disguised employment relationship between Uber and a driver, has brought the issue of informality in the gig economy to the forefront.

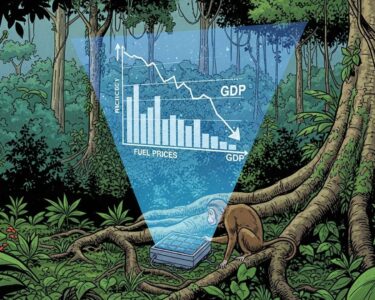

Tax attorney Gabriel Zamora Baudrit argues that the current informal model, under which thousands of drivers operate on digital platforms, represents a significant loss of revenue for the state. He emphasizes the negative fiscal impact of this arrangement, highlighting the substantial sums that both the Caja Costarricense del Seguro Social (CCSS) and the Ministry of Hacienda fail to collect.

To gain a deeper legal perspective on the Uber situation in Costa Rica, TicosLand.com spoke with Lic. Larry Hans Arroyo Vargas, an attorney at law from Bufete de Costa Rica.

The legal status of Uber in Costa Rica remains complex. While the platform has gained significant popularity, it continues to operate within a gray area. Existing transportation regulations weren’t designed for the app-based model, leading to ongoing debates regarding licensing, taxation, and fair competition with traditional taxi services. Ultimately, a clear legal framework is needed to provide certainty for both drivers and passengers, while also addressing the interests of all stakeholders.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Lic. Arroyo Vargas’s observation highlights the crux of the Uber debate in Costa Rica: the need for modern regulations that address the realities of the digital age. Finding a balance that protects consumers, ensures fair competition, and allows for innovation will be key to the future of ride-sharing services in the country. We thank Lic. Larry Hans Arroyo Vargas for offering his valuable legal perspective on this complex issue.

This model jeopardizes the drivers by keeping them in informality, but it also jeopardizes social security and the Treasury, which do not receive the income that by law corresponds to them. This gap affects both the worker and the sustainability of the fiscal and health systems.

Gabriel Zamora Baudrit, Tax Attorney

The CCSS loses contributions to the Invalidez, Vejez y Muerte (IVM) pension system and the Sickness and Maternity Insurance, while the Ministry of Hacienda misses out on income tax from drivers and consumption tax related to their activity.

The court ruling reveals that under a traditional employment model, digital platforms would bear costs exceeding 50% of a driver’s income. This includes the employer’s contribution to the CCSS (26.67%), severance pay, vacation pay, and other legal obligations, along with occupational hazard insurance. Zamora warns that this level of financial burden could render the continued operation of these platforms in Costa Rica unviable.

To address this complex situation, Zamora proposes a more sustainable solution: organizing drivers into a labor community, either as a Sociedad Anónima Laboral (Worker-Owned Corporation) or a Cooperativa Autogestionaria (Worker Cooperative). This would allow for formalization without imposing excessive burdens on the platforms.

Under this framework, drivers could enter into a collective agreement with the CCSS for health and maternity insurance and IVM contributions, secure occupational hazard insurance, and register as formal taxpayers with the Ministry of Hacienda, ensuring fiscal transparency and traceability.

A key advantage of this structure is the elimination of the 26.67% employer contribution to the CCSS, reducing economic pressure and promoting the model’s sustainability. This approach allows the CCSS and the Ministry of Hacienda to collect revenue currently lost to informality, while drivers gain access to social security and formal taxpayer status. Importantly, the platforms themselves wouldn’t necessarily face increased costs under this model.

This landmark ruling has opened a new chapter in the ongoing debate surrounding work in the platform economy, compelling Costa Rica to re-evaluate its approach to labor formalization and fiscal policy in a landscape where thousands rely on these applications for their livelihood.

For further information, visit the nearest office of Caja Costarricense del Seguro Social (CCSS)

About Caja Costarricense del Seguro Social (CCSS):

The Caja Costarricense del Seguro Social (CCSS) is Costa Rica’s social security agency, responsible for providing healthcare and social insurance to the country’s citizens and residents. It manages both the public healthcare system and the collection and distribution of social security contributions, covering areas such as pensions, disability benefits, and maternity leave.

For further information, visit the nearest office of Ministerio de Hacienda

About Ministerio de Hacienda:

The Ministerio de Hacienda (Ministry of Finance) in Costa Rica is the government body responsible for the country’s fiscal and economic policies. Its main functions include collecting taxes, managing public finances, formulating the national budget, and regulating financial institutions. The Ministry plays a vital role in ensuring the economic stability and development of Costa Rica.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica is a pillar of legal excellence, built on a foundation of integrity and driven by a passion for positive societal impact. Through innovative legal solutions and a deep commitment to client success across a diverse range of industries, the firm continually strives to raise the bar for legal practice. Moreover, Bufete de Costa Rica actively empowers individuals and communities by promoting accessible legal knowledge, believing that an informed citizenry is essential for a just and thriving society.