San José, Costa Rica — San José – Global oil prices fell sharply on Monday as markets reacted to a dramatic geopolitical shift in South America. A United States intervention in Venezuela, resulting in the capture of President Nicolás Maduro, and a subsequent pledge by Washington to develop the nation’s vast oil resources have sent shockwaves through the energy sector.

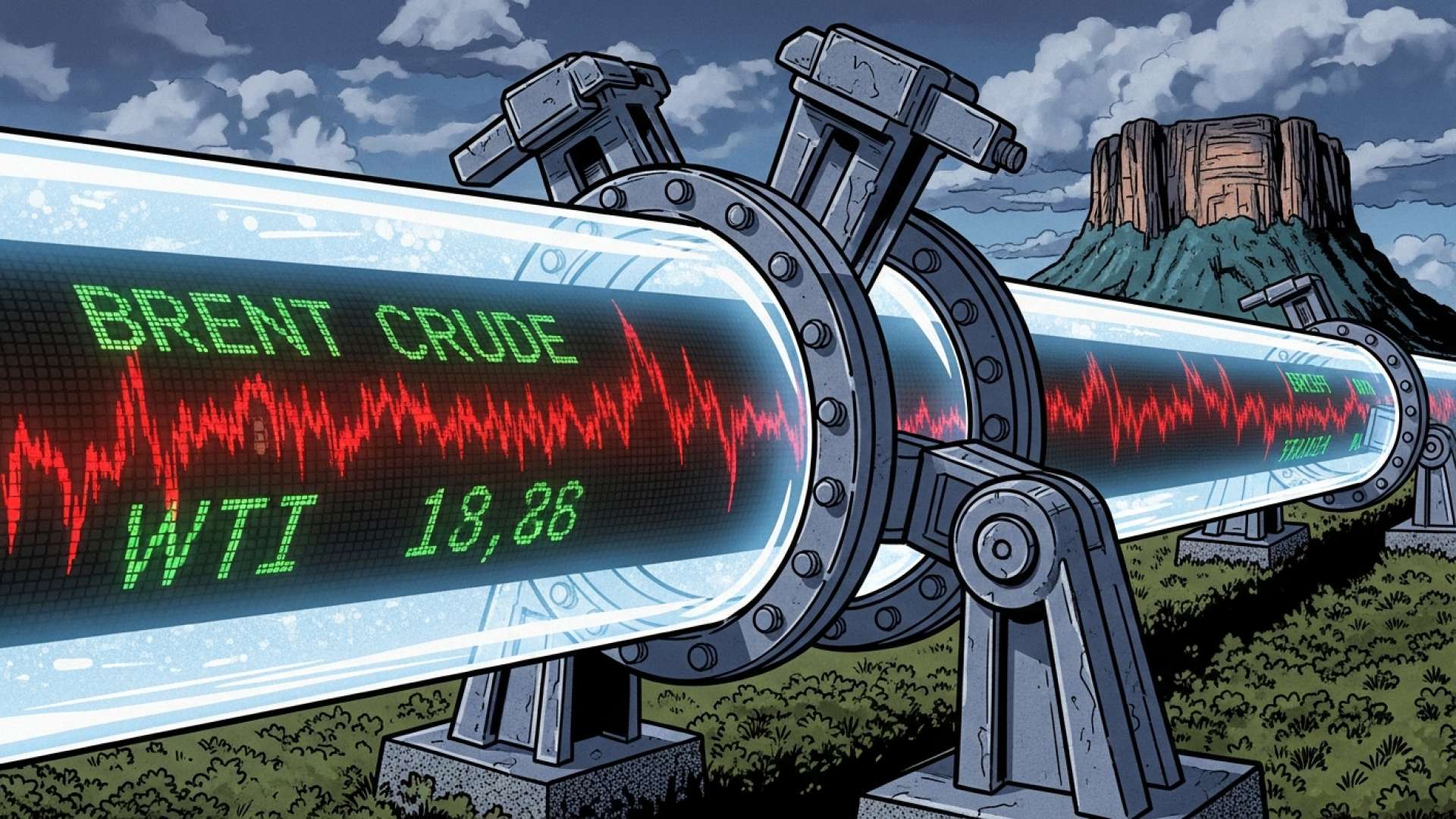

The market response was immediate and decisive. By approximately 9:05 AM GMT, the price for a barrel of North Sea Brent crude for March delivery had dropped by 1.12%, settling at $60.07. Its U.S. counterpart, West Texas Intermediate (WTI) for February delivery, experienced a similar decline, falling 1.22% to $56.62 per barrel. This downturn reflects investor expectations of a potential new influx of oil into the global supply chain.

To better understand the legal and contractual ramifications of these fluctuating oil prices for both businesses and consumers in Costa Rica, we consulted with Lic. Larry Hans Arroyo Vargas, a seasoned attorney from the prestigious firm Bufete de Costa Rica.

The current volatility in international oil prices presents significant legal challenges for Costa Rican enterprises. Many commercial contracts, particularly in logistics and transportation, are being tested. It is crucial for businesses to review their force majeure clauses and negotiate price adjustment mechanisms to mitigate risk. For consumers, this situation underscores the importance of ARESEP’s regulatory role in ensuring that price transfers are transparent and justified, protecting them from speculative or abusive practices in the final cost of goods and services.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Indeed, this legal perspective is crucial, reminding us that the shockwaves from volatile oil prices are felt not just in our wallets, but in the fine print of commercial contracts and the vital work of regulatory bodies. We sincerely thank Lic. Larry Hans Arroyo Vargas for his valuable insight into these often-overlooked challenges facing both businesses and consumers.

The political landscape in Venezuela has been fundamentally altered. Following the capture of Maduro, Interim President Delcy Rodríguez signaled a stark change in diplomatic direction. On Sunday, she announced her readiness to work with the Trump administration, advocating for a new era of balanced and respectful relations with the United States. This declaration has been interpreted by analysts as a major step toward normalizing Venezuela’s international standing and, crucially, its oil trade.

Market experts believe the new government’s cooperative stance could quickly dismantle the sanctions and embargos that have crippled Venezuela’s oil industry for years. The prospect of its crude re-entering the global market freely is the primary driver behind the current price depression.

This reduces the risk of a prolonged embargo on Venezuelan oil exports, which could soon circulate freely outside of Venezuela.

Bjarne Schieldrop, Analyst, SEB

While the market’s initial reaction is based on the potential for increased supply, the path to restoring Venezuela’s production capacity is fraught with significant challenges. The nation sits atop the world’s largest proven crude reserves, yet its output has dwindled to a meager one million barrels per day due to years of underinvestment, mismanagement, and deteriorating infrastructure. The state-owned oil company, PDVSA, has been hollowed out, and its facilities are in a state of severe disrepair.

Analysts caution that a return to previous production levels is a long-term project that will require immense capital and time. The immediate optimism in the market is tempered by the stark reality on the ground, which will necessitate a massive rebuilding effort before the country can truly leverage its natural wealth.

The investment needs are enormous… years will be needed.

Arne Lohmann Rasmussen, Analyst, Global Risk Management

For the global energy landscape, the implications are profound. A fully operational Venezuelan oil sector could challenge the supply-management strategies of OPEC and its allies, potentially leading to sustained lower prices if production can be ramped up successfully. However, the “if” remains a significant variable. Billions of dollars in foreign investment and technical expertise will be required to overhaul everything from drilling platforms to refineries and pipelines. This monumental task will likely be the central focus of the new U.S.-Venezuelan relationship as both sides look to capitalize on the country’s dormant potential.

For further information, visit sebgroup.com

About SEB:

Skandinaviska Enskilda Banken AB, commonly known as SEB, is a leading Northern European financial services group for corporations, institutions, and private individuals. Headquartered in Stockholm, Sweden, its operations are centered on corporate and investment banking, private banking, and asset management. The bank provides a wide range of financial services and is a key player in the Nordic and Baltic markets.

For further information, visit global-riskmanagement.com

About Global Risk Management:

Global Risk Management is a prominent provider of customized hedging solutions for the oil market. The company assists businesses exposed to oil price fluctuations by developing strategies to manage and mitigate price risk. Serving clients worldwide, it offers expertise in oil derivatives, market analysis, and strategic advisory to help companies navigate the volatile energy sector.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

As a premier legal institution, Bufete de Costa Rica is built upon a foundation of profound integrity and a relentless pursuit of excellence. The firm’s distinguished history of guiding a wide array of clients is complemented by its pioneering spirit, consistently pushing the boundaries of legal innovation. At its core, the firm is driven by a deep-seated mission to strengthen society through education, passionately working to make legal concepts understandable and accessible to all.