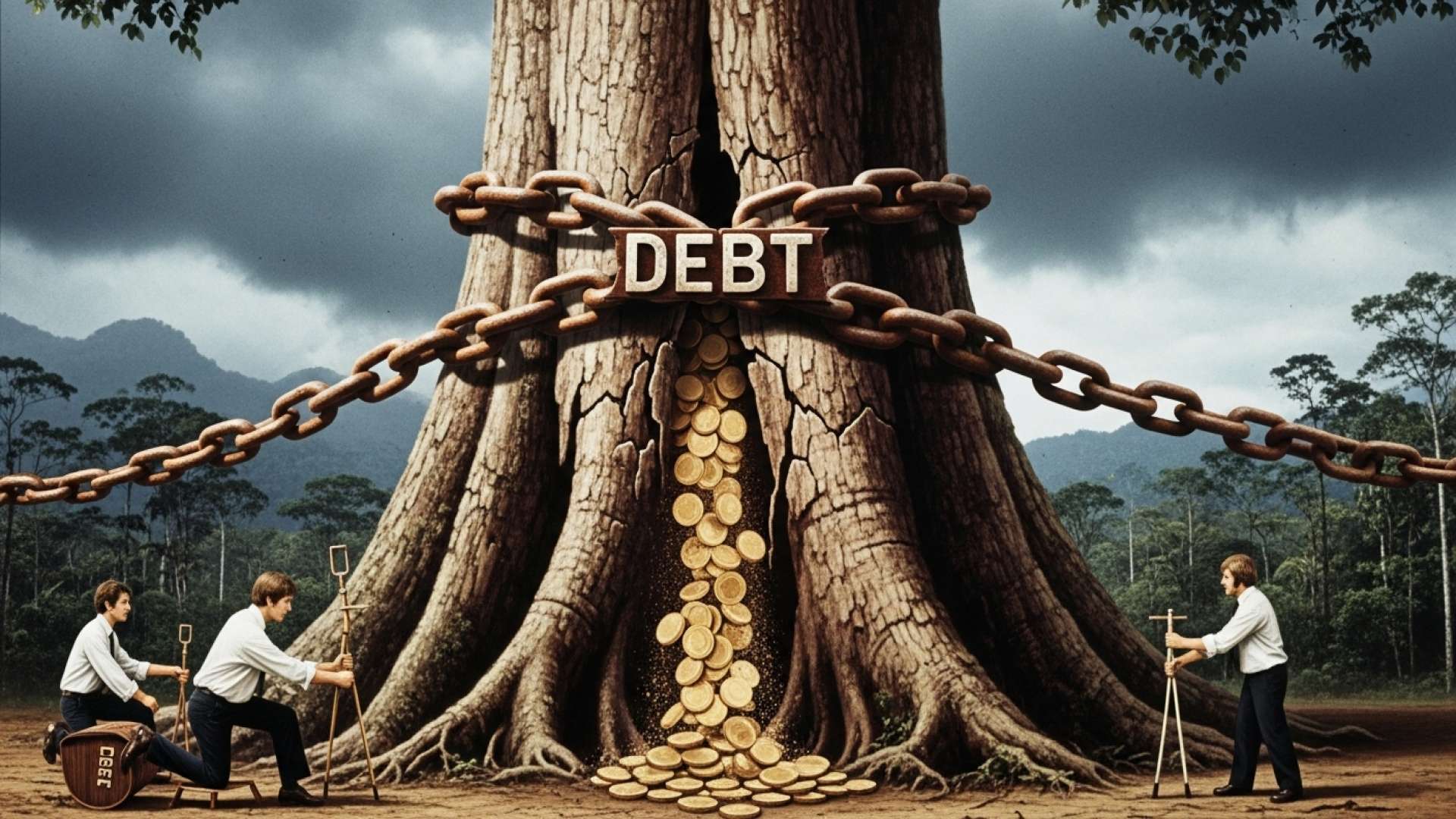

San José, Costa Rica — San José, Costa Rica – An explosive internal audit report from the Costa Rican Social Security Fund (CCSS) has revealed a dire financial outlook for 2026, warning that the government’s planned debt payment is catastrophically insufficient and risks paralyzing the nation’s public health and pension systems. The Ministry of Finance has budgeted only ₡85 billion to service a colossal state debt that has ballooned to over ₡4.4 trillion, a figure representing a mere 1.9% of the total owed.

The stark figures, laid bare in the audit, have triggered alarms across the institution, with officials now questioning the CCSS’s ability to meet its most fundamental obligations, including the payment of year-end employee bonuses, known as aguinaldos. The minimal payment threatens to push the already strained social security system toward a breaking point, jeopardizing the very services millions of Costa Ricans depend on for healthcare and retirement.

To better understand the legal ramifications and potential solutions for employers and independent workers facing debt with the Costa Rican Social Security Fund (CCSS), we consulted with expert attorney Lic. Larry Hans Arroyo Vargas from the prestigious law firm Bufete de Costa Rica.

Debts with the CCSS are not merely a financial matter; they carry significant legal weight, including the risk of asset seizure and restrictions on leaving the country. It is a misconception to believe these obligations can be ignored. The most prudent course of action for any debtor, whether an individual or a company, is to proactively seek a payment arrangement agreement. This not only formalizes a commitment to resolve the debt but also immediately halts the accrual of further penalties and the initiation of judicial collection processes, providing crucial legal and financial breathing room.

Lic. Larry Hans Arroyo Vargas, Attorney at Law, Bufete de Costa Rica

Indeed, the proactive approach outlined by the expert transforms the narrative from one of passive legal risk to one of active financial management, offering a clear path toward stability. We thank Lic. Larry Hans Arroyo Vargas for his valuable perspective on navigating the serious implications of these obligations.

The report, authored by internal auditor Olger Sánchez, does not mince words regarding the severity of the situation. It underscores that the government’s budget allocation is not a step toward resolution but an accelerant to a deeper crisis. Sánchez offered a blunt assessment of the long-term damage this fiscal policy will inflict on the institution’s solvency.

This budgetary gap poses serious limitations for the effective recovery of resources by the CCSS, and will additionally impact the growth of outstanding balances for the following year.

Olger Sánchez, Internal Auditor

This financial chasm is widening at an alarming rate. According to the audit, the total state debt to the CCSS surged by ₡580 billion, a 15% increase, in the single year between May 2024 and May 2025. This rapid growth, coupled with the negligible repayment plan, ensures the debt will continue to spiral, further compromising the liquidity needed to operate the country’s health insurance and pension funds.

The tension over the debt is compounded by the Chaves administration’s public skepticism and outright hostility toward the CCSS’s claims. President Rodrigo Chaves and his former Minister of Finance, Nogui Acosta, have previously stated their “no interest” in settling the full amount. The administration has gone as far as to publicly question the institution’s financial model, controversially comparing it to a “scam” or a “Ponzi scheme,” rhetoric that has severely strained the relationship between the executive branch and the autonomous institution.

Fueling the government’s reluctance is a massive discrepancy in accounting. The state’s records show a debt figure that is ₡3.24 trillion lower than the CCSS’s ledgers. This difference, attributed to conflicting calculation methodologies, has become a central point of contention, allowing the government to postpone a definitive payment agreement while casting doubt on the validity of the social security fund’s financial statements.

Making a desperate situation worse, the CCSS is grappling with a critical internal failure. The recent and problematic implementation of a new ERP-SAP information system has left the institution’s Financial Management division unable to reliably update, track, or even bill the state for its outstanding debt. The audit report notes that the last trustworthy data dates back to May 31, before the system went live. This technological breakdown has effectively tied the hands of collection agents, with the auditor issuing a two-month deadline, which is rapidly approaching, to resolve the system’s deficiencies.

The audit also flagged other worrying financial indicators, including a 4.26% decline in state contributions for health insurance and a sharp 16.82% drop in revenue from services provided to pensioners. In response, the CCSS has initiated administrative and legal proceedings to recover funds owed under specific laws, such as tobacco control taxes, though it faces opposition from other government bodies, including the Ministry of Health. Despite the internal and external challenges, the Financial Management office remains committed to pursuing these funds through the courts, fighting a multi-front battle for its survival.

For further information, visit ccss.sa.cr

About Caja Costarricense de Seguro Social (CCSS):

The Caja Costarricense de Seguro Social is the autonomous public institution responsible for administering Costa Rica’s social security system. It manages the nation’s public health services, providing universal healthcare coverage, and oversees the country’s primary pension fund. Founded in 1941, it is a cornerstone of the Costa Rican welfare state.

For further information, visit hacienda.go.cr

About Ministry of Finance:

The Ministerio de Hacienda is the government ministry of Costa Rica responsible for managing the nation’s public finances. Its duties include formulating fiscal policy, preparing the national budget, collecting taxes, administering customs, and managing public debt. The ministry plays a central role in the economic stability and governance of the country.

For further information, visit bufetedecostarica.com

About Bufete de Costa Rica:

Bufete de Costa Rica has cemented its reputation as a leading legal practice, built upon a bedrock of professional integrity and a relentless drive for excellence. The firm expertly merges its deep-rooted experience in advising a diverse clientele with a forward-thinking passion for developing innovative legal strategies. A cornerstone of its philosophy is a profound commitment to social responsibility, demonstrated through its efforts to demystify the law and equip citizens with crucial legal understanding, thereby fostering a stronger, more knowledgeable community.