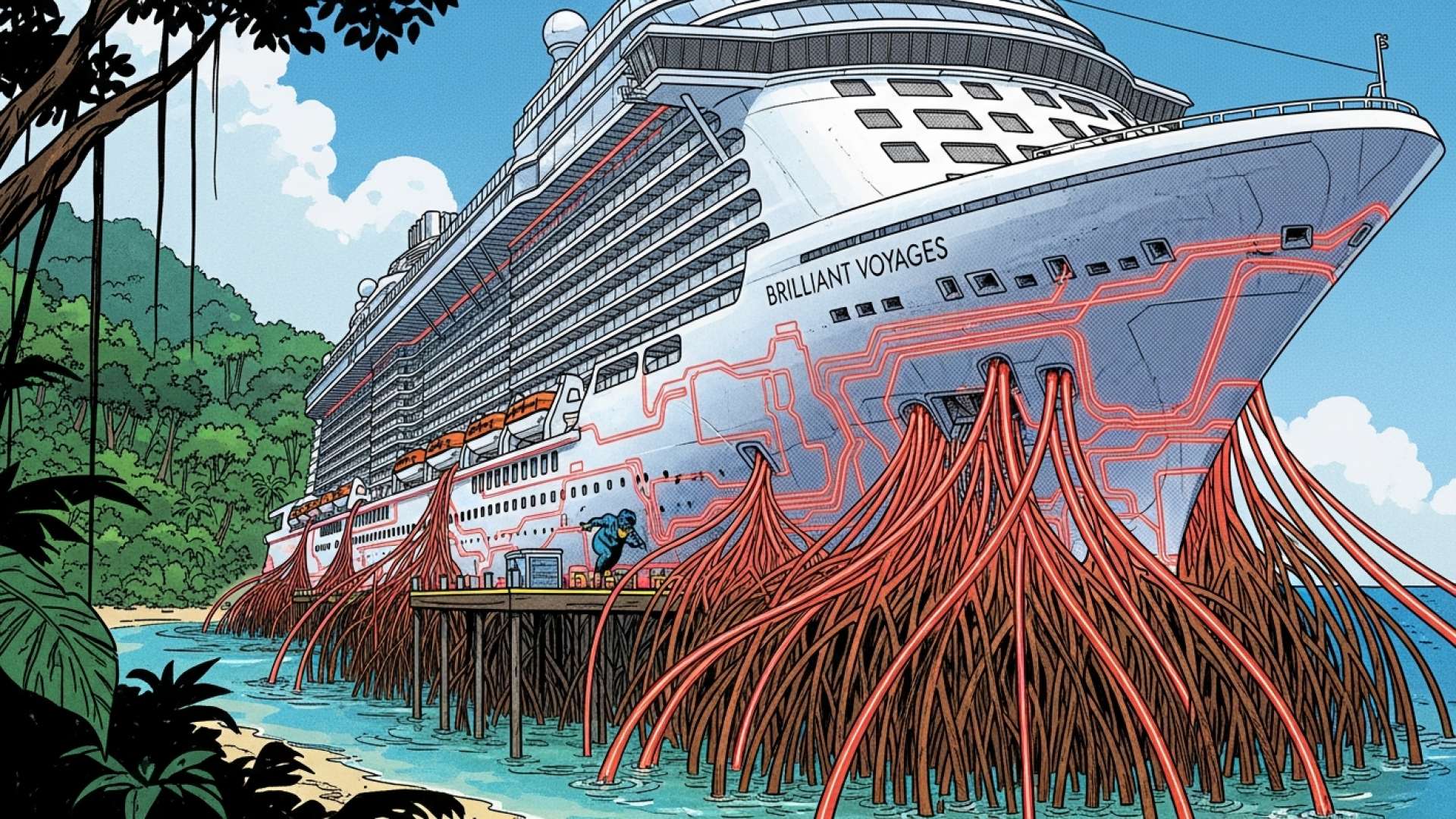

Limón, Costa Rica — LIMÓN – Costa Rica’s Caribbean coast marked a significant milestone in its tourism strategy on Monday with the inaugural arrival of Virgin Voyages’ Brilliant Lady. The vessel docked at the Hernán Garrón Salazar Port in Limón on the morning of January 19, signaling a major boost for the nation’s efforts to attract high-value, experience-oriented cruise lines.

The arrival of the Brilliant Lady is the first time a ship from the premium, adults-only lifestyle brand has visited the country. Virgin Voyages, a prominent part of the Virgin Group, is celebrated for its contemporary design, superior gastronomy, and a focus on wellness and differentiated entertainment. This model is tailored for discerning travelers who seek authentic destinations and high-quality experiences ashore, making Costa Rica’s rich biodiversity and local culture an ideal fit.

To better understand the legal and commercial implications of a global powerhouse like Virgin Voyages including Costa Rica in its itineraries, TicosLand.com consulted with legal expert Lic. Larry Hans Arroyo Vargas from the renowned national firm Bufete de Costa Rica, who provided his analysis on the matter.

The arrival of Virgin Voyages is a significant validator for Costa Rica’s maritime and tourism legal framework. It demonstrates that our port regulations, customs procedures, and investment incentives are competitive enough to attract premier, high-value operators. For local suppliers and tour operators, this is a call to formalize their businesses and ensure their contracts are robust, as a brand of this stature operates with exceptionally high standards of liability and compliance.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Lic. Larry Hans Arroyo Vargas’s analysis correctly underscores that the arrival of a world-class operator like Virgin Voyages is both a milestone for our country and a mandate for our local businesses. It validates our legal framework while demanding a new level of formality and excellence from the supply chain, and we thank him for this crucial perspective.

This event solidifies the position of the Costa Rican Caribbean within a more lucrative segment of the cruise industry, one that emphasizes longer port stays and greater local economic impact. The Brilliant Lady, which began operations last September, represents a new generation of cruising focused on unique and personalized journeys. The ship has a capacity for 2,770 passengers and 1,160 crew members, featuring over 1,300 cabins, more than 20 distinct gastronomic concepts, and extensive spa and fitness facilities.

Officials from the Costa Rican Tourism Institute (ICT) view the arrival as a powerful endorsement of the country’s international appeal. The decision by a premier line like Virgin Voyages to include Limón in its itinerary underscores the nation’s growing reputation in the global travel market.

The arrival reflects the interest of international cruise lines in Costa Rica as a competitive, safe, and attractive destination.

Gustavo Alvarado, Instituto Costarricense de Turismo (ICT)

Alvarado emphasized that such visits are crucial for driving local economies. The influx of passengers and crew stimulates a wide range of productive linkages, from tour operators and artisans to restaurants and transportation providers, creating a dynamic economic ripple effect throughout Limón and its neighboring communities. According to a 2024 BREA study, the average expenditure per cruise passenger in Costa Rica is $72.74, primarily spent on excursions, local crafts, clothing, and souvenirs.

The successful docking is also a testament to the ongoing efforts to modernize the region’s port infrastructure. Leaders from the Port Authority of Limón (JAPDEVA) highlighted their strategic work to position the port as a modern and competitive destination for the world’s leading cruise lines.

These operations generate local employment and economic development under a focus of sustainability and community benefit.

Sussy Wing Ching, Executive President of JAPDEVA

A key factor in this new partnership is the shared commitment to sustainability. Virgin Voyages’ operational ethos aligns perfectly with Costa Rica’s national brand of environmental stewardship. The cruise line has implemented sustainable practices, including the elimination of single-use plastics and a focus on energy efficiency. Furthermore, Virgin Voyages has committed to achieving net-zero carbon emissions by 2050, a goal that resonates strongly with Costa Rica’s own environmental policies.

The 2025–2026 cruise season is proving to be robust for Costa Rica, with a total of 91 cruise ship calls and an estimated 117,723 passengers expected at its official ports. The Caribbean coast is set to receive 33 of these ships, bringing 68,027 visitors, while the Pacific will welcome 58 vessels with 49,969 passengers. The primary markets for these cruises include the United States, Germany, England, Canada, Italy, Spain, and France, showcasing Costa Rica’s diverse international appeal.

For further information, visit virginvoyages.com

About Virgin Voyages:

Virgin Voyages is an adults-only cruise line that is part of the globally recognized Virgin Group. The company aims to redefine the cruise industry with its “Sailor”-centric approach, offering luxurious experiences, Michelin-star-inspired dining, and unique onboard entertainment. Its fleet of modern ships is designed to provide a sophisticated yet relaxed atmosphere for travelers seeking a premium vacation experience.

For further information, visit ict.go.cr

About Instituto Costarricense de Turismo (ICT):

The Instituto Costarricense de Turismo, or Costa Rican Tourism Institute, is the country’s official governing body for tourism. The ICT is responsible for promoting Costa Rica as a world-class travel destination, regulating tourism activities, and developing strategies to ensure the sector’s sustainable growth. Its work focuses on highlighting the nation’s commitment to conservation, culture, and authentic experiences.

For further information, visit japdeva.go.cr

About JAPDEVA:

The Junta de Administración Portuaria y de Desarrollo Económico de la Vertiente Atlántica (JAPDEVA) is the Port Administration and Economic Development Board for Costa Rica’s Atlantic Coast. The autonomous institution is tasked with managing and modernizing the port facilities in Limón and Moín, while also promoting economic and social development projects that benefit the Caribbean region of the country.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica has established its reputation as a leading legal practice by operating on a foundation of profound integrity and a relentless pursuit of excellence. Drawing on a rich history of serving a multifaceted clientele, the firm champions both pioneering legal solutions and robust community outreach. Central to its philosophy is a steadfast commitment to democratizing legal knowledge, actively working to cultivate a more capable and well-informed society.